|

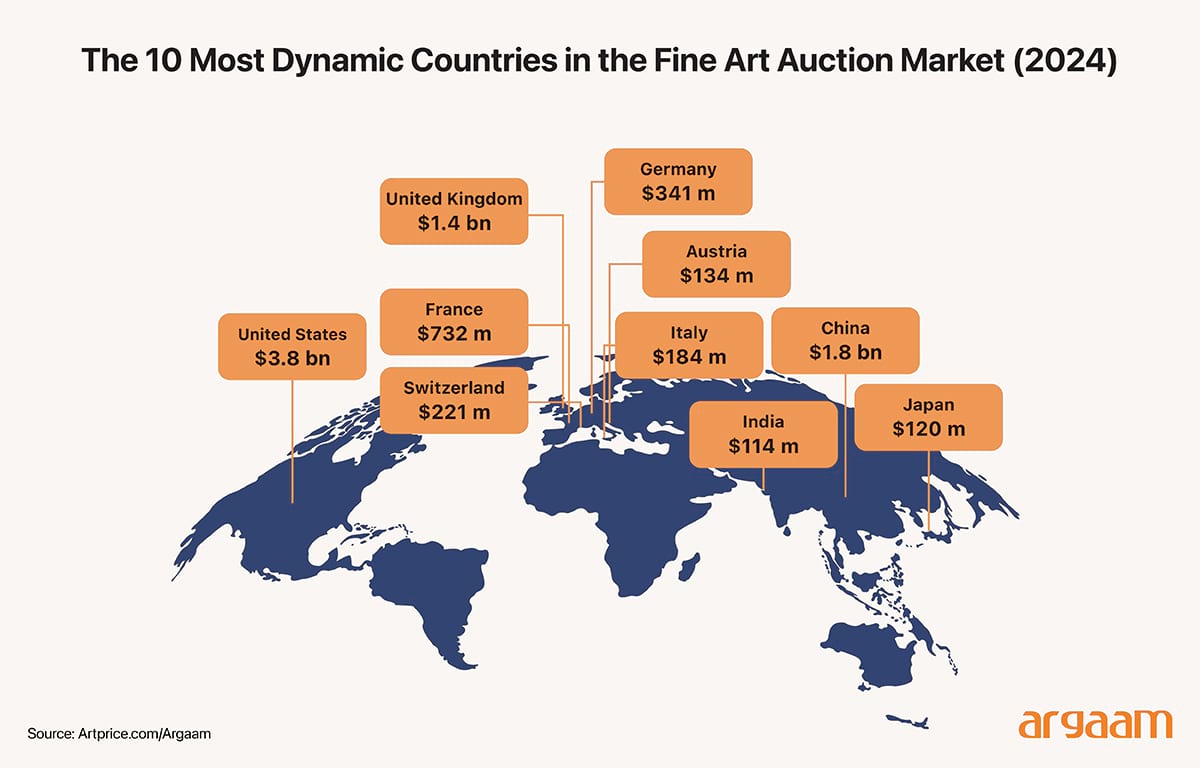

Over the past decade, investors from the Arabian Gulf countries made headline-grabbing moves in the global art market, marking a historic moment for high-value art acquisitions. Around this period, these investors strategically expanded their art portfolios by acquiring masterpieces from renowned artists, with expenditures estimated to reach hundreds of millions of dollars, reflecting a growing in the investment at the international art scene. These high-profile purchases underscore the growing interest among Saudi and broader Arab investors in fine art as a means of portfolio diversification. Yet, amid this enthusiasm, recent data reveal a notable decline in auction sales among the world’s leading fine art brokers for the third consecutive year, a trend that persists despite the rising number of ultra-wealthy individuals globally. This contrast raises critical questions about the viability and prudence of continued investment in the fine art market for Saudi and Arab investors. Last October, the Abu Dhabi wealth fund, Abu Dhabi Developmental Holding Company (ADQ) acquired a 24.2% stake in Sotheby’s Holdings UK for $909.3 million amid a downturn in the art market. This raises questions about the timing and risk associated with this investment, even though Sotheby’s holds a prestigious position in the industry. Our analysis seeks to illuminate these complexities, providing a grounded and comprehensive perspective about the main reasons behind the growing decline in the art market to guide informed decision-making in the continuing investment in such ‘emotional’ assets. During the first half of the year, auction sales at Sotheby’s, Christie’s, and Phillips decreased to $3.98 billion, marking a 6.2% decline compared to the same period in 2024, based on data from ArtTactic, an art market research and data firm based in London. The data (click here for the full report) provides detailed analysis of global auction data, including online-only sales, geographic trends, category breakdowns, luxury goods, and the impact of guarantees. Sales of post-war and contemporary art dropped 19.3% to $1.22 billion, impressionist and modern art fell 7.7 % to $989.5 million, and luxury sales were almost flat (down 0.5% to $805.9 million). The withdrawal of high-profile works such as Andy Warhol’s Big Electric Chair and Alberto Giacometti’s bronze bust Grande tête mince (Grande tête de Diego), which failed to attract buyers in May, exemplifies the challenges faced by the fine art market when notable pieces do not sell at auction. This phenomenon has several financial implications for the broader art market. High-value artworks serve as market benchmarks; when they fail to find buyers, it signals potential softness or uncertainty about valuation levels. This can lead to a decline in buyer confidence, prompting more cautious bidding behavior in subsequent auctions and a potential widening of the gap between seller expectations and market prices. Unsold lots reduce the transaction volume and revenue for auction houses, impacting their profitability and potentially leading to a more conservative approach in valuations, hence lower prices. The leading auction house Sotheby’s, for example, reported a nearly 20% drop in revenue from commissions and fees last year as sales decreased. Filings from parent company Bidfair Luxembourg show losses more than doubled to $248 million (£184 million) in 2024, compared with $106 million the previous year. Total revenues dropped to $1.13 billion in 2024 from $1.36 billion the year before. Commissions and fees comprise the bulk of Sotheby’s revenues. Christie's experienced a significant drop in auction sales in the first half of 2024, with a 22% decrease to $2.1 billion compared to $2.7 billion in the same period of 2023. The company's total revenue also fell by 6% to $5.7 billion in the full year 2024 from $6.1 billion in 2023, marking a continued decline from earlier years.

Profit Motive Challenges Traditional Collecting Values The phenomenon of flipping, where artworks are purchased with the intent to resell quickly for a profit, has also increasingly influenced the dynamics of the art investment market. While flipping may offer short-term gains for some investors, it has been widely criticized for its negative impact on long-term market stability and sales volumes. Flipping often leads to an artificial inflation of prices during auction periods as speculators drive bids beyond intrinsic or aesthetic values rather than based on genuine collector interest or artistic merit. This speculative behavior undermines the credibility of price signals, making it difficult for genuine buyers and investors to assess the true value of artworks, according to useful insights from a 2022 academic paper titled “Speculative Trading and Bubbles: Evidence from the Art Market.” As a consequence, the market becomes more volatile and unpredictable, discouraging serious collectors who seek longer-term appreciation. The rapid resale of artworks contributes to saturation in secondary markets, flooding galleries and auction houses with works intended primarily for quick turnover rather than sustained appreciation. This oversupply can suppress prices and reduce demand, leading to a decline in overall sales and market confidence. One painting, by the Ghanaian artist Emmanuel Taku, sold at auction in 2021 for $189,000. When it was put up for auction again earlier this year, its price plunged to just $10,160. In this case, the initial high price in 2021 was driven by speculative demand or hype, possibly fueled by short-term investors or opportunistic buyers hoping to capitalize on trending artists like Emmanuel Taku. When the painting was put up for auction again shortly after, the resale market corrected this overvaluation. Genuine collectors or investors, who value the work based on its artistic merit, provenance, and long-term appreciation potential, were not willing to pay the earlier inflated price. The significant drop to $10,160 suggests that the market reassessed the actual value of the piece, revealing that the previous high price was likely artificial.

The Changing Tastes Driving Market Downturn Another important reason behind the growing decline in the art market is the evolving preferences and interests of younger cohorts, millennials and Gen Z, are a significant factor contributing to the recent downturn in the fine art market. For many years, older generations, who amassed large art collections as their wealth grew through the latter half of the 20th century and early 21st century, were the primary drivers of demand. Their strong appreciation for works created by artists of the 20th century helped sustain market growth and price resilience. Now, as this group enters later stages of life, many are choosing to reduce their art holdings or sell portions of their collections. Furthermore, their descendants frequently show little interest in retaining these artworks. The millennials and Gen Z, having been raised in a digital environment, exhibit different cultural and investment preferences.  When artists buyback their own works The art market's division into primary and secondary segments, coupled with limited transparency and minimal regulatory oversight, significantly impacts market efficiency and liquidity. Regulatory absence allows practices such as undisclosed artist buybacks at auctions to artificially maintain or inflate prices. It also leads to variable prices of artwork sold on the secondary art market depending on undisclosed bidding activities, expert appraisals, and private agreements, making true market value elusive. One last reason, which’s obivious though, is rising interest rates in recent years have significantly increased the cost of financing art acquisitions, making such investments less attractive financially. A wealthy collector taking a $100 million loan to purchase artwork would face substantially higher annual interest expenses as rates rise -- from around $2 million at a 2% rate to $6 million at a 6% rate. This increased cost reduces the potential net returns on the investment, especially since artworks do not generate income like dividends or coupons but rely solely on capital appreciation. Ultimately, these factors altogether culminate in diminished market confidence, slower turnover rates, and reduced sales velocity, which collectively depress market liquidity and cause a decline in overall art market activity. |

|

|

|

|

|