|

In all financial transactions related to personal loans in Saudi Arabia, the bank or finance company lends the borrower, the traditional model where the lender bears credit risk.

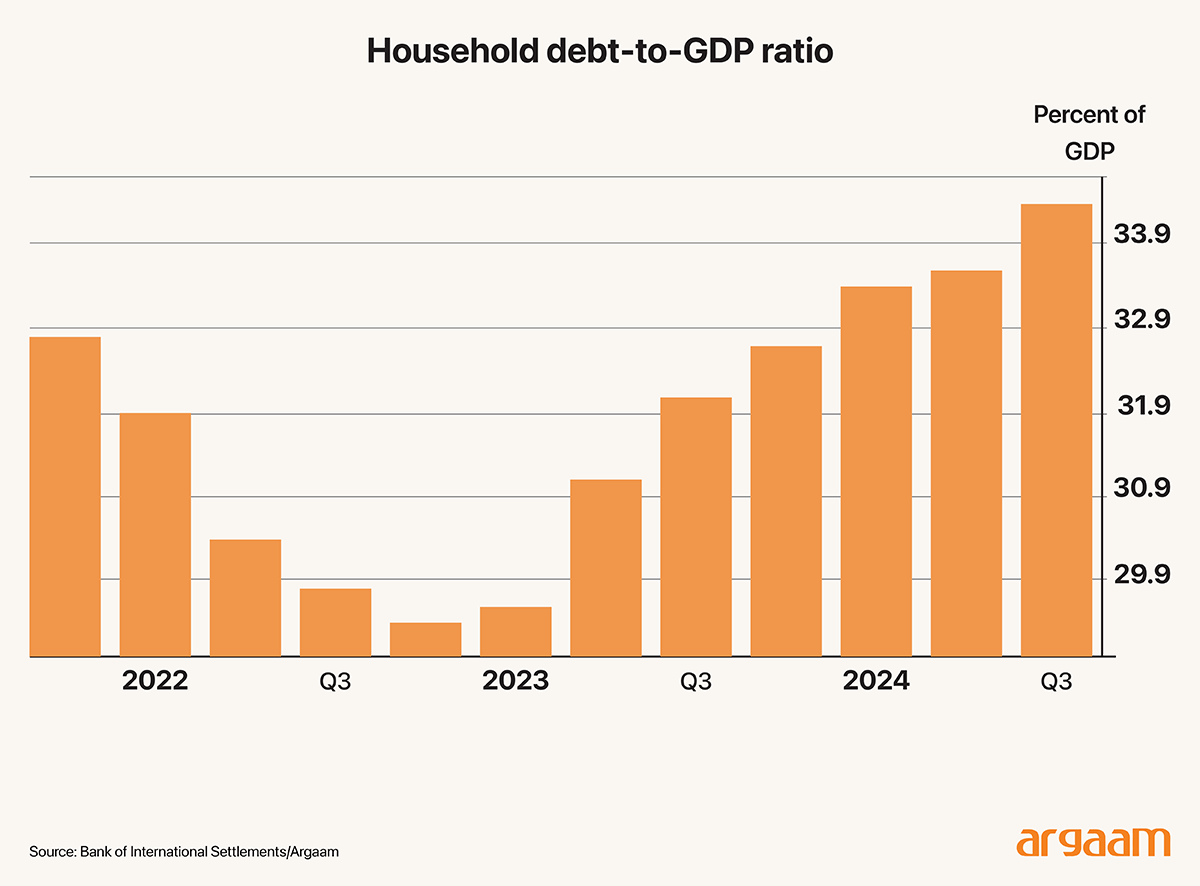

But what if this dynamic changed? What if the consumer puts money upfront, effectively lending to the bank or card issuer, and only then accesses funds to make purchases or payments? This is the fundamental principle behind the concept of ‘pay now, buy later’. The main purpose of this analysis is to present to decision makers and policymakers the fundamental principle behind these prepaid cards: the cardholders “pay early” for the products or services they are going to use by loading money in advance, which eliminates credit risk for banks. This means these cards are not connected to a traditional deposit account, so spending is limited to the prepaid balance. The "pay now, buy later" model plays an important role in promoting responsible borrowing among citizens and residents in the Kingdom and spending behaviors, especially in contexts where unsecured lending is rising faster than income growth. The household debt-to-GDP ratio is 34.4% in the Kingdom. It indicates that the total household debt amounts to about one-third of the country’s gross domestic product, reflecting a significant level of borrowing. Although the current non-performing loan NPL rate is low at around 1.3%, the concern is that if unsecured lending loans not backed by collateral grows faster than people's income, households may accumulate debt at an un-sustainable pace especially with the surge of fintech companies and non-bank finance companies.

Let’s have an example. A fitness centre in Riyadh offering prepaid membership packages. Instead of paying monthly after using the facilities, members pay upfront for a bundle of 22 gym sessions. In return, the gym provides a bonus of two extra sessions free of charge. This encourages members to commit funds ahead of time, giving the gym working capital upfront, while in the meantime it benefits from more predictable cash flow and reduced risk of unpaid services. Because customers have already paid, the business locks in future sales—customers are likely to return to use the prepaid value rather than seeking alternatives, ensuring a steady stream of revenue. Members can then use their prepaid sessions whenever they visit within a certain period of time (let’s assume three months), ensuring their spending stays within the amount loaded beforehand, avoiding surprises typical of pay-later models like monthly bills.

10% of Issuer Revenues in China

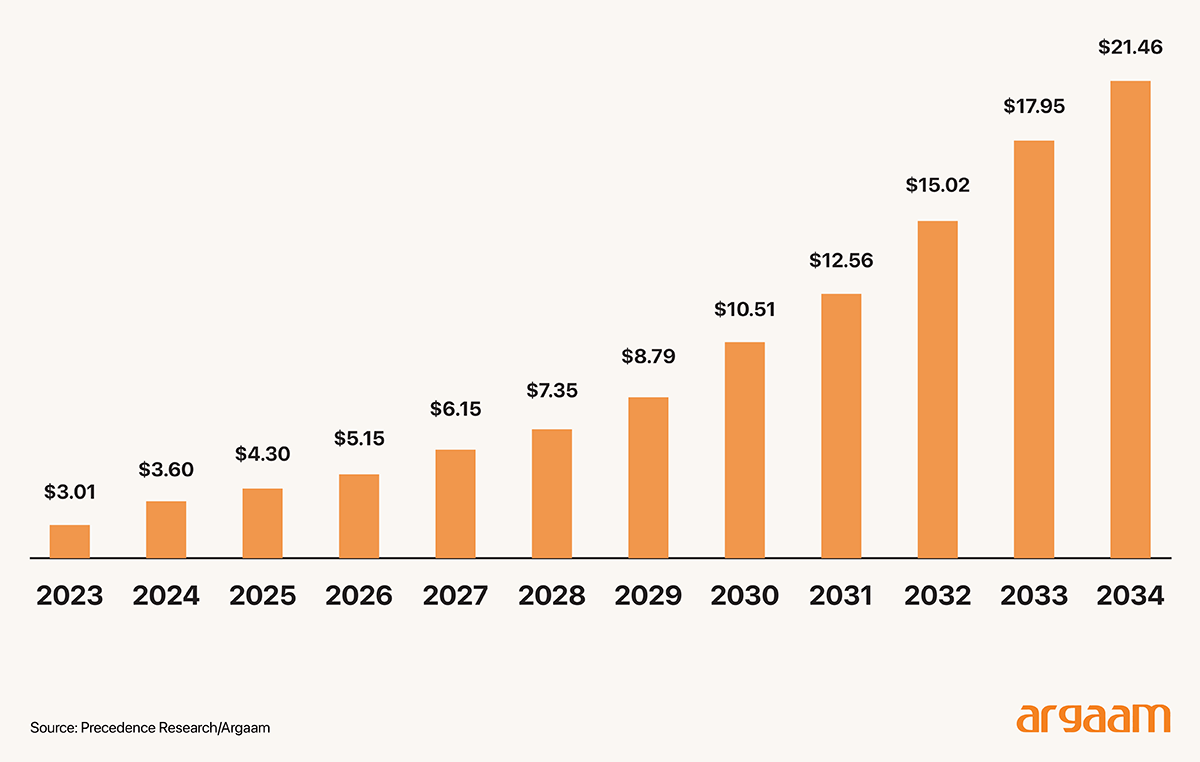

Such a scheme is used in China. Over 1.5bn pre-paid cards were issued in the country in 2023, according to the latest available data, worth almost 740bn yuan. For a typical issuer, the cards account for over 10% of their revenue. In China, most pre-paid cards do not expire. They aren’t merely loyalty or gift cards. The high usage and load volume reflect a rapidly expanding market segment, making prepaid cards a key growth area. Issuers who leverage prepaid card programs can capture more market share, especially among consumers who may be unbanked or prefer alternative payment methods. The 10% of revenue from prepaid cards indicates that these products are not just a peripheral offering but a core, lucrative business segment for issuers in China. The global prepaid card market size is projected to be worth around USD 21.46 trillion by 2034 from USD 3.60 trillion in 2024, at a CAGR of 19.54% from 2024 to 2034. The rapid rise of global e-commerce and an increasing switch to digital payment systems are the major factors responsible for growth in the prepaid card market.

North America dominated the prepaid card market with the highest market share of 61% in 2023. By card type, the closed loop segment held the largest share in the prepaid card market for 2023. Closed-loop prepaid cards are payment cards that can be used only within a specific network or with a particular merchant or group of merchants. The largest share of the prepaid card market in 2023 being closed-loop reflects the strong consumer adoption and merchant support for these more focused, retailer-specific prepaid card products.

The main risk factor in the ‘pay now, buy later’

Prepaid card programs carry varying levels of risk depending on the issuer. Banks, which typically operate under strong capital requirements and regulatory oversight, generally present lower financial risk. In contrast, nonbank issuers such as retail stores lack the same financial stability and regulatory safeguards, making them more vulnerable to insolvency or operational failure in a rapidly changing market. This disparity increases the risk that consumers using prepaid cards from nonbank providers could lose access to their funds if the issuer faces financial difficulties. Unlike traditional bank deposit accounts that are insured by agencies such as the Depositors Protection Fund (DPF) in Saudi Arabia, prepaid card funds may or may not have such insurance coverage depending on whether the card is linked to a DPF-insured account or held on the issuer’s balance sheet. For example, if you have a prepaid card issued by a company, when you load SAR 1000 onto your prepaid card, the company deposits that sum into a pooled bank account that it manages. This means the company is legally responsible for that SAR1000 and shows it as a liability on its balance sheet. In other words, they owe you that money when you want to spend it. Now, suppose the company faces financial trouble and declares bankruptcy, your funds might be treated like other debts the company owe. If the company used your money for its operations or if the funds aren’t held in a government-insured bank, you might risk losing some or all of your SAR1000, until and unless bankruptcy proceedings in court return some funds to creditors (including customers), which might take a while. In conclusion, our own research just give insights into how Pay Now Buy Later might fit within consumers’ existing financial habits. The rapid growth and wide variation in prepaid products globally, especially in China and the US, highlight the importance of conducing a thorough nationwide research in the kingdom to understand local consumer segmentation, preferences, and financial behaviors. The research will also help identify which features and protections are most valued by Saudi consumers, ensure that potential risks, such as misunderstanding fees related to card issuance or consumer protection, are addressed. With the rapid digital transformation in Saudi Arabia’s financial sector, prepaid payment models present a promising opportunity to promote responsible spending habits and curb household debt inflation. However, the success of this transition requires clear regulatory frameworks that protect consumer rights and ensure transparency in fees and practices. The Kingdom's best interest lies in building a financial sector that empowers Saudi families to make sound financial decisions without falling into the trap of complexity or unforeseen risks. This is the foundation of a healthy and sustainable economy. |

|

|

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |