|

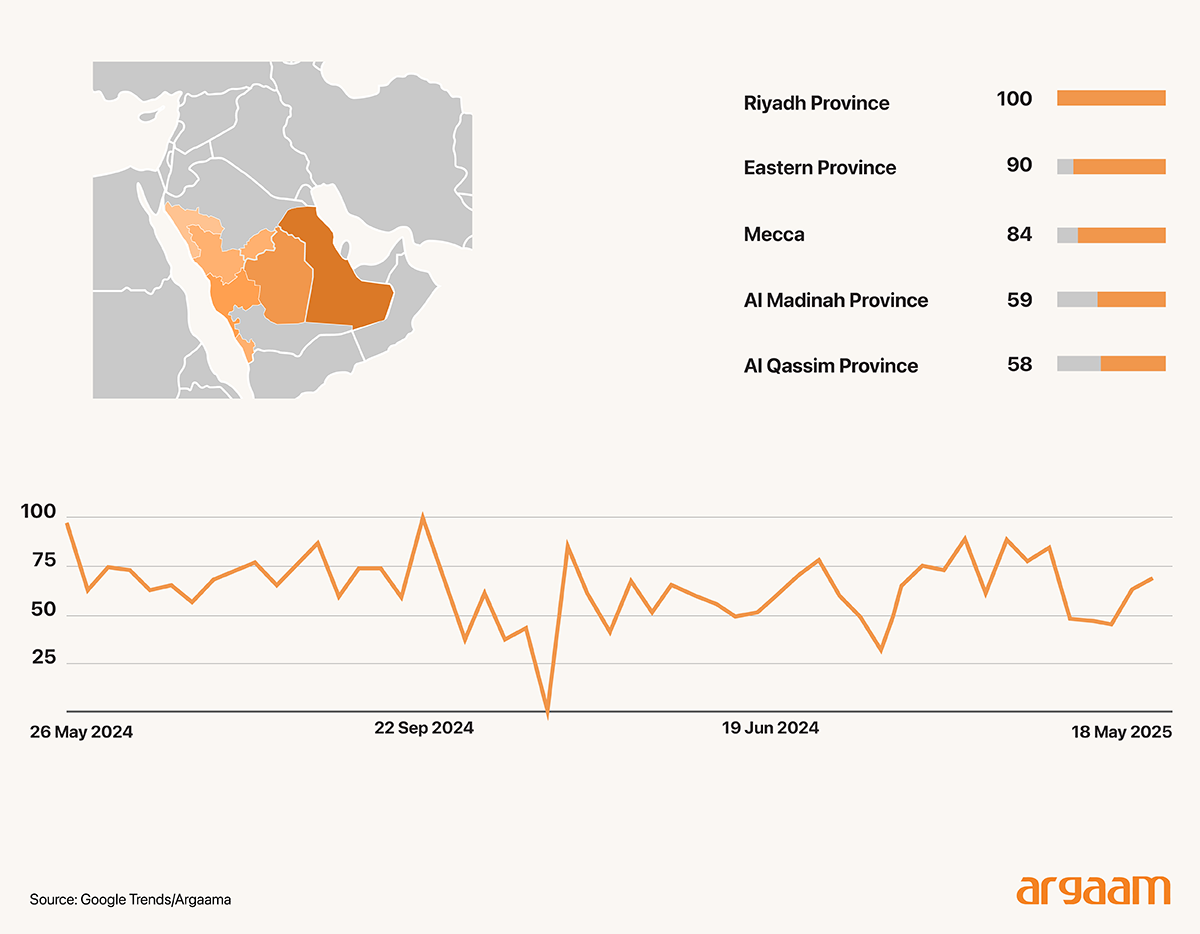

The foreign company that is selling very expensive sports leggings for SAR229-SAR625 online in Saudi Arabia is now facing a problem. That's because other Saudi brands have started copying their style and offering similar products at SAR42-SAR81. Copying a style or design in fashion isn’t the same as violating copyright laws. other brands are free to create similar designs as long as they don't copy specific, protected elements like logos, trademarks, or patented features. So, very less expensive versions of such foreign premium products be it in sportswear or cosmetics or even watches have become an acceptable alternative, particularly for younger shoppers in Saudi Arabia, who buy their stuff nowadays via TikTok.  TikTok is one of the most used platforms in the Kingdom, with more than 35 million users, mainly due to the widespread spread of advertising content on the platform. As a result of this TikTok advertising and marketing trend in a country like Saudi Arabia where more than 60% of the population is less than 30, local brands produce comparable styles, so that upper middle, middle and low-income consumers have more options to choose from, often at better and much cheaper prices. The coming chart is based on Google Trends data. Over the past 12 months, the data indicates that both Saudis and residents of the kingdom have exhibited a significant interest in searching for "dupe". This heightened curiosity reflects a growing consumer desire to find affordable alternatives to expensive brand-name items, driven by factors such as economic considerations, social trends, and the increasing influence of online shopping. The surge in these searches suggests that many individuals are exploring more budget-friendly options without compromising on style. The word is most searchable in Riyadh followed by the Eastern Province, Makkah, Al Madinah and Al Qassim.

The cost of the TikTok competition

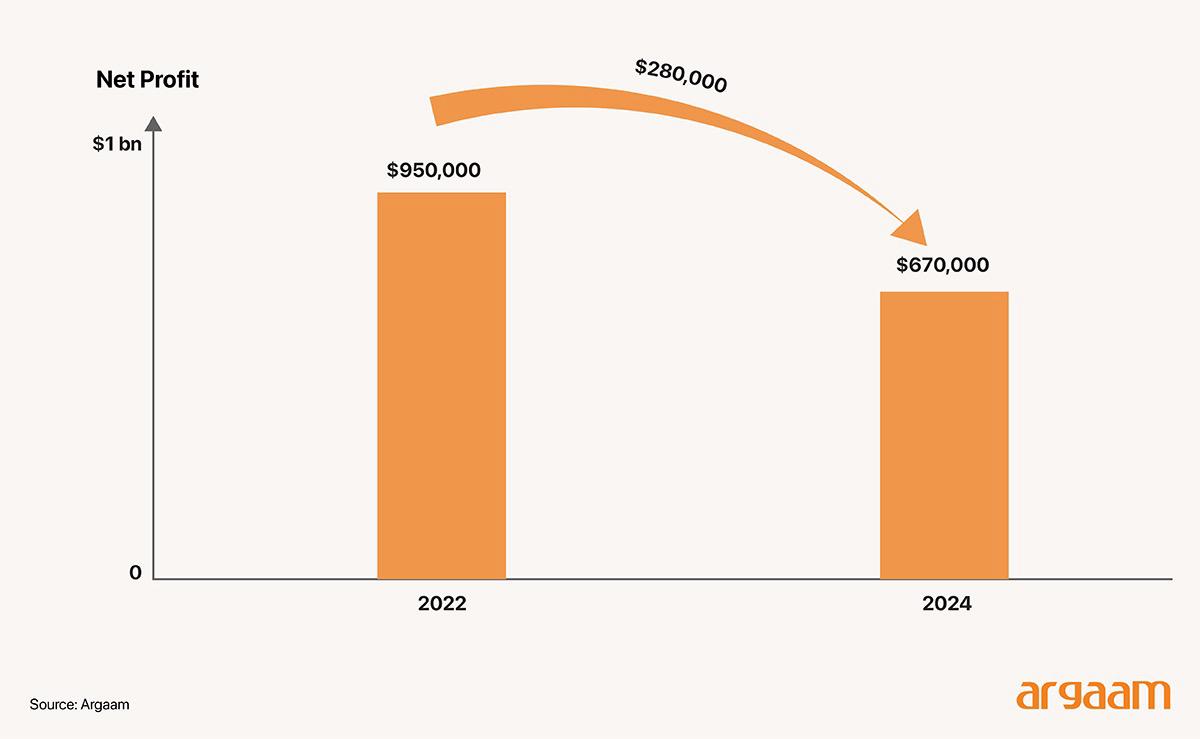

This increased competition diminishes the original company's ability to charge premium prices or maintain a sense of exclusivity, which are key factors in its previous success. The international company often has to lower prices as a discount to remain competitive. This price pressure can lead to reduced profit margins on each product sold. Additionally, the company may incur higher marketing and branding expenses to differentiate itself, further squeezing profitability. For example, if the company’s selling price per pair of leggings in the Saudi market around $120, and the cost to produce it in China, Bangladesh or Sri Lanka is only $25, then the profit margin per product is $95. If the company is forced to offer a 20% discount to stay competitive, reducing the selling price to $96. Now, the profit per product becomes $71. The company spends an extra $4 per piece on marketing and branding efforts online and in stores. So, the new effective profit per product becomes less at $67. Since profit per unit decreases, the company's gross profit and net income will decline proportionally, assuming sales volume remains constant. So, If the company sells, for example, 10,000 units annually: ● Original profit: 10,000 units × 95= $950,000 ● New profit due to the competition from local brands: 10,000 units × 67= $670,000 The company’s annual profit drops by $280,000.

Young Consumers Are Redefining Wealth and Style For many young Saudis like other young people around the world from London to Singapore, a brand logo doesn’t hold as much meaning as it used to, as finding bargains is more important. Younger consumers increasingly seek value for money, viewing discounts and deals as a sign of savvy purchasing rather than brand prestige. Generation Z and younger Millennials are influenced by social media, where sharing deals and affordable fashion has become a growing pattern.

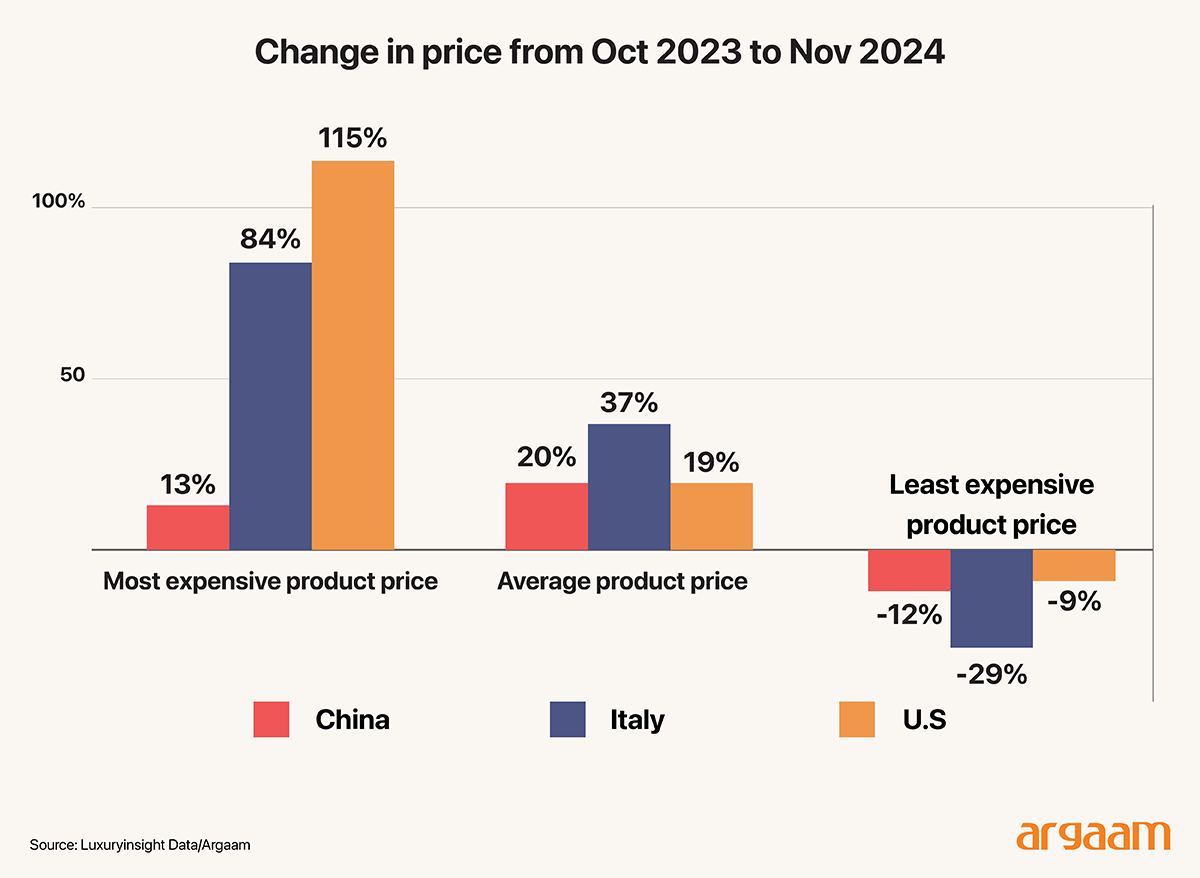

Let’s take the British luxury brand Burberry as a case study on the industry-wide slowdown in demand for luxury products. The recent slump in Burberry’s sales and profitability reflects broader challenges faced by luxury brands amid shifting global consumer dynamics, even prior to the onset of the U.S.-China trade tensions and tariffs introduced during the Trump administration. Last year, the company's earnings recorded a 40% decline in operating profits year-over-year, with a 15% revenue reduction to £2.5 billion for the full year when exchange rate impacts are excluded highlighting a significant contraction across all regions, notably in Asia Pacific and the Americas, which both experienced 23% declines in sales. The following chart explains the strategic move by Burberry to introduce new lines of products that are significantly cheaper than its existing high-end offerings. This move can be understood as a response to evolving consumer behaviors, particularly the influence of TikTok and online shopping patterns of duplicates and competitive local brands among young people in its biggest markets: the US, China and Italy.

Since duplicates of luxury items are prevalent on TikTok, introducing more affordable products allows Burberry to offer genuine, branded alternatives that appeal to consumers seeking authenticity but at a lower price point. Unlike top-tier brands like Hermès or Chanel, Burberry leans heavily on outlet stores and discounts, which made up over 17% of its sales in 2024. But while this might bring in revenue, it damages the brand’s luxury image. Luxury brands are all about exclusivity, and discounts dilute that. In Burberry’s biggest market, the US, roughly one-third of U.S. adults have intentionally bought a duplicate, according to a recent poll by the research firm Morning Consult, which polled 2,200 people in October. The figure is higher among younger shoppers, rising to almost half for Gen Z and 44% for millennials.

