|

Warner Bros., a name that resonates through cinematic history, from Superman and Batman to the magical realm of Harry Potter. It’s not just a film studio; it’s a cultural powerhouse that recently gave us the blockbuster sensation "Barbie," and it controls iconic media outlets like CNN that shape global news narratives. The entire company is up for sale and the price tag is estimated initially at $71 billion price, one of the most staggering deals in entertainment history. But as the spotlight shines on this monumental opportunity, a question lingers in the background: Is Warner Bros. truly the unbeatable bargain that Saudi major investors like the Public Investment Fund (PIF) cannot afford to overlook? Or is there a hidden complexity beneath the glitz and glam, one that could challenge the wisdom of plunging billions into what appears, at first glance, to be a crown jewel of Hollywood?

In theory, the PIF can afford it. It’s developing a portfolio of high-quality domestic, regional and international investments diversified across sectors, geographies, and asset classes. PIF has already invested in some of the world's most innovative companies, forming partnerships that will ensure Saudi Arabia is at the forefront of emerging trends while supporting the Kingdom's Vision 2030 blueprint. The PIF’s assets are expected to surpass $1.075 trillion by the end of 2025. The PIF’s goal is to reach at least $2.6 trillion by 2030. PIF currently manages around $1 Tn in assets.

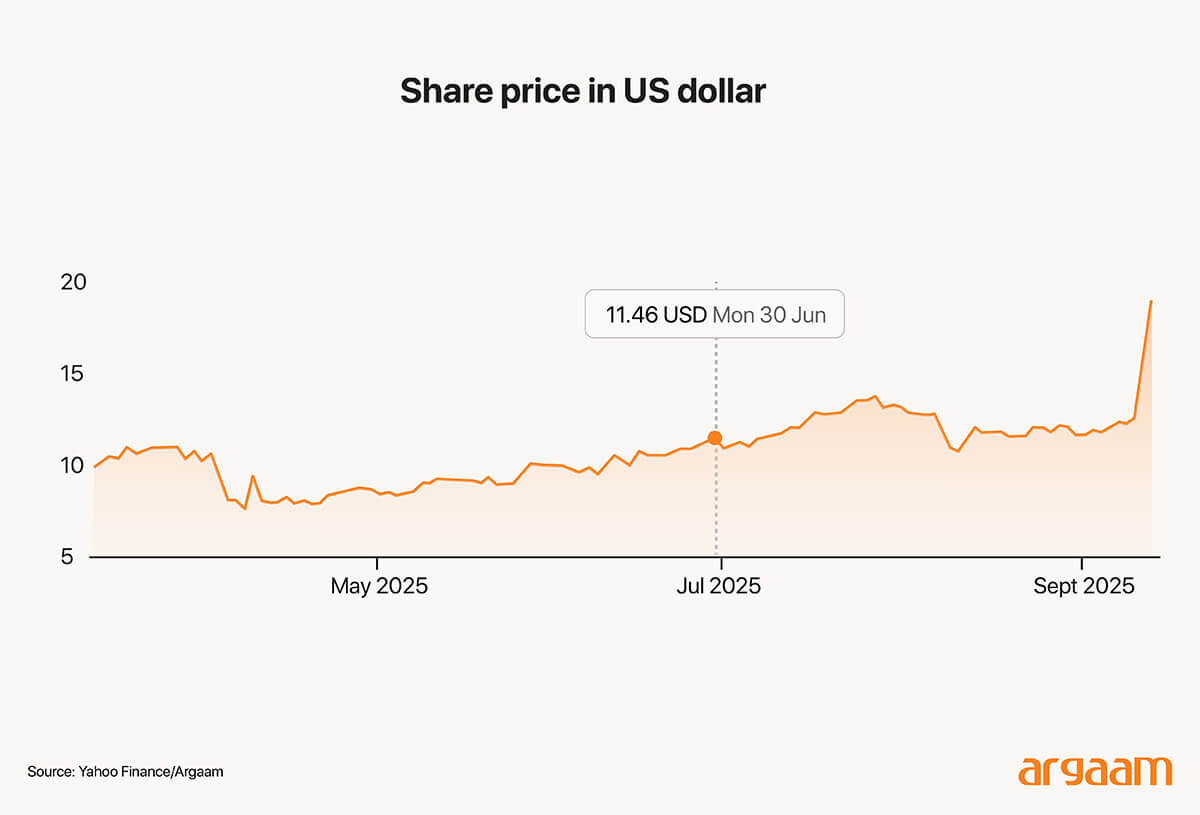

The allure of Warner Bros. brand is undeniable and the surface dazzle with future success. Yet, our analysis whispers caution. While Warner Bros. presents some impressive figures, such as a market capitalization approaching $33 billion, an enterprise value of approximately $71 billion, and $38.4 billion in revenue over the past 12 months, it is important to closely examine the company’s key financial metrics as reported in its Q2 2025 earnings release. This analysis will provide a clearer understanding of the company’s financial health and performance from an investor’s perspective.

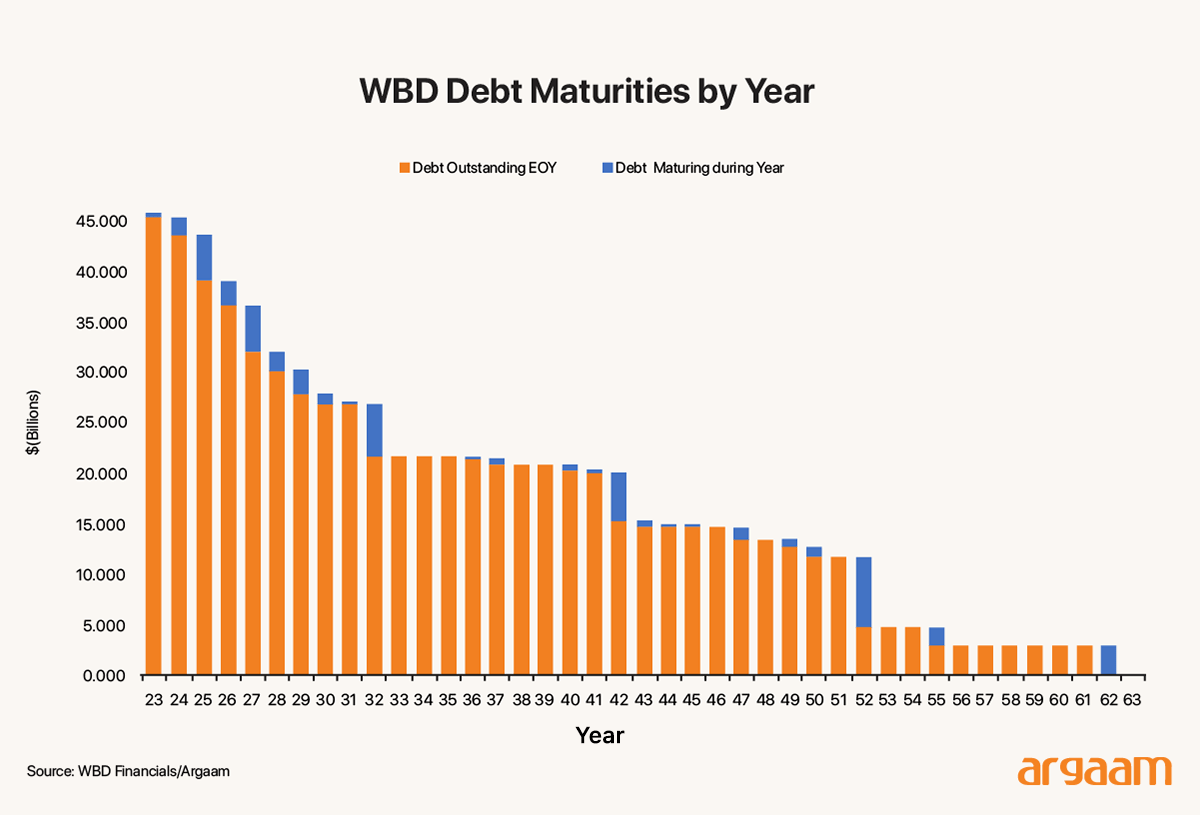

Behind the Hollywood Spotlight It’s evident from the company’s latest available financial results that the substantial debt burden represents a serious and critical disadvantage for Saudi investors considering a bid for the Hollywood-famous company. With an overall debt of approximately $38 billion, the leverage profile of the company raises significant concerns. The sheer scale of this indebtedness poses considerable financial risk, making the acquisition less attractive due to the obligation to service such a large amount of debt. This level of leverage could limit the company’s operational flexibility and increase vulnerability to market fluctuations, thereby making potential investors thinking twice before pursuing ownership despite the company's renowned brand and market position.

The company’s price-to-earnings (P/E) ratio stands at a notably low 4.4x, compared with global market averages typically ranging between 15x and 20x. This valuation can be interpreted in two ways: on one hand, it may appear attractive to investors seeking undervalued opportunities; on the other hand, it could reflect broader concerns regarding the sustainability of the company’s earnings. In essence, investors are currently willing to pay only $4.4 in share price for every $1 of earnings. Ultimately, how this multiple is perceived depends heavily on market sentiment and risk appetite, which also explains the stock’s heightened sensitivity to news around debt and liquidity management. Any increase in borrowing may be seen either as a prudent move to secure liquidity or as an additional burden that could strain financial stability. This dynamic highlights the company’s continued reliance on debt financing and liquidity management to sustain cash flows an approach that, while supportive in the short term, could constrain financial flexibility over the medium term.  Combined with ongoing declines in advertising revenue and domestic linear pay TV subscribers, the company’s revenue base faces challenges in maintaining stable cash generation to comfortably service its debt. (And that’s why it has opted for shifting the business model largely towards streaming services on par with Netflix, for an example). One positive thing in the company’s debt-related bands is that debt repayment schedule is spread out over multiple years rather than concentrated in a single period as shown in the chart above. Of the Company’s around $38 billion of remaining debt, approximately: ● $4.5 billion is due in 2025, ● $2.3 billion is due in 2026, ● $10.0 billion is due between 2027 and 2031, ● $6.7 billion is due between 2032 and 2041, and ● $20.1 billion is due between 2042 and 2062. Debt-to-Equity Ratio The company reported a ratio of 0.95x, indicating that total debt is nearly equivalent to shareholders’ equity (i.e., for every $1 of equity invested, the company carries approximately $0.95 in debt). Revenue: Total revenue reached $9.8 billion in Q2 2025, reflecting only marginal growth compared to the same period last year. Operating Cash Flow: Operating cash flow came in at $983 million during Q2, down roughly 20% year-over-year. Free cash flow stood at approximately $1.2 billion, a decline that highlights mounting pressures on liquidity and overall financial resource management.

Unseen risks related to litigation

In addition to the common risks associated with acquiring a company like Warner Bros., there is a crucial litigation risk that extends beyond typical anti-trust concerns. For a Saudi investor, this risk arises from potential legal disputes rooted in the foreign ownership of a major U.S. entertainment company, based on insights from an academic paper titled ‘Litigation risk and the cost of debt financing in M&As’. Unlike domestic competitors such as Paramount, a foreign investor may face heightened scrutiny related to governance, regulatory compliance, cultural differences, or geopolitical considerations. Even if anti-trust laws are not directly involved, litigation risks can stem from challenges by shareholders, regulatory bodies, or other stakeholders questioning the investor's strategic intentions, contract interpretations, or operational decisions. legal disputes can further lead to substantial direct and indirect expenses, including large legal fees, potential settlements, and damages costs. This elevates the risk that the company may face unexpected financial burdens, making lenders demand higher yields as compensation, and accordingly increase the company’s overall debt. |

|

|

|

|

|