|

While the recent insights given by a Bloomberg economist highlight important challenges facing Saudi Arabia’s economy amid oil price fluctuations, his recurring emphasis, either in Linkedin posts or comments cited by the global media outlet, on a high fiscal break-even price as the primary indicator of Saudi Arabia’s financial health may present an incomplete picture. Using the fiscal break-even price alone to gauge Saudi Arabia’s ability to finance government spending and mega-projects risks oversimplifying complex economic realities and potentially misinforming audiences. As of current Brent crude prices at approximately USD 70 per barrel (significantly higher than the level that caused historic distress in 2020), Saudi Arabia continues to generate substantial revenue despite oil prices being below the break-even threshold cited by Bloomberg as $96 on August 4, 2025. Our analysis demonstrates that the fiscal break-even price is not an absolute threshold but rather a reference point in the context of broader fiscal management. Evaluating economic growth prospects solely through the lens of break-even oil prices ignores key factors chiefly the economic growth outlook, the non-oil revenue initiatives, the reserves and financial performance of the Public Investment Fund (PIF), which’s dubbed as the financial engine of the kingdom. The contrasting growth forecasts for Saudi Arabia’s economy from the IMF’s upward revision to 3.5% in 2025, according to the latest report in June, versus Bloomberg economist’s downward revision to only 2.6% underline the need for objective reporting and evaluation.

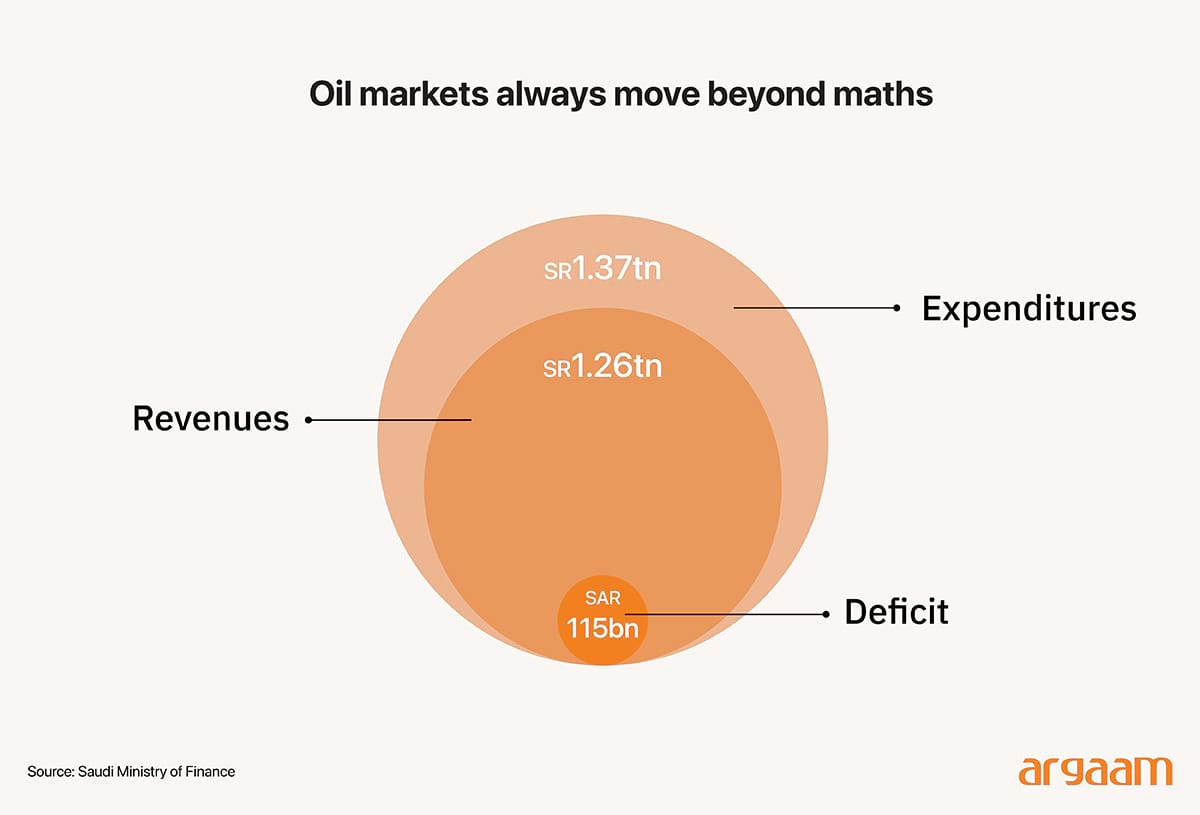

The International Monetary Fund (IMF) is a globally recognized international financial institution with extensive data resources, rigorous modeling capabilities, and a mandate to provide impartial, comprehensive macroeconomic analysis. Its revised upward forecast of 3.5% GDP growth for Saudi Arabia in 2025 reflects confidence in key supporting factors, chiefly government spending and domestic demand are expected to fuel growth despite lower oil prices. In contrast, Bloomberg’s reduction of Saudi Arabia’s 2020 economic growth forecast to 2.6%, largely attributed to revenue losses from lower oil prices and an obsessive focus on fiscal break-even levels, may demonstrate a narrower analytical scope. This approach seems to emphasize short-term oil price volatility and fiscal constraints without fully accounting for: 1) Saudi Arabia’s financial buffers such as sovereign wealth fund. 2) Ongoing economic diversification and government stimulus efforts. 3) Medium-to-long-term reforms that the IMF incorporates into its projections. ➤ As of the first half of 2024, the real year-on-year non-oil gross domestic product (GDP) growth in Saudi Arabia was 3.7 %. ➤ In 2024, Saudi Arabia's non-oil exports reached an all-time high of 515 billion riyals (approximately $137.29 billion). This signifies a major step in the country's efforts to diversify its economy away from oil dependence. ➤ The rise in revenues in 2024 (a total of SAR1.26 trillion or $336 billion) was primarily fueled by a surge in non-oil income, which accounted for 40 % of total revenues and reached SAR 502.47 billion, reflecting a 9.78 % year-on-year increase.

Therefore, while individual analysts contribute valuable perspectives, the IMF’s comprehensive methodology, institutional independence, and use of systemic data make its forecasts more authoritative and reliable for guiding expectations about Saudi economic growth. On Saudi Arabia’s sizable sovereign wealth fund, accumulated reserves, and ability to strategically manage spending provide substantial buffers that support fiscal stability beyond what break-even price calculations alone suggest. Fund boosted its total assets to SAR 4.32 trillion ($1.15 trillion) by the end of 2024, an 18% increase compared to the previous year, according to a disclosure filed with the London Stock Exchange and published in June 2025. The sovereign wealth fund reported gross revenues of SAR 413 billion for 2024, reflecting a 25 % year-on-year rise. This growth was fueled by solid performance across several portfolio companies, including Savvy, Ma’aden, STC, Saudi National Bank, AviLease, and Gulf International Bank, as well as dividend income from Saudi Aramco. Despite global macroeconomic challenges such as high interest rates, inflationary pressure, and select asset impairments, the fund reported a net profit of SAR 26 billion in 2024. PIF’s debt ratio remained unchanged at 13% by the end of the year, the disclosure noted.

How Fiscal Sustainability Supports Oil Economies It is essential to highlight that fiscal sustainability, rather than merely achieving a balanced budget in the short term, is a more crucial and prudent objective for a country like Saudi Arabia or any oil-exporting economy. Saudi Arabia's fiscal sustainability is a key focus, particularly as highlighted in the latest Vision 2030 report to diversify the economy. This means that maintaining a government's ability to service its debt and meet long-term spending commitments without resorting to excessive borrowing or abrupt fiscal adjustments that could destabilize the economy. This is particularly important for countries dependent on volatile commodity revenues like oil, where short-term budget balance targets can be misleading or even counterproductive.

A rently published academic paper titled "Differentiation of Oil Production Break-even Level among World Oil Companies" provides an insightful analysis of fiscal sustainability among oil-exporting countries. One example cited in the paper is Saudi Aramco's crude oil selling price in 2019, while the forecasted fiscal break-even oil price was significantly higher at USD 78.3 per barrel. Despite the average oil price in 2019 being around USD 64.6 per barrel, which is below the fiscal break-even price, Saudi Arabia maintained budgetary stability by relying on accumulated financial reserves and prudent borrowing rather than balancing the budget strictly each year. Similarly, Russia provides another example as the government’s budget balance is not solely determined by immediate oil price fluctuations. Russia, like Saudi Arabia, relies on strategic reserves and exchange rate management to buffer the economy against short-term price shocks, indicating that break-even prices alone do not fully capture fiscal sustainability. So when the price of oil goes down in dollars, Russia earns less money for its oil, but as it could depreciate the local currency and since it spends most of its money in rubles, then each dollar Russia earns can be exchanged for more rubles. This adjustment can improve budget revenues in ruble terms despite falling world oil prices, thus reducing the deficit or limiting the budget shortfall.

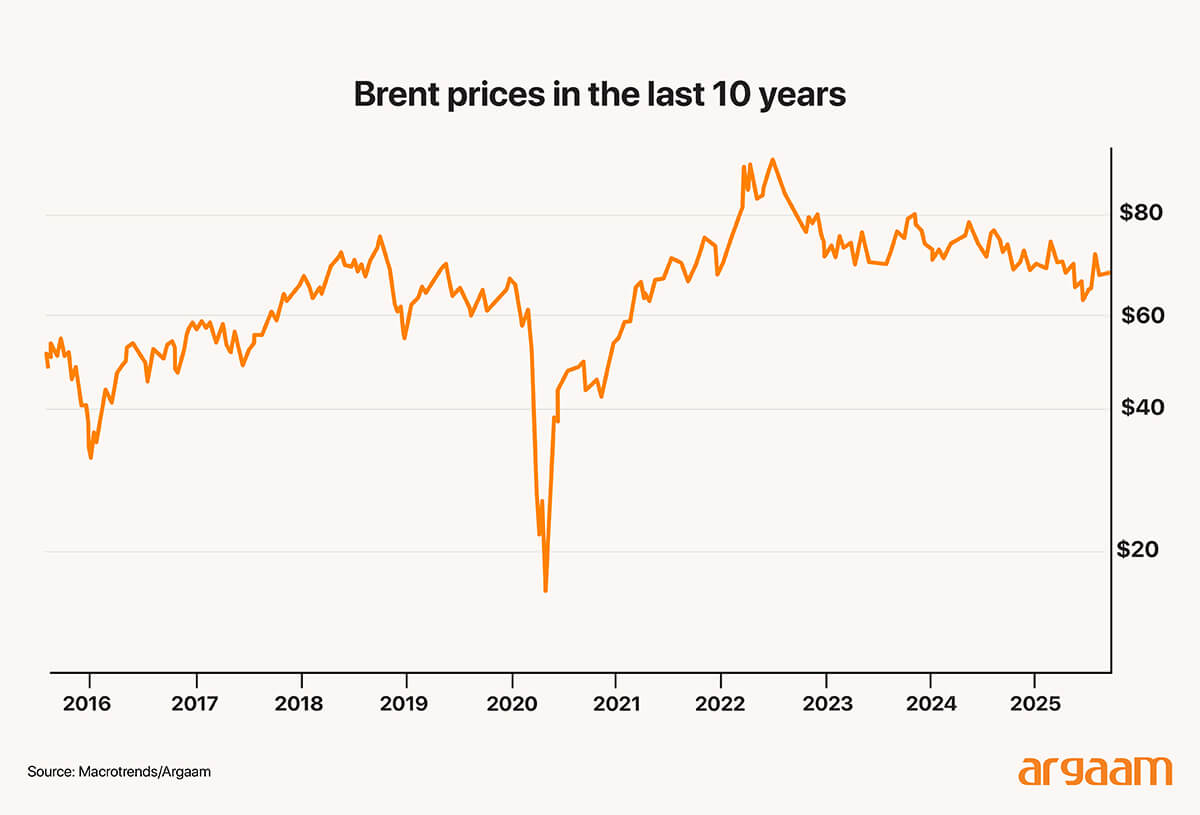

Oil markets always move beyond maths Breakeven prices are also not static; they change depending on factors such as production volumes and technology, which reduces operational costs. Oil prices remained elevated in August at the writing of this analysis even as OPEC+ has raised output, with Brent crude fluctuating near $70 a barrel, up from a 2025 low of near $58 in April, despite the fact that OPEC+ decided to raise oil production by 547,000 barrels per day for September, mid increasing U.S. pressure on India to halt Russian oil purchases. This situation illustrates that breakeven prices, which primarily consider production costs and fiscal thresholds, do not fully capture the complex interplay of geopolitical factors, market sentiment, supply-demand imbalances, and external pressures that influence actual market prices.

Even when production increases (which would normally tend to lower prices) other factors can maintain or even elevate prices beyond breakeven levels. Therefore, relying solely on breakeven prices can be misleading, as these prices are affected by many variables beyond production costs, making them an insufficient standalone indicator of market behavior or profitability The reliance on the term "breakeven" with minimal explanation of its nuances and Saudi Arabia’s broader fiscal context may inadvertently skew perception toward a pessimistic narrative by the western media. This selective framing overlooks the complexity of Saudi Arabia’s fiscal resilience and dynamic economic management. |

|

|

|

|

|