The Macroeconomics behind duplicates in Saudi Arabia

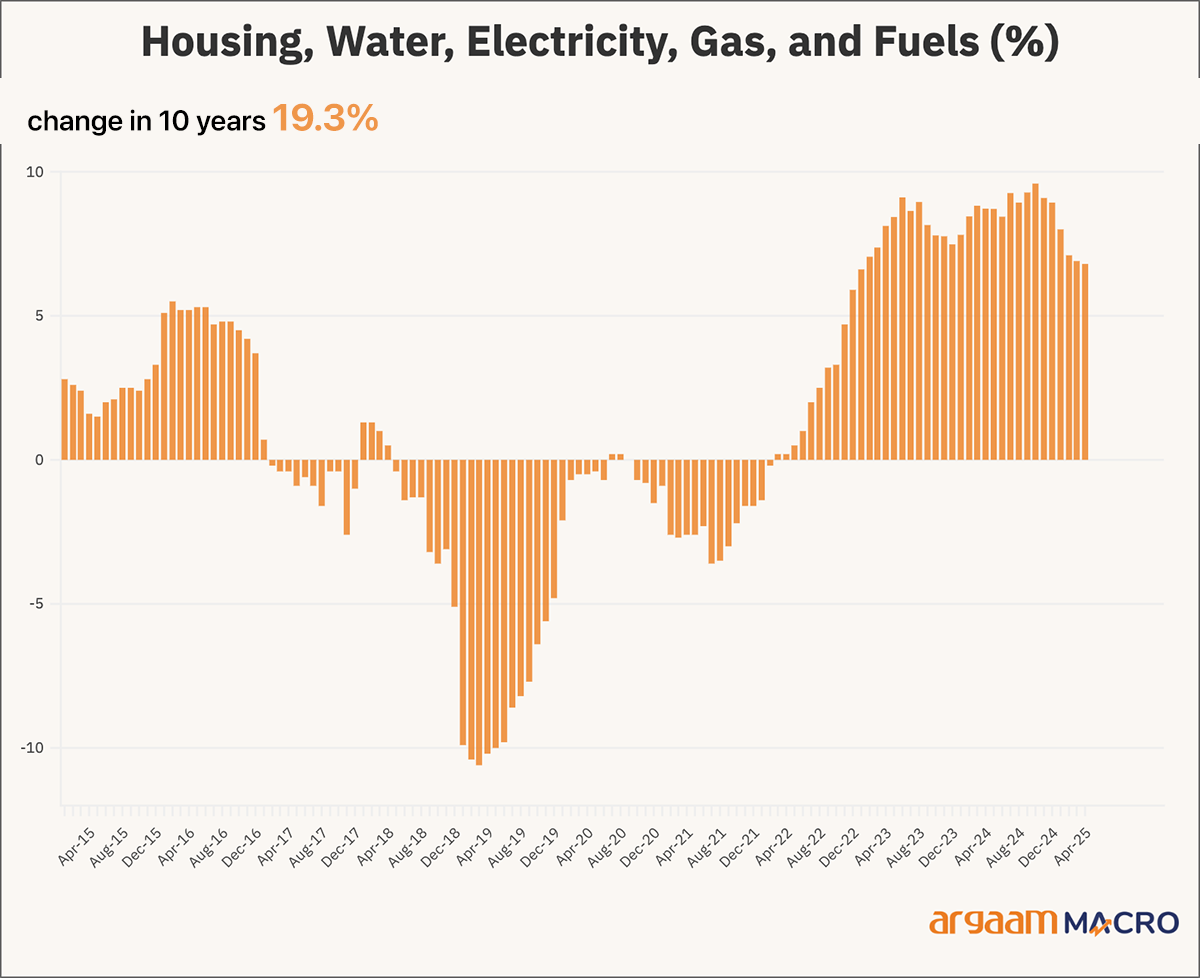

The No. 1 reason that people buy duplicates or local brands that compete with international brands is to save money. Macroeconomic factors such as household income and inflation play a critical role in shaping this behavior in the kingdom among a broad section in society. The inflation reduces consumers' purchasing power, making affordability a significant concern. According to the latest official figures in Saudi Arabia, the annual inflation rate rose 2.3% during March 2025, compared to the same month of 2024, recording the highest rate of increase since July 2023 (21 months). As prices for everyday goods and services increase, individuals tend to prioritize essential expenses and seek more cost-effective alternatives, such as duplicates or local brands, to satisfy their fashion needs without overstretching their budgets. For example, housing, water, electricity, gas and fuel increased by 6.9%, driven by the increase in the apartment rental prices by 11.9%.

But when it comes to the high-net-wealth families in society, such macroeconomic factors have limited influence when it comes to their luxury purchasing behavior. This segment of consumers generally possesses substantial disposable wealth that insulates them from broader economic uncertainties. When it comes to luxury international brands, the emotional and symbolic value associated with authentic luxury items remains compelling enough for some people who prioritize ownership of the genuine product. They appreciate this intangible heritage in the product; namely, the story behind the product add value that duplicates cannot match. For example, collecting limited edition Rolex watches or vintage jewelry carries a sense of legacy and investment potential as they age. |

|

|

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |