|

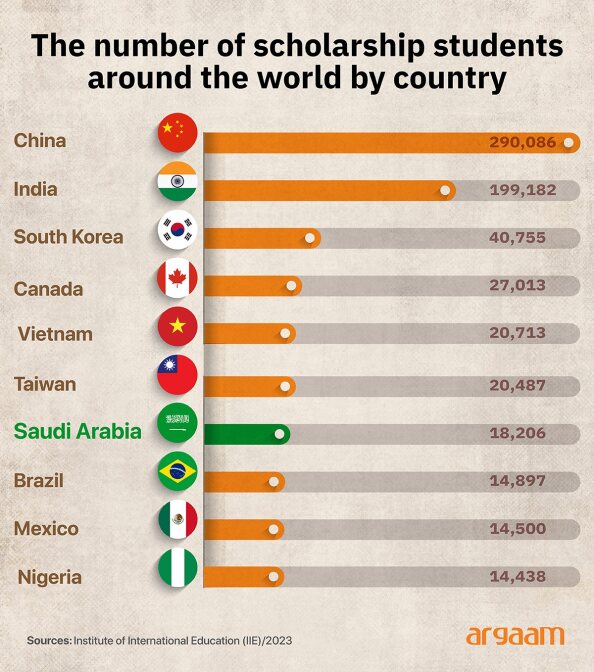

Saudi Arabia 🇸🇦 is seeking a more educated workforce that can drive innovation and enhance economic growth through mainly two scholarships for the talented Saudi students to pursue higher education in top universities around the world and chiefly the United States.

They are Custodian of the Two Holy Mosques Scholarship, which was established in 2005, and King Abdullah University of Science and Technology, which was established in 2008.

The two fully-funded scholarships have educated tens of thousands of students so far within the fields of science, technology, engineering, and math, becoming a central pillar of Saudi Arabia’s drive to become a knowledge-based economy.

But we explore a new concept in this analysis, which is well-regulated student loans that enable young Saudi citizens to invest in their education, which can in turn lead to higher earning potential and increased productivity in a more competitive economy.

Students loans could further help Saudi citizens in older age to get better job opportunities by investing in post-graduate education degrees. The demand for high-quality education as the kingdom already has some of the top academic institutions in the Middle East with some of them having prominent positions in global ranking like King Abdulaziz University (74) and King Abdulaziz University (100).

In September, the Kingdom further awarded foreign investor license's to five international public and private universities, opening the way for them to set up branch campuses in the kingdom offering masters and bachelor programs in priority areas such as healthcare, engineering, and business. So the perception of investment in one’s human capital in Saudi Arabia and future career via regulating a new scheme of student loans on par with countries like the US and the UK can instill a sense of responsibility to manage their finances effectively and repay the debt. How can student loans in the kingdom help the wider economy? What are the risks that should be assesses carefully for efficient student loan policy? And why’s it crucial to regulate student debt loans?

📈

How can student loans in the kingdom help the wider economy?

🛍️ Increased Consumer Spending: When graduates secure well-paying jobs as a result of their education, they are more likely to spend money on goods and services, which stimulates economic activity. This consumer spending is vital for businesses and can lead to job creation and economic expansion. 🤝 Encouraging Entrepreneurship: Graduates with manageable student debt may be more inclined to start their own businesses, contributing to job creation and economic dynamism. By providing access to education and training, student loans can foster an entrepreneurial spirit that drives innovation and economic growth. 🏠 Homeownership: Access to student loans can help individuals attain high-quality education, which is often linked to well-paying jobs and accordingly help in homeownership through mortgages. Homeownership contributes to economic stability by increasing property values, generating tax revenue, and fostering community development. ✅ Debt Management: Effective government regulation of student loans can help borrowers manage their debt more effectively, reducing the risk of default. When borrowers are able to repay their loans without excessive financial strain, it contributes to overall economic stability. 📊 Mitigating Economic Inequality: By providing access to education for individuals from diverse backgrounds, student loans can help reduce economic inequality. A more equitable distribution of education can lead to a more balanced economy, where opportunities for advancement are available to a broader segment of the population.  The student loan risk assessment

🏫 Neoliberal Policies in Higher Education: Neoliberalization of higher education in several western countries has led to rising tuition rates and could possibly make a university for-profit. As institutions increasingly rely on tuition revenue, students are compelled to take on more debt to finance their education, creating a cycle of indebtedness. 💵 Expectation of Higher Earnings: Borrowers with higher levels of student loan debt often have expectations of higher future earnings, as they typically invest in education with the belief that it will lead to better job opportunities and higher salaries. However, this expectation can create a disconnect if the anticipated earnings do not materialize, leading to financial strain. 💰 Impact on Spending Behavior: The expectation of higher future earnings can influence spending behavior among borrowers. Those with significant student loan debt may feel more inclined to spend freely, believing that their future income will allow them to manage their debt effectively. This can lead to overspending, particularly if they perceive their debt as manageable in light of their expected earnings, which again couldn’t materialize in the evolving job market. 💳 Debt Burden vs. Income Reality: Despite the expectation of higher earnings, borrowers could face challenges in repaying their student loans, especially if they graduate into a job market that does not provide the anticipated income. This mismatch can lead to increased default rates and slower repayment, as borrowers struggle to balance their debt obligations with their actual earnings.

Why’s it crucial to regulate student debt loans? Student Protection: Regulation helps protect borrowers from predatory lending practices, such as high interest rates, hidden fees, and misleading loan terms. By establishing clear guidelines and standards for student loans, regulators can ensure that borrowers are treated fairly and have access to transparent information about their loans. Preventing Over-Indebtedness: Effective regulation can help prevent students from taking on more debt than they can realistically repay. By implementing limits on borrowing amounts and requiring institutions to provide clear information about the total cost of education, regulators can help students make informed decisions about their financial futures. Reducing disparity: Student debt disproportionately affects marginalized groups, including students of low-income families. Regulation can help promote policies that support equitable access to education.  |

|

|

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |