|

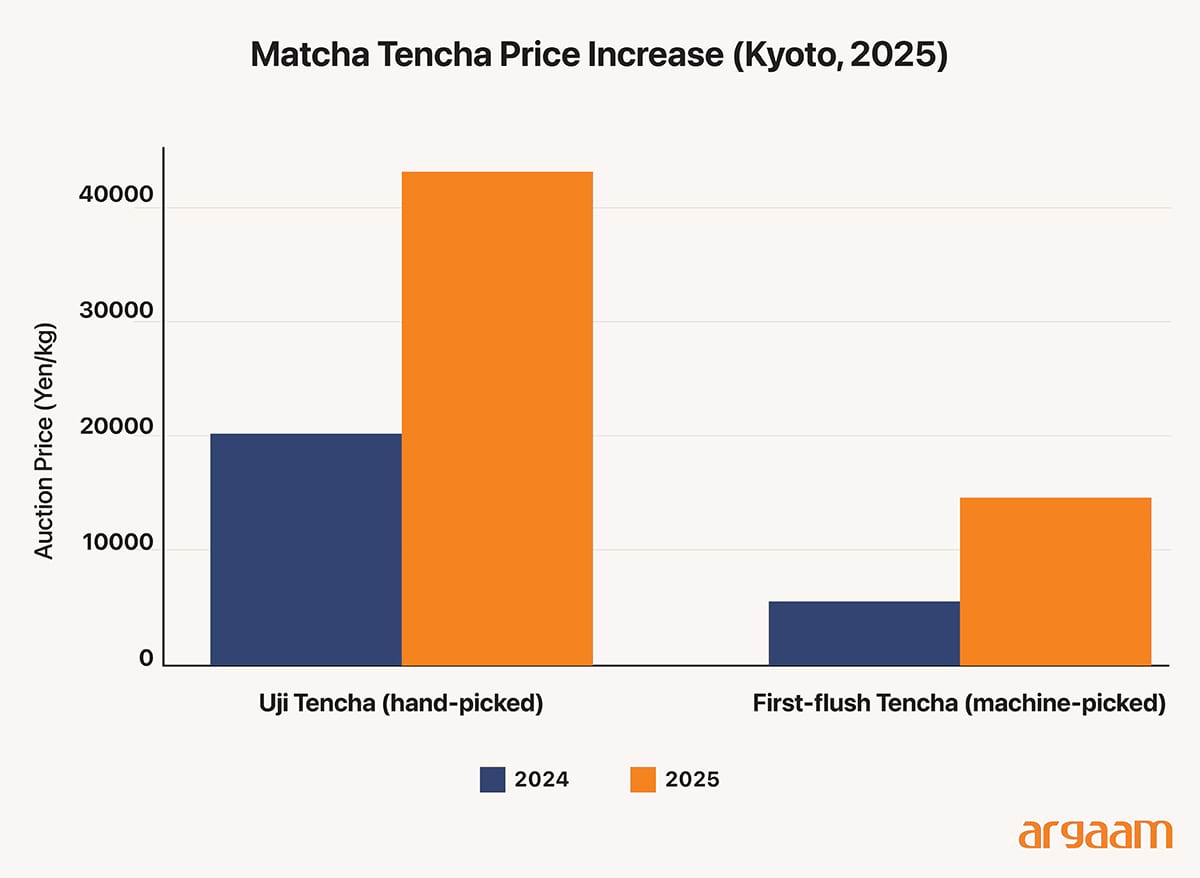

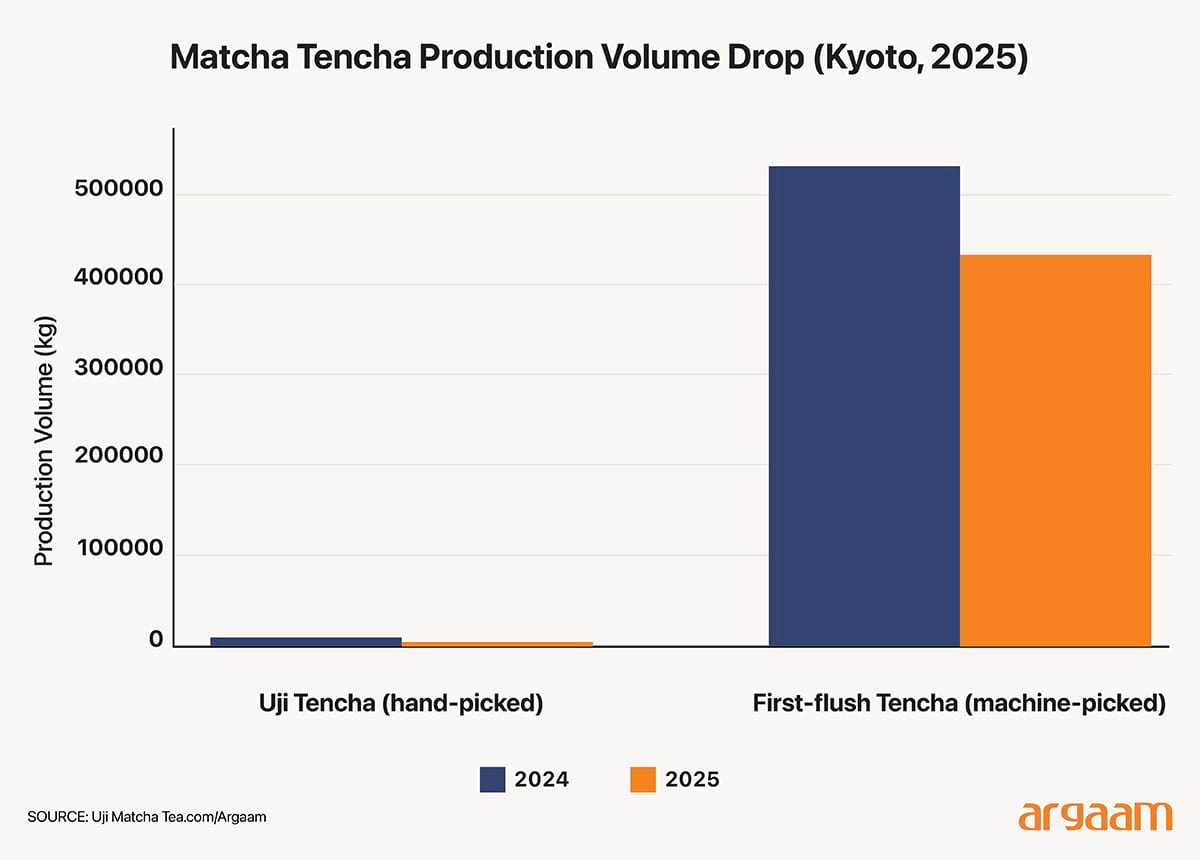

The global tea market is undergoing a significant transformation as traditional demand patterns shift and new consumer preferences emerge. Notably, Kenya’s tea export industry, which has long been a cornerstone of the country’s economy, experienced a marked 21% decline in exports in recent years, signaling a growing weakening in demand from its traditional importers, chiefly the most populous country in the Arab world: Egypt. This downturn is largely attributed to economic difficulties in traditional importing countries and consumers increasingly seeking healthier beverage alternatives. Furthermore, geopolitical developments after the election of Donlad Trump in the US last year have introduced additional layers of complexity to the trade in one of the most popular products of green tea: matcha. The sweeping change materialised earlier this month (August 2025) with the imposition of a 15% tariff by the United States on Japanese goods. Given that Japan remains the historical epicenter of matcha production, these tariffs will substantially increase the total cost of production of Japanese matcha in key international markets, making it more expensive for distributors, retailers, and ultimately consumers. But even before the Trump’s tariffs, the matcha production in Japan has been going through turmoil over the past couple of years, mainly due to an unstoppable increase in demand in the domestic and global markets. One store in Tokyo alone sells a month’s supply of matcha powder in a single day. The severe shortage of farmers is also a critical factor. Their number has shrunk from more than 53,000 farmers in 2000 to just less than 12,000 today, as younger generations aren’t willing to take over the job. This means an immediate price hike as shown in the chart below.    The price of the handpicked tencha (leaves) increased from about 20,000 yen per kilogram in 2024 to over 43,000 yen in 2025, that’s more than double. When we convert these prices to Saudi Riyals (SAR) using today’s exchange rate at the writing of this analysis on August 9, 2025 (1 SAR = 39.6 yen), the cost of production in Japan grew from around SAR 500 to over SAR 1,000 per kilogram in just one year. Importing matcha from Japan to Saudi Arabia also involves additional shipping, tariffs, and handling costs. These extra costs raise the final market price, making imported matcha more expensive for consumers.

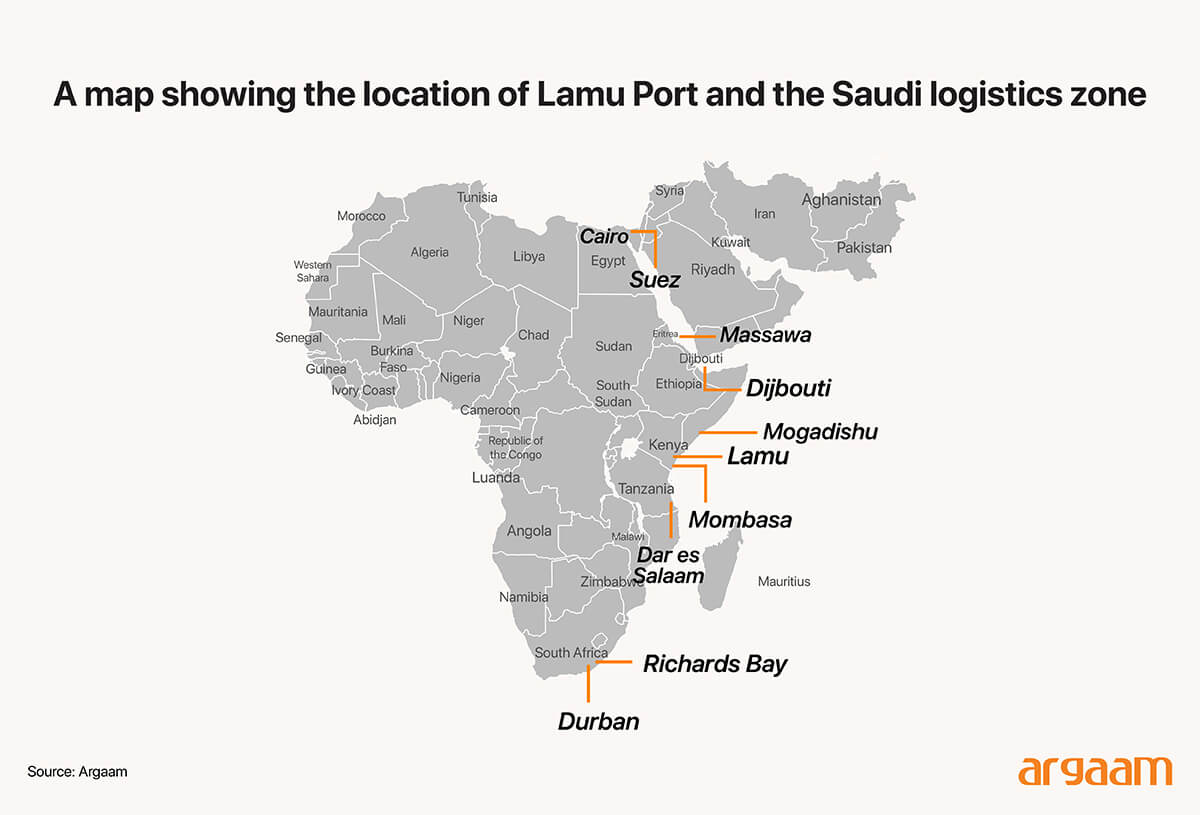

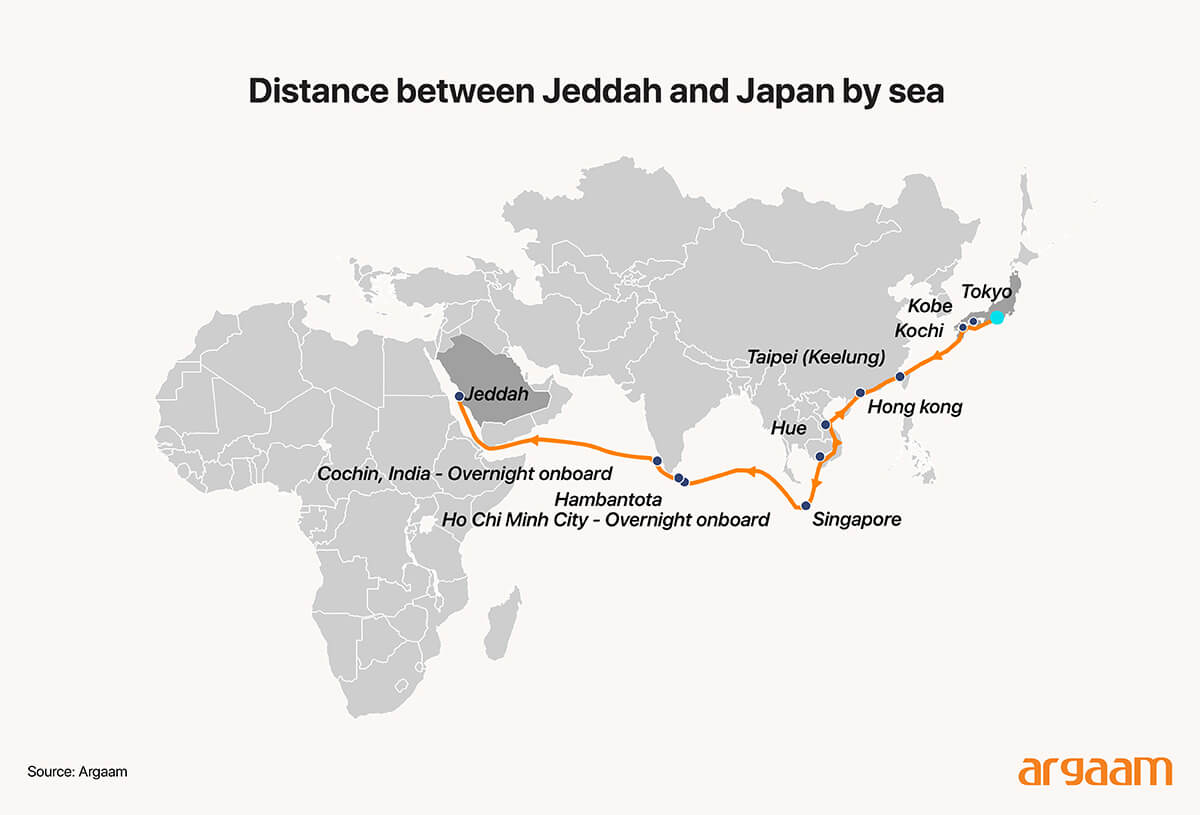

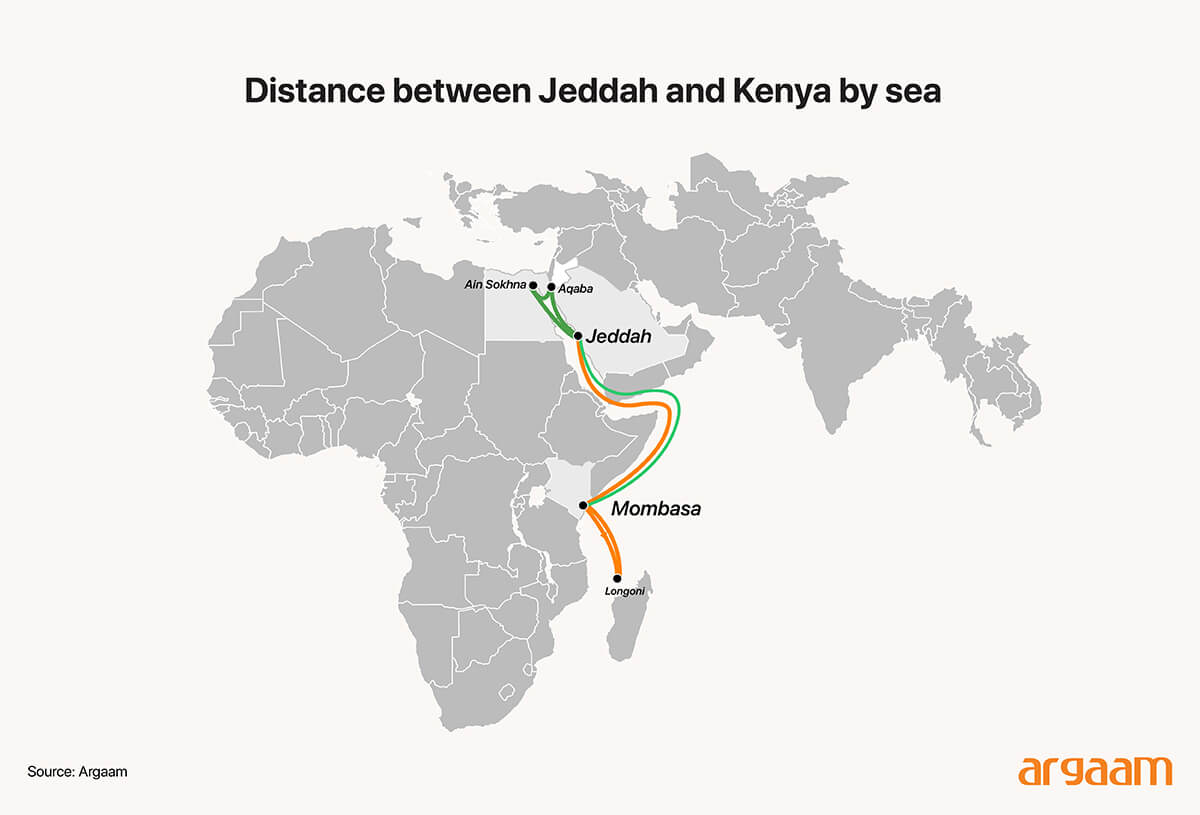

Kenya’s Matcha Promise As we chose to analyse and explore what could be a niche market and a potential great investment opportunity for matcha cultivation beyond its traditional Japanese roots. We found ourselves drawn to Kenya not only because of its unique agro-climatic but also for an attractive economic perspective, given the growing decline in black tea sales as we mentioned in the beginning. So, why not shifting towards green tea instead? But firstly it’s important to note that cultivating matcha leaves in Saudi Arabia is not financially reasonable primarily due to the country's unsuitable climatic and soil conditions for tea production. Establishing the necessary controlled environment for tea cultivation would involve substantial capital investment in infrastructure such as irrigation systems, climate control, and soil modification, significantly increasing operational costs. Furthermore, the lack of local expertise and established tea farming infrastructure means Saudi Arabia would face a steep learning curve, adding to inefficiencies and production risks. These challenges would likely result in low yields and poor-quality matcha, undermining the financial viability of domestic cultivation compared to sourcing from established tea-growing countries like Kenya. Remarkably, many regions in Kenya, including the highlands of Kericho, Nyeri, and Bomet West of the Rift Valley, share the matcha characteristics, boasting well-aerated red volcanic soils and favorable altitudes ranging between 1500 and 2700 meters. Coupled with Kenya's established tea industry infrastructure and growing expertise among small- and large-scale farmers, this presents an untapped opportunity for Saudi institutional investors to pioneer a new chapter in premium green tea production.  Saudi Arabia’s Lamu Investment Economically, Saudi Arabia is particularly interested in establishing a commercial and logistics foothold in East Africa’s largest economy through the new Lamu Port, just as it did when it signed a contract with Djibouti last year to establish the Saudi Logistics City in the free zone at the African country’s main port. This Saudi logistics zone is situated near the Bab-el-Mandeb Strait, a critical maritime chokepoint connecting the Red Sea to the Gulf of Aden and the Arabian Sea. This location provides Saudi Arabia with rapid and efficient access to African and global markets, enabling faster shipment of Kenyan matcha produce to Saudi and broader Middle Eastern markets.  The Saudi logistics zone in Djibouti is developed with state-of-the-art storage facilities equipped with temperature and humidity control systems, which are crucial for the matcha powder, which’s highly sensitive to heat, light, and moisture, to preserve its freshness and nutritional properties during transit en route to Saudi markets. The logistics zone offers specialized handling services that minimize exposure of matcha powder to contaminants or physical damage. Japanese export ports are also equipped with high-standard logistics services and advanced cold-chain technologies suitable for remanufactured premium-grade matcha destined for export. However, the Kenyan route via sea freight offers a geographically advantageous and economically favorable option for transporting bulk matcha powder to Saudi Arabia. Kenya’s Lamu port lies approximately 3,000 kilometers from the Saudi port of Jeddah via the Red Sea and Gulf of Aden shipping lanes, and the journey takes approximately 12 days. In contrast, the sea distance from Tokyo, Japan, to Jeddah is roughly 10,000 kilometers, factoring transit through the South China Sea, Indian Ocean, and Red Sea. An average journey from a key Japanese port like Yokohama to Jeddah can take around 20 days and 18 hours by sea. This near threefold shorter distance from Kenya results in reduced fuel consumption, lower shipping fees, and shorter transit times, which collectively lower overall transportation costs. Additionally, Kenya's proximity allows for more frequent and flexible shipping schedules, reducing holding costs and inventory risks associated with longer voyages from Japan.   Kenya’s Secret to Competitive Matcha Production Kenya’s tea industry benefits significantly from lower labor, land, and operational costs compared to Japan, which translates into much lower production expenses. For example, the daily wage of a skilled farmer in Kenya is around 400 Kenyan shillings, which is approximately 12 Saudi Riyals (SAR). In contrast, a skilled worker in Japan earns about 952 Japanese Yen per hour, equivalent to roughly 24 SAR per hour. Over an eight-hour workday, this amounts to 192 SAR per day. Comparing these figures, the daily labor cost in Japan is about 16 times higher than that in Kenya (192 SAR versus 12 SAR per day). Given that labor is a substantial part of production costs in tea cultivation, this stark difference means producing matcha in Kenya is considerably cheaper. For instance, if producing one kilogram of matcha in Japan costs around 1,000 SAR and labor accounts for 30% of this cost (about 300 SAR), the labor cost for the same kilogram in Kenya would be roughly 18.75 SAR, assuming proportional labor requirements. When factoring in these labor savings alongside lower land and operational costs, production in Kenya could easily be less than half the cost of producing matcha in Japan. Additionally, since Saudi Riyals are stronger than Kenyan Shillings, converting costs to SAR further accentuates the affordability of Kenyan production.  Taleem’s incremental slide further reinforces the theme of price discounts emerging in response to broader market dynamics or sector-specific challenges, such as shifts in tenant performance or changes in the regulatory landscape.

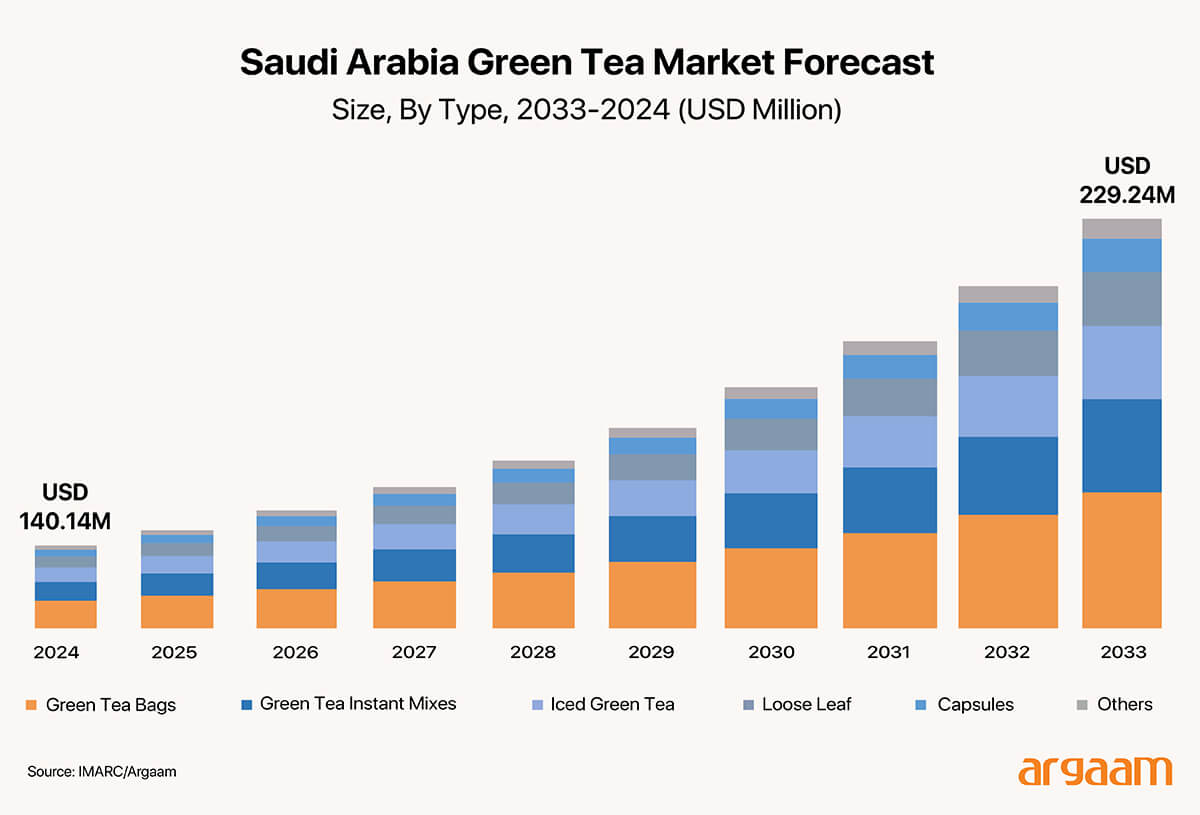

Transforming Saudi Arabia’s Beverage Culture According to a recent report by IMARC Group, Saudi Arabia’s green tea market, which includes matcha, was valued at $140.14 million and is projected to grow to $229.24 million by 2033. Imports of packaged green tea nearly doubled in value between 2020 and 2023, suggesting a growing appetite for premium, health-focused drinks. That growing demand is reflected on cafe menus and social media feeds across the Kingdom. Matcha lattes, once limited to specialty coffee shops, are now a fixture at trendy cafes and home kitchens alike. The health benefits of matcha extend beyond popular perception, grounded in its rich composition of bioactive compounds, notably epigallocatechin gallate (EGCG), a potent antioxidant. Extensive research highlights EGCG's role in reducing systemic inflammation, improving endothelial function to support cardiovascular health, and enhancing neuroprotective effects that may aid cognitive performance. Furthermore, a recent academic study conducted in Saudi Arabia and published early this year revealed that more than 50% of participants recognized matcha's potential in supporting metabolic health, specifically citing its perceived efficacy in weight management and regulation of blood glucose levels. These findings align with clinical evidence suggesting that regular consumption of matcha may modulate insulin sensitivity and promote fat oxidation, contributing to its growing reputation as a functional food with multifaceted health impacts. This ‘green gold’ offers more than just a beverage: it represents a renewed appreciation for an ancient tradition in Japan combined with thoughtful innovation in Saudi Arabia. |

|

|

|

|

|