|

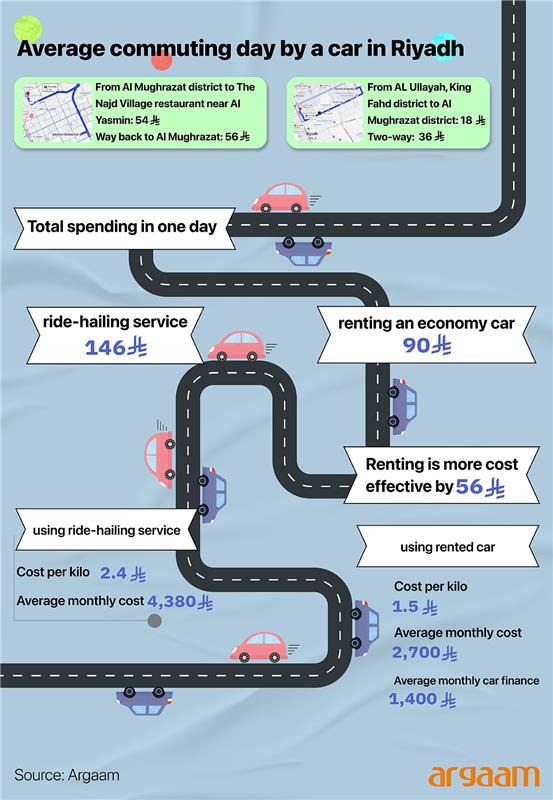

In a city as sprawling as Riyadh, the costs associated with car mobility can significantly affect one's budget if not making the right choice. Through personal experience by Argaam Weekend using two different forms of car mobility—car rentals and a ride-hailing service while comparing both against an average car finance, we have observed a stark contrast in long-term financial implications for long-term periods of usage. While ride-hailing services offer convenience for occasional trips especially through providing the one-click payments for a journey using smartphones, their costs can quickly escalate for daily commuters, let alone the hassle of waiting for long due to traffic congestion. For example, a ride-hailing service may charge an average of SAR 2.4 per kilometer, which can add up if you travel within the city regularly. This’s compared to an average of SAR 1.5 per kilometre if using a rented car on a monthly package or a car finance as shown in our detailed econometric analysis:

The strong auto market in Saudi Arabia

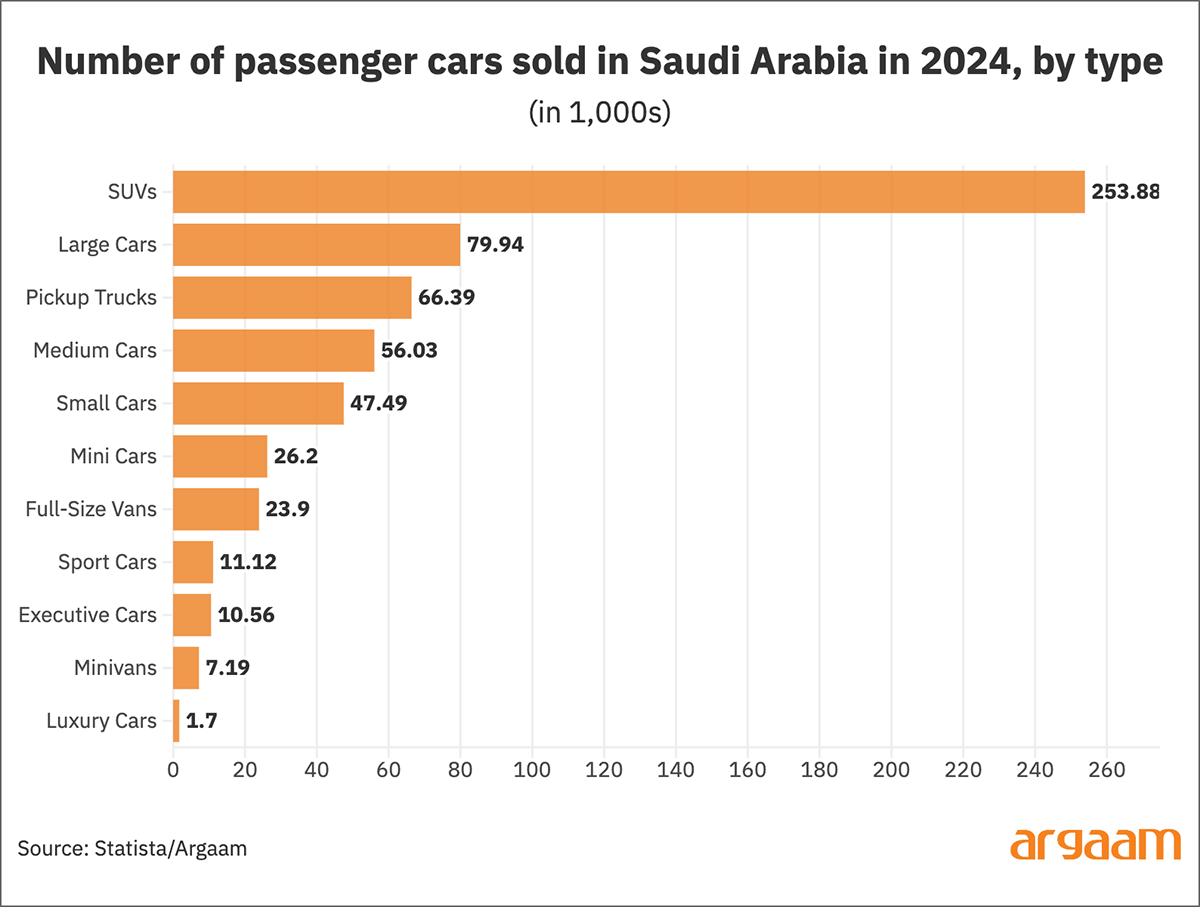

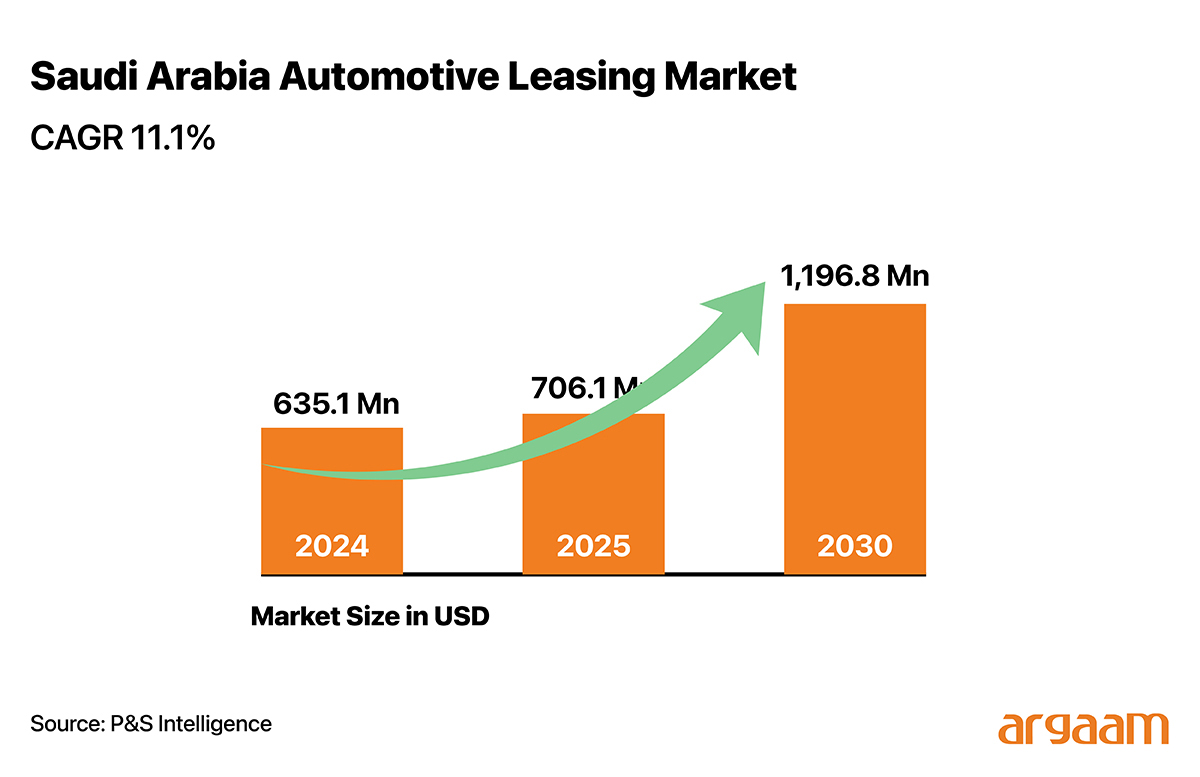

In this evolving landscape, both consumers and service providers will need to continuously assess the value and efficiency of their transportation choices to navigate the challenges presented by the burgeoning automotive market in Riyadh. Higher fares of ride-hailing companies in the kingdom in recent years could induce many people to stick to car ownership or lease. As Saudi Arabia sees an increase in car sales, the dynamics of the ride-hailing market may undergo significant changes. Higher car ownership rates could lead to decreased demand for ride-hailing services, as more individuals opt for the convenience and personalization that comes with owning their own vehicles. The kingdom’s automative retail market was valued at US$19.72 billion in 2023 and is projected to reach $74.74 billion by 2032 at a CAGR of 16.13% during the forecast period 2024–2032. The Kingdom's Vision 2030 program aims to reduce oil dependency, promoting growth in the automotive sector with an emphasis on local manufacturing and innovation. In 2024, the Saudi vehicle market grew 7.8% year-on-year, reaching its highest level in 8 years. In 2025, the passenger car market is projected to reach US$15.3 billion in revenue. As far as the market of the ride-hailing market in Saudi Arabia is concerned, it is expected to reach $1.2 billion by 2029. This is based on an annual growth rate of 5.6% between 2025 and 2029.  The car lease market in Saudi Arabia has also exhibited impressive growth, underscored by a compounded annual growth rate (CAGR) of %11 in recent years. This notable expansion reflects a growing preference among consumers and businesses for leasing vehicles as a flexible and cost-effective alternative to traditional car ownership.

