|

Private equity firms in the Gulf are actively seeking top-tier talent from global financial hubs like Wall Street and London to enhance their competitiveness and global footprint. One of the key incentives used to attract this talent in the West is profit-sharing or carried interest awards, designed to align employee compensation with fund performance and incentivize superior returns. In the private equity industry, investment professionals are often awarded small stakes in the firm as part of their compensation. Their carry is their share of the profits that the overall fund generates whenever it sells a portfolio company. In the Gulf, a growing number of candidates are inquiring about their ability to offer carried interest awards, according to an August 7 report published in Bloomberg. But does it work in our region? While these profit-sharing arrangements can be effective for talent attraction and motivation, they carry significant financial risks and challenges from the firm ownership perspective, especially for large institutional owners like sovereign wealth funds. Profit-sharing essentially represents a variable labor cost tied to firm or fund profitability rather than a fixed wage. This can lead to large payouts when profits are high, which reduces the net returns to the main employer or the owners. In years of exceptional performance, these payouts could escalate, creating cash-flow pressure or requiring additional capital to meet commitments. If a private equity firm or a hedge fund wants a 12% internal rate of return (IRR) on its capital but has to share 20% of profits with employees, it effectively receives only 80% of that return, reducing effective IRR to approximately 9.6%, before considering other costs. |

Additionally, sovereign wealth funds in the Gulf manage hundreds of billions in assets. Even a small percentage allocated to profit-sharing to a group of employees in a portfolio company can translate into substantial absolute sums. So if a fund manages, let’s say to simplify the analysis, $500 billion and allocates $10 billion to private equity funds, a 20% carried interest on $1 billion profits equates to $200 million paid out as profit-sharing, a significant amount of public or state-controlled capital flowing to employees. And when profits drop during a downturn, employees might still expect some minimum pay or bonuses to stay, even if profits are low. This means the company could face financial pressure because it has to pay workers despite earning less. Also, the Shariah-compliant profit-sharing system, as applied in several private equity firms in the Gulf, requires participants to share both profits and losses. This means that investors or partners cannot expect to receive returns without bearing the risk of potential losses. Will the foreign talents accept this fair play? While the Shariah-compliant profit-sharing model emphasizes risk-sharing, foreigners who expect only profit participation without loss exposure may find this system inconsistent with their traditional compensation expectations. The free-rider dilemma Before we move to the last part of our analysis on geopolitics, which’s always a factor in the Middle East, profit-sharing schemes that tie rewards to group performance inherently carry a risk of free-riding, where individual employees may reduce their effort knowing that their personal contribution is diluted across the group’s shared benefits. Since each employee receives only a fraction of the total profit, the incentive to exert maximum effort diminishes, especially as group size increases, as outlined in a recent research paper titled ‘Profit-Sharing – A Tool for Improving Productivity, Profitability and Competitiveness of Firms?’. When employees know that their individual efforts only slightly affect the total profits shared among the whole group, they might not try as hard. Because each person gets only a small part of the reward, they may feel it’s not worth putting in extra effort. As a result, the profit-sharing plan doesn’t work as intended to boost productivity. Without effective mechanisms to combat shirking—such as peer monitoring, internal competition between teams, or careful design of incentive schemes—profit-sharing can result in payouts that do not align with actual value creation, leading to frustration and possible financial inefficiencies.  Clear provisions concerning how profit shares are handled in case of termination, layoffs, or restructuring help mitigate risks. Without a legally sound framework, ambiguities may arise regarding eligibility, timing, and distribution of profit shares, especially when employment status changes. This uncertainty can lead employees to contest payments or entitlements, resulting in costly legal disputes. The company may be obliged to pay the disputed profit shares retroactively to terminated employees, along with interest, penalties, and court fees. This can be a substantial unexpected expense affecting cash flow, let along damaging the employer’s reputation. If the profit-sharing system is tied to the performance of a specific department or project, transferring the employee to another department may nullify their entitlement, unless the contract stipulates that the entitlement continues regardless of the change.

Caught in the crossfire? John is a talented financial analyst from London. He was lured to a prestigious private equity firm in the Middle East with an enticing profit-sharing reward scheme as the sole financial incentive and not the fixed-pay agreed in advance in the negotiation phase. The promise was clear: if the firm thrived, he would reap handsome rewards, far beyond a fixed salary. Dreaming of achieving his ambitious financial goals, John eagerly took the leap. Months into his new job, a geopolitical storm erupted: the Iran-Israel war broke out, shaking the region and sending shockwaves through the markets. The private equity firm’s profits plummeted, not because of John’s performance, but due to geopolitical factors far beyond his control.

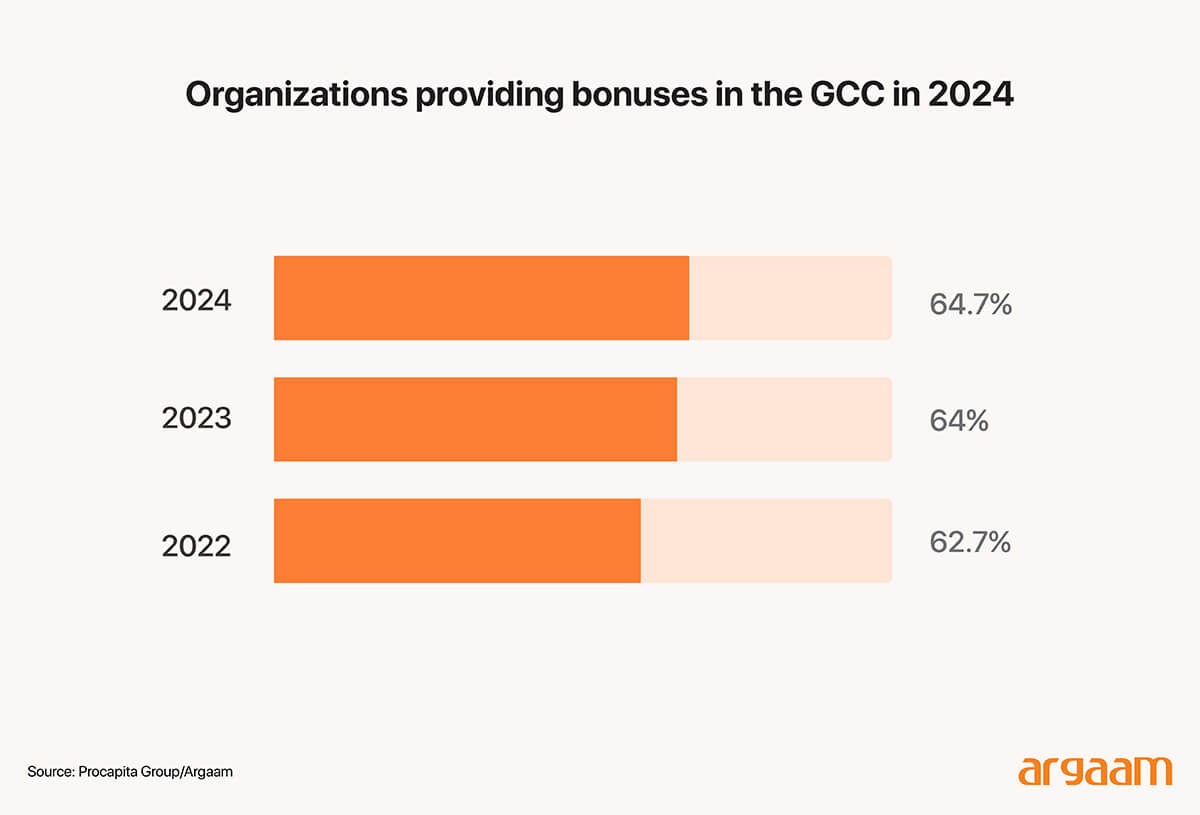

His once-promising profit-sharing rewards dwindled to almost nothing, leaving him staring at a financial setback he had never anticipated. John soon realized the harsh truth: the allure of profit-sharing had blinded him to the risk intertwined with the carry system. Ambitions turned fragile, and the system designed to motivate him backfired. The combination of a fixed base wage plus the traditional incentives such as performance bonuses, fee schools, and tax-free income in Gulf countries already constitutes a fair compensation system. The tax-free income status in particular in Saudi Arabia and the UAE, effectively increases earning power compared to taxed incomes in many Western countries. Furthermore, recent reforms in labor laws across Saudi Arabia and the UAE have enhanced worker protections, ensuring fair treatment, job security, and dispute resolution mechanisms. This regulatory environment contributes to a balanced and equitable working condition for both foreign and local employees. |

|

|

|

|

|