|

Property developers from Riyadh, Dubai, and Cairo are progressively adopting a more global perspective, reflecting a thoughtful strategy aimed at managing risk through international diversification.

Making Strategic Inroads into different continents The Emirate Dubai-based Emaar has a massive real estate portfolio in Dubai, but it has also expanded its portfolio overseas in countries like India, Morocco and Turkey. In India, it has unveiled projects in the capital Delhi as well as Lucknow, Jaipur, and Mohali. The company’s revenues for the first half in 2025 reached $5.4 billion and net profit reached $2.8 billion (Emaar’s financial statements, H1 2025). The company’s competitor Damac Properties, which also has a massive real estate portfolio in Dubai, has unveiled Damac two luxury residential projects in Miami's Surfside area in the United States, as well as a project in the Maldives. (Damac Properties in Miami, 2024). The company’s revenues in the first half of 2025 reached $2.2 billion and the net profit $654.5 million.

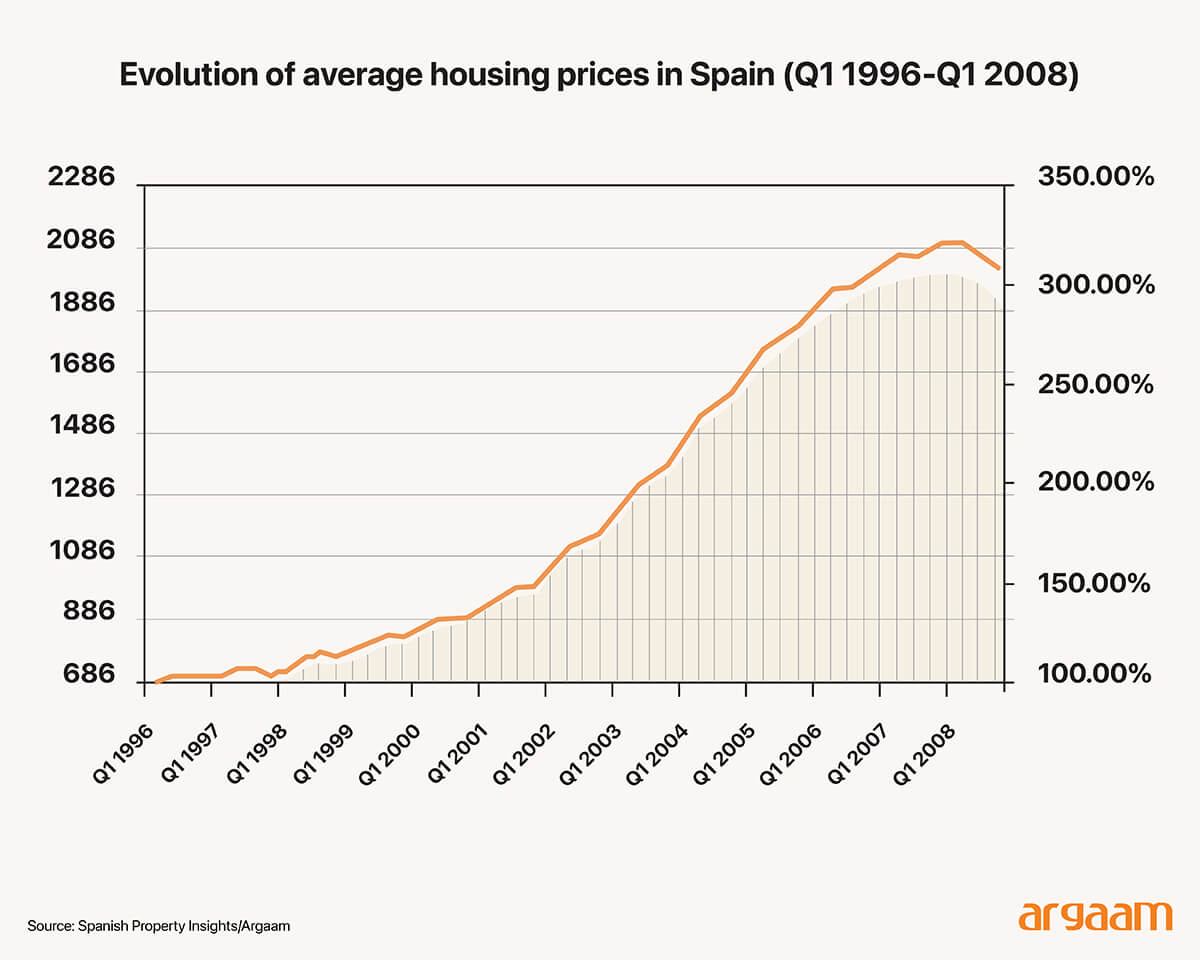

It is clear to us that the developers aim to optimize their returns while carefully navigating the delicate balance between three risks. One of the risks of a property boom is saturation, which happens when there’s an oversupply of housing units, where demand no longer matches the excessive construction that took place during the property boom. (A saturated property market, The Geographical Journal) Between roughly 1997 and 2007, Spain experienced a vigorous building boom fueled by strong demand, easy credit, and the perception of housing as a safe investment. This period saw steep increases in home prices (more than 10% annually) and large-scale production of new homes (over 4 million homes built between 1996 and 2007) The boom led to structural imbalances including excessive housing production relative to actual demographic and economic needs. Large numbers of homes remained vacant or were bought as second or holiday homes rather than primary residences. This was particularly evident in urbanised and tourist-oriented areas. Population growth stagnated after 2007 due to a reversal of previous migration trends. Meanwhile, economic downturn and increased mortgage defaults undermined demand further. These factors contributed to stagnation and collapse in housing demand while supply remained excessive. (Housing, population and region in Spain, The Geographical Journal, 2016).

After the boom, average housing prices dropped sharply by around 30% from their peak values in 2007, indicating substantial loss of property value for homeowners and investors. The bubble severely affected the financial sector at the time, especially savings banks known as cajas, whose capital was based on local deposits and which had been major sources of credit (over 40 billion euros during the boom). Residential construction started plummeting by nearly 90% from boom levels, leaving many projects unfinished and representing sunk costs and wasted investments.

Another risk in the regional market is a real estate bubble. The saturation of the housing market is closely linked to the formation of a bubble, but saturation itself is a symptom rather than the initial cause. Bubbles in housing prices tend to occur at regular intervals and are typically characterized by excessive demand and inflated prices disconnected from fundamentals. (20 Years of Research on Real Estate Bubbles, School of Economics and Management, University of Chinese Academy of Sciences, Beijing). Speculative behaviors by investors cause bubbles to form. Some investors may speculate on rapid price increases, buying properties not primarily for use or long-term holding, but expecting to sell at higher prices soon.  The real estate sector in Saudi Arabia lies at the heart of Vision 2030. The scale and continuity of the Kingdom’s real estate and infrastructure projects indicate that it has already moved from the vision phase to the execution phase. This transition is supported by sustainable financing mechanisms that align with societal needs and global standards of governance and environmental responsibility—instilling confidence in both local and international developers and investors. Click Here to Read Complete Report

The third risk and reason of portfolio diversification by major property developers in the region is geopolitics. Public markets have the benefit of being highly liquid, which private markets, such as real estate, do not. For example, after the invasion of Ukraine, public equity investors in Russia could quickly sell some of their positions. Businesses and investors with private, off-market holdings, on the other hand, faced a much longer exit route and often had to accept significant losses to extricate themselves from the country. (Impacts, the future of global real estate). Property developers generally adopt a ‘wait-and-see’ approach before making irreversible fixed capital commitments to expensive new buildings or heavy machinery. Proximity to conflict zones also has a clear impact. Poland, historically the largest and most liquid real estate market in central and eastern Europe, saw investment plummet after Russia’s 2022 invasion of Ukraine. Before the war, Poland accounted for between 50% and 60% of foreign capital inflows to the region. A joint academic study has analyzed the impact of geopolitical risk on housing markets across 23 advanced and emerging economies from 2005 to 2024. (King’s College London, Pamukkale University, Izmir Katip Celebi University). It found that house prices decline significantly following a rise in geopolitical risk, with the magnitude and persistence varying based on the shock type and source. Uncertainty-driven threats tend to exert stronger and more persistent effects on house prices than realized geopolitical events. |

|

|

|

|

|