|

Highly skilled and talented workers from abroad are vital assets to the Saudi economy. We argue in this analysis that the latest decision to freeze rent in Riyadh for five years to tackle soaring property costs in the capital will help attract talents from around the world and relocate them from some regional hubs like Dubai. Rapid job creation and ongoing economic diversification projects in Saudi Arabia under Vision 2030 are drawing both locals and expatriates mainly into Riyadh. Rent in both Riyadh and Dubai has become a substantial challenge for the foreign talents, which may deter them from accepting job offers or remaining long-term in the city.

But Riyadh’s strategic decision to freeze the rent in Riyadh for five years is giving the Saudi capital an edge over Dubai and other regional cities such as Cairo, as it gives the potential talented expats financial certainty in a city that’s steadily solidifying its emergence as a dynamic global city in the region. The bold move in the kingdom’s real estate sector Riyadh’s strategic decision to freeze rent for five years serves as a clear signal that the city aims to be more than just a transient stop for foreign talent. By stabilizing one of the largest components of living expenses, which’s housing costs, the city reduces financial unpredictability that often deters long-term settlement. The rent freeze will benefit also the foreign expats to become home owners as developers might construct fewer units due to decreased rental prices, leading to decreased property values. The property values calculated based on discounted future rent earnings. (rent control effects, 2024, Journal of Housing Economics) Across the Gulf Cooperation Council, inflation generally remains contained by currency pegs and energy and food policy buffers, even as categories like housing and services push higher.

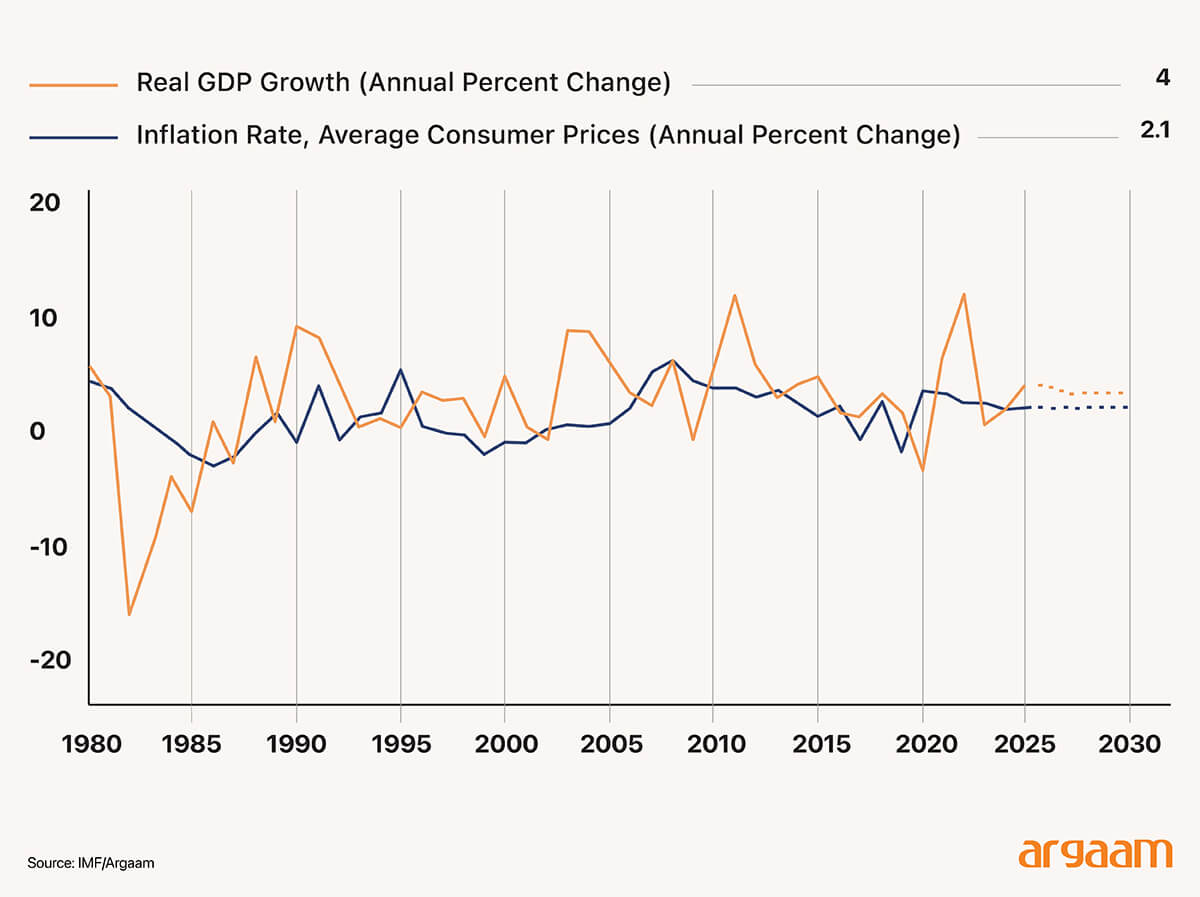

The Rent Factor in the CPI for Foreign Professionals Rising rental costs have been the most significant inflationary force both in Riyadh and Dubai. For rental properties, the Consumer Price Index, according to international standards, counts the rent paid to the landlord for a residential unit and included utilities. If a unit is owner-occupied, the CPI computes what it would cost to rent that home in the current housing market, known as Owners’ Equivalent Rent (OER). Utilities paid by homeowners are measured separately in the CPI. Affordable rental costs shouldn’t exceeding 30% of household income. (rent control effects, 2024, Journal of Housing Economics). The new five-year rent freeze implemented in Riyadh aims to address the sharp rise in rental prices amid increasing inflations. The Consumer Price Index in the Kingdom recorded an annual increase of 2.3% in August 2025, compared to the same month of the previous year (August 2024). This was mainly driven by a rise in housing, water, electricity, gas, and other fuel prices by 5.8%. (General Authority of Statistics, August 2025). The increase in the housing, water, electricity, gas, and other fuels division by 5.8% in August 2025 is driven by a 7.6% rise in the actual rentals for the housing group. The average apartment prices in Riyadh rose by 10.6% year-on-year (YoY).(Knight Frank, Q2 2025). The price per square metre ranges between SAR 5,500 to SAR 27,000 in the capital. (Bayut Saudi, Nov 2025). The Kingdom’s August outcome of 2.3% keeps Saudi inflation moderate by international standards, with domestic housing and services rather than imported goods seen as the main swing factors. Housing prices make up more than 40% of Dubai’s consumer price inflation. (Dubai Statistics Centre, September 2025). The increase in the housing, water, electricity, gas, and other fuels division by more than 6% in August 2025 is driven by rental increases of 10-20% over the last 12 months. The average apartment prices in Dubai rose by 13.7% year-on-year (YoY). Home prices across the city have soared by about 70% since the end of 2019. (Knight Frank, July 2025). Residential property prices in Dubai (two-bedroom) ranges between AED 21,000 to AED 53,000. (Dubai dubizzle, Nov 2025).  For employers in both Riyadh and Dubai, competitive and fair offers attract top talent to relocate. Given the soaring rents in both cities in recent years, the pay increases aren’t keeping up with the rising monthly pressure. There is little difference now between average salaries in Saudi Arabia and the UAE, with only a 5% to 8% uptick on average. (Cooper Fitch, November 2025). Riyadh’s recent five-year rent freeze policy provides a critical cost-of-living stabilization advantage over Dubai, where rents continue to climb. This intervention can be interpreted as a deliberate macroeconomic stabilizer, helping to preserve real disposable income levels for employees and thus supporting the virtuous cycle of wage growth and consumption that fuels the kingdom’s GDP expansion. Saudi Arabia's GDP growth for 2025 is projected to be around 4%, driven by strong non-oil sector expansion. (IMF October 2025).

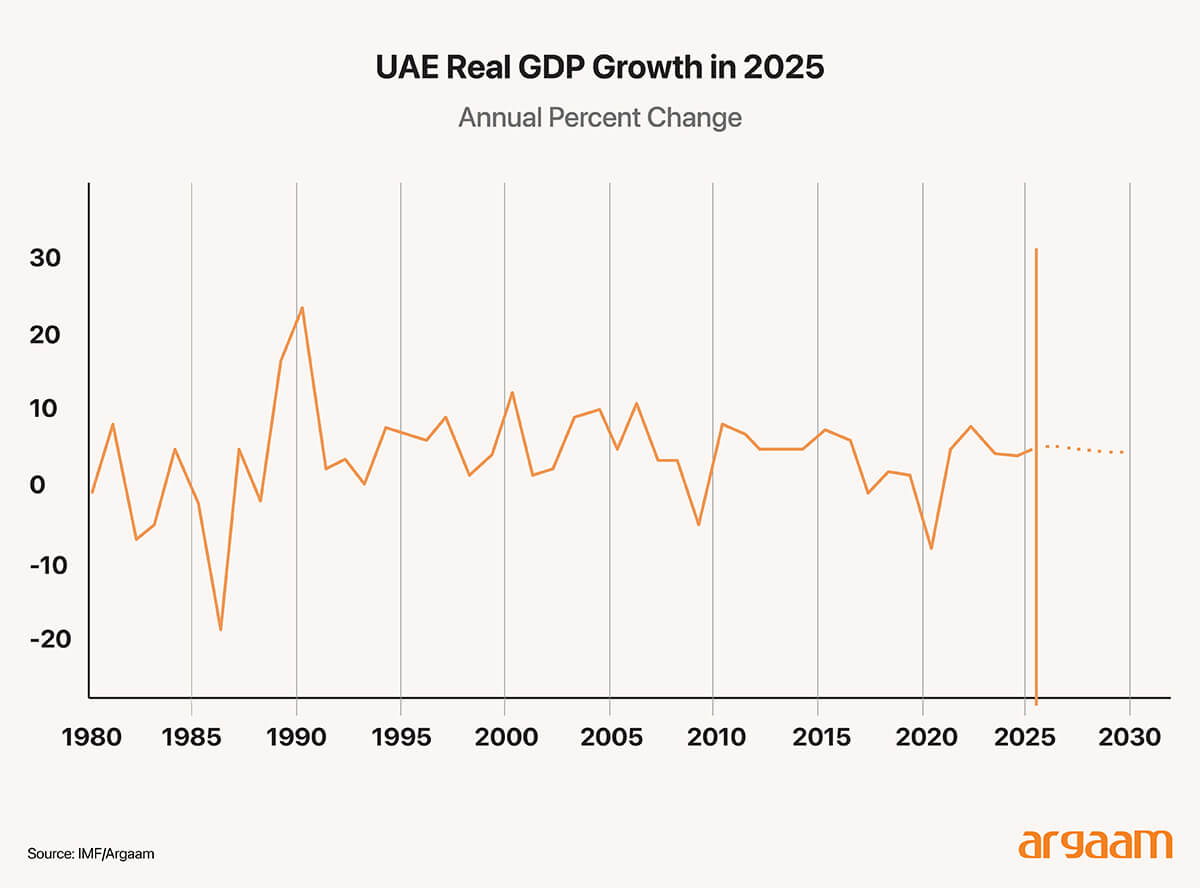

The IMF projects the UAE's GDP to grow by 4.8% in 2025, up from an estimated 4% in 2024. This growth is supported by strong non-hydrocarbon sector expansion, particularly in tourism, construction, and financial services.  Apart from the talented and skilled workforce, wages in Saudi Arabia decreased 9.4% in the second quarter of 2025 over the same quarter in the previous year. (Trading Economics, 2025). Wage Growth in Saudi Arabia averaged -0.38% from 2022 until 2025, reaching an all time high of 7% in the fourth quarter of 2023 and a record low of -13.10% in the first quarter of 2025. In 2025, 49% of employees in the UAE tried to negotiate their pay and only 15% were successful. (Michael Page’s 2026 Salary Guide). This is a significant drop from 2024, when 64% engaged in salary negotiations and 24% were successful. Dubai’s cost of living, chiefly rents and house prices, has become very expensive in the past three years for expats, mainly due to an influx of crypto millionaires wealthy Russians. This has created a feeling among exapats that the city has become a place for the super-rich. (Bloomberg, August 2025). Dubai has jumped up the rankings to become the costliest city in the Middle East for international employees. It is ranked 15th on the global ranking, up three places from 2023. Abu Dhabi was ranked 43, Riyadh (90) and Jeddah (97). (Mercer, 2024 ranking). The soaring rental prices for foreign skilled employees, which consume a high percentage of their annual income, can significantly affect the ideal cycle between economic growth and wage growth. (Wage share and economic growth, Applied Economics Letters, 2021) High housing costs effectively reduce disposable income and limit the increase in overall living standards despite higher wages. This can reduce the positive effect where higher wages fuel demand and further economic growth. Additionally, if housing costs become too burdensome, they will reduce the attractiveness of the labor market. Riyadh’s rent freeze directly addresses one of the most significant components of expatriates' cost of living, effectively reducing disposable income pressure. This can increase the real value of compensation packages and improve living standards for relocated talent. Additionally, both Riyadh and Dubai employers have recently reduced school fee allowances and other social benefits, which further exacerbates financial pressure on employees relocating to either city. In such an environment, housing cost stability becomes an even more important factor for attracting and retaining talent. |

|

|

|

|

|