Increasing disposable income in the kingdom

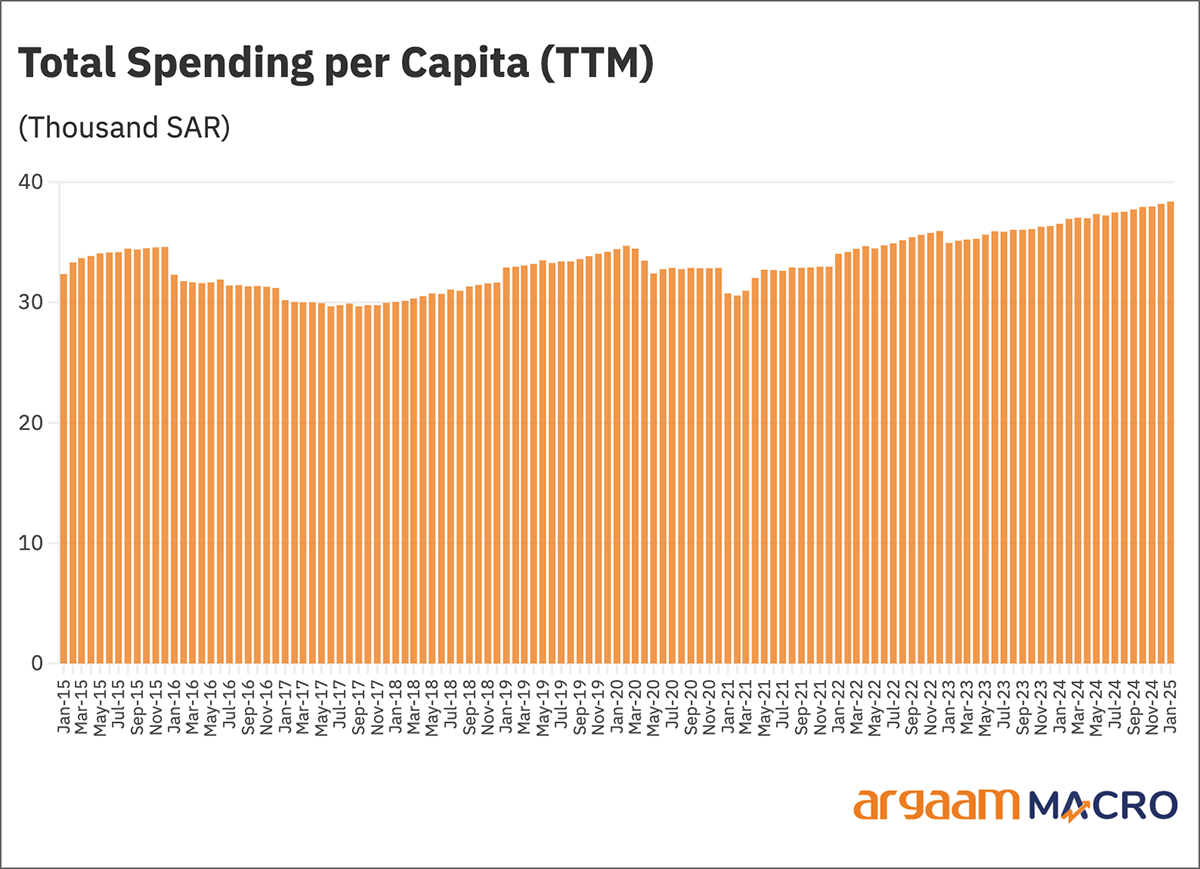

As consumers experience higher disposable incomes, they are better positioned to afford the financial commitments associated with purchasing and maintaining vehicles, such as down payments, monthly installments, insurance, and fuel costs. This growing economic stability and financial flexibility encourage individuals and families to invest in private transportation, thereby fostering car ownership. Saudi Arabia's disposable income has increased in recent years due to a decrease in unemployment and the growth of the non-oil private sector. The country's consumer market is expected to expand further as disposable incomes increase.

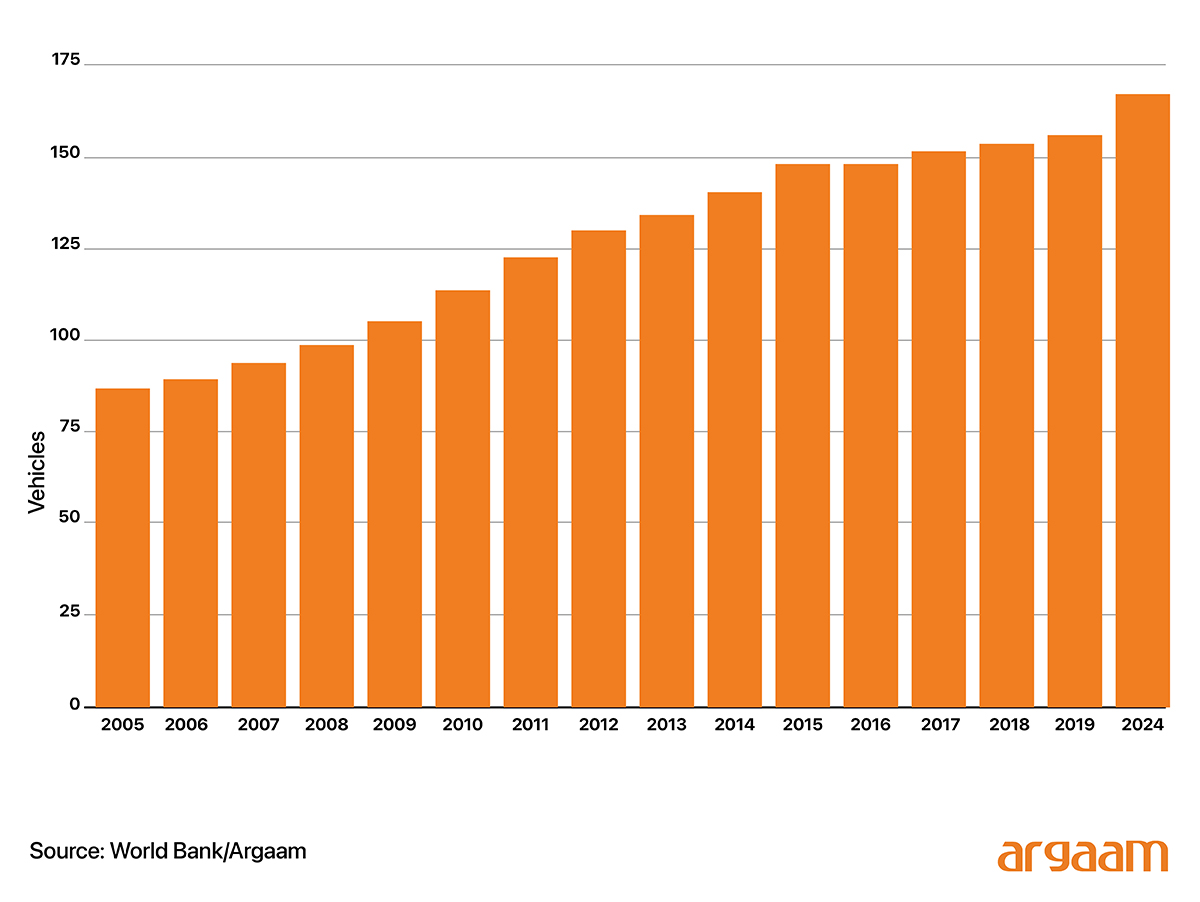

To explain our chart, the total spending per capita in Saudi Arabia reaching an all-time high of SAR 38,380 over the past decade signifies higher disposable income and economic confidence among consumers, as individuals feel more secure in their financial situations and are more willing to spend on both necessities and luxuries. With rising per capita spending, the automotive industry is likely to experience substantial growth. Higher spending power means more consumers can afford to purchase or finance vehicles, leading to an increase in car sales. A rise in spending typically leads to growth in ancillary services associated with car ownership, such as insurance, maintenance, and fuel consumption. Businesses in these sectors may see increased revenues, attracting investments and creating job opportunities. Given a population of approximately 34 million and a car ownership rate of 162.12 cars per 1,000 people, there are approximately 5.51 million cars in Saudi Arabia. The significant number of cars supports the notion that personal vehicle ownership is integral to the lifestyle of many Saudis. From the chart below, we find that there has been an increase of around 85% of car ownership in the kingdom per 1,000 people over the past 19 years. The car ownership per 1,000 people jumped from 87.5 in 2005 to 162.2 in 2024.

The challenge of profitability

With greater numbers of privately owned cars on the road, the competition faced by ride-hailing companies like Careem and Uber may intensify, thereby impacting their profitability. To remain viable, ride-hailing services in the kingdom like Careem, Bolt and Uber must make more money per trip. But huge losses are particularly hard to avoid in ride-sharing. Revenue growth is entirely dependent on its gigantic costs, a good chunk of which are spent subsidising rides to lure customers onto the app, away from competitors. Congestion delays the response to a request for a ride, which inconveniences passengers. And it raises the cost of operating taxis by increasing the time spent between dropping off one rider and picking up the next. Until they turn profits, ride-hailing firms will be vulnerable to a loss of investors’ patience. Since most ride-hailing companies don’t split out profits by geography, we will look at the wider picture of the world’s largest company Uber. In the past five years over 60% of the firm’s revenue growth has come from businesses other than ride-hailing, according to a survey done by the Economist. Most important has been food delivery, which surged during the pandemic. Uber’s profit margin before interest, tax, depreciation and amortisation when ferrying meals is less than half that when ferrying people.

How can the ride-hailing companies be profitable?

Some of the world’s leading ride-hailing companies have started new lines of business on top of its existing platform. For example, they have started food delivery and also given users the ability to rent scooters and bicycles through the app. Some have also introduced such Price Lock that offers daily commuters guaranteed prices to lure customers from other competitors. Another path to profitability is to bypass ride-hailing’s biggest expense: drivers. The scale of the cost is illustrated by the fact that drivers take around %73 of the profit of the ride-hailing companies. Having cars driven by software would dramatically lower that cost. Much of the resulting gain could be claimed by a price war between operators of autonomous- vehicle fleets, but capturing even a small proportion of it would swiftly make any ride-sharing firms profitable. No wonder big companies spend hundreds of millions on research and development into autonomous vehicles. |

|

|

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |