|

There’s a growing trend in which the legal system in several Western countries are increasingly recognizing the legal status of cryptocurrencies as properties, which could be used in Saudi Arabia not just to protect investors from fraud and Ponzi schemes, but to provide clarity and guidance for future legal disputes in insolvency and bankruptcy cases.

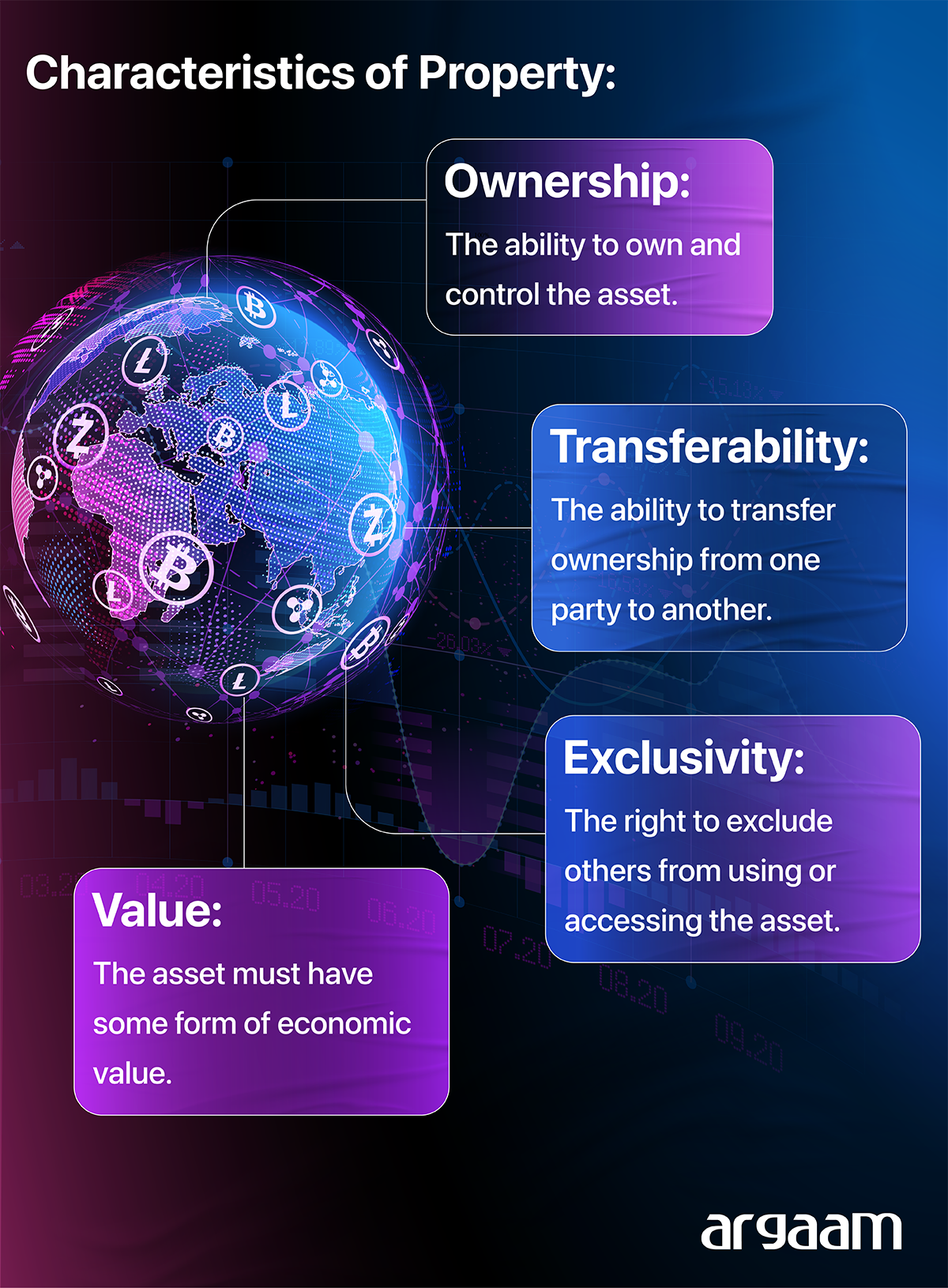

Countries that regard crypto assets as property: The US, the UK, Germany, Canada, Switzerland, New Zealand, Ireland and Australia. When crypto assets are recognized as property, victims of fraud or theft can pursue legal remedies to recover their assets. Courts can issue injunctions or orders to prevent the disposal of stolen assets, increasing the likelihood of recovery. As more jurisdictions recognize crypto assets as property, international harmonization of laws can occur. This can facilitate cross-border transactions and provide a consistent legal framework for crypto assets globally.

What’s the use of the court injunctions in a crypto asset case? Why are the key benefits of the recognition of crypto assets as properties? And what are the examples of court cases in the US, UK and Singapore that recognized crypto assets as properties?

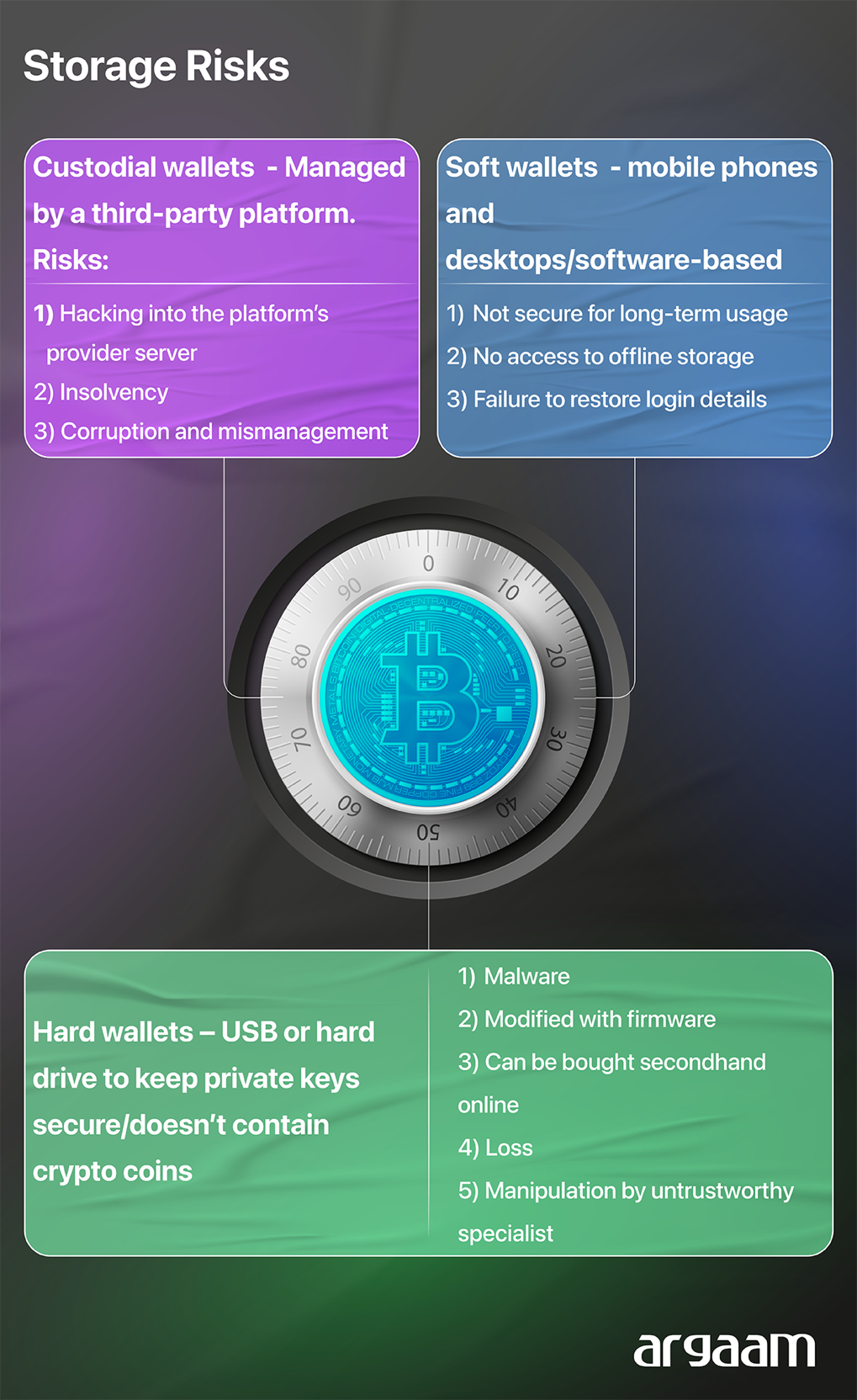

In our analysis, we also explain with infographics the cost of crypto fraud in 2023 and the risks of storage in different crypto wallets.

Interlocutory Proprietary Injunctions

Courts in countries like Singapore and the United Kingdom, Australia, New Zealand and Canada have granted injunctions that restrain individuals or entities in control of the defrauded assets from disposing of them. This legal remedy allows victims to assert their claims over the crypto assets even when the fraudsters are unknown. Interlocutory proprietary injunctions provide victims with immediate protection as law prevents the individuals or entities currently in control of those assets from selling, transferring, or otherwise disposing of them.

This is crucial because crypto assets can be quickly moved or laundered, making recovery more difficult if immediate action is not taken.

Targeting the assets themselves

The issuance of an interlocutory injunction allows victims to assert their claims over the crypto assets, even when the fraudsters are unknown. This is particularly important in cases where the identity of the fraudsters cannot be determined, as the injunction targets the assets themselves rather than the individuals who committed the fraud.

🧲

Attracting institutional investors

Legal clarity by treating crypto assets as properties attracts institutional investors, such as hedge funds, pension funds, and other financial institutions, which typically require a certain level of regulatory certainty before entering a market. Their participation can lead to increased liquidity, stability, and overall market growth, further boosting confidence among retail investors. 🚫

Anti-money laundering Recognizing crypto assets as property helps regulators develop appropriate frameworks for their oversight. This can lead to clearer regulations regarding taxation, anti-money laundering (AML), and consumer protection.  Examples of global legal cases that considered crypto assets as properties: 1- Klein v. Bitcoin [2021] 🇺🇸: In this case, a U.S. court recognized Bitcoin as property in the context of a bankruptcy proceeding.

The court ruled that Bitcoin is a form of property that can be owned, transferred, and included in bankruptcy estates, affirming its status as a legal asset. The court ruled in the plaintiff’s favor. ● JOSH KLEIN, a California resident; and COVALENCE CAPITAL FUND I, LP, a Delaware limited partnership, Plaintiffs, v. DOUGLAS JAE WOO KIM, a New York resident, Defendant. ● Amount of Principal owed to the plaintiff: 33 Bitcoin “BTC” and $15,000.00. ● Attorneys' fees: $217,287.31 ● Legal costs: not available.

2- B2C2 Ltd v. Quoine Pte Ltd [2020] SGCA 24 🇸🇬: In this case, the Singapore Court of Appeal recognized that crypto assets can be classified as property. The court ruled on a dispute involving the unauthorized reversal of trades involving Bitcoin, affirming that crypto assets are capable of being owned and can be subject to property rights. ● In this case, the Singapore Court of Appeal ruled in Favor of B2C2 Ltd, determining that Quoine Pte Ltd had wrongfully reversed trades that had been executed on its platform Quoine's cryptocurrency exchange. The court ordered Quoine to pay B2C2 the amount that was lost due to the unauthorized reversal of the trades. ● Specifically, the court awarded B2C2 approximately $12 million SGD Singapore Dollars which’s approximately $8.8 million. ● Legal costs: $880,000

3- Bitcoin [2020] EWHC 1000 🇬🇧: The case arose in the context of bankruptcy proceedings involving an individual who had declared insolvency.

The question before the court was whether Bitcoin could be classified as property that could be included in the bankrupt estate.

● The High Court of England and Wales ruled that Bitcoin is indeed property. The court recognized that Bitcoin has value and can be owned, transferred, and included in the assets of a bankruptcy estate. ● The court considered a total of £9 million approximately $12 million USD worth of Bitcoin. ● Legal costs: £1.5 million  |

|

|

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |