Across the Arabian Gulf and the broader Middle East, the cost of private nurseries and childcare has become a significant and growing financial burden for many families. This upward trend in expenses reflects anincreasing demand for quality care in key cities like Riyadh, Dubai and Cairo.

For households, these costs often consume a substantial portion of their monthly budget, sometimes comparable to or even exceeding housing expenses for families with two or three young children.

This heavy financial outlay critically influences parental decisions, particularly for mothers, as it can make continued full-time employment less economically viable, leading to reduced work hours or withdrawal from the workforce and accordingly impacting GDP.

Our analysis took a focused approach, modeling the economic and financial impact on households by examining private nursery costs in prime urban locations such as Riyadh, Dubai, and New Cairo.

These dynamic metropolitan areas served as key case studies due to their rapid development and high cost of living.

To measure the impact effectively, we utilized several key metrics: the absolute fees charged by private nurseries in these areas, average household salaries to contextualize affordability, and a critical comparison between the average childcare costs and typical housing costs.

This allowed us to illuminate the significant proportion of household income dedicated to early childhood education and care, providing a robust framework for understanding the financial pressures faced by families in these specific urban environments.

The provided data based on our research illustrates in the following chart the cost of private nursery fees across Riyadh, Dubai, and New Cairo.

In Riyadh, annual costs range from SAR 27,000 for local nurseries and SAR 50,000 for international nurseries.

Dubai’s households typically paying between AED 25,000 and AED 60,000 per year.

New Cairo sees parents facing annual fees from EGP 35,000 ($740) to EGP 135,000 ($2,850).

Riyadh, Dubai, and New Cairo are major economic hubs with a generally high cost of living. This translates directly to increased operational expenses for nurseries, including rent for facilities in desirable areas, utilities, and competitive salaries required to attract and retain qualified educators and staff.

These cities are experiencing rapid economic growth and urbanization, attracting a diverse population, including many working parents.

This creates a robust market for childcare, particularly for private, high-quality options, where demand can push prices upwards.

The childcare market in Saudi Arabia is expected to reach over $4 billion in 2030 (Grand View Research), while it’s projected to reach AED 3.8 billion in UAE in 2030.

We could not identify reliable data indicating the size of the childcare market in Egypt.

When work becomes economically irrational

From an economic perspective, high childcare costs act as a significant barrier to women's employment primarily through the lens of two economics factor: the opportunity cost, which means the financial benefits of working (wages) must outweigh the costs associated with working.

In some cases, especially for lower-income jobs, the cost of childcare can even exceed the potential wages, making working economically irrational. (Research on the Economic Effects of Childcare).

Secondly, the impact on labour supply, which means tend to be more elastic than men's, meaning their decision to work is more responsive to changes in net wages.

High childcare costs effectively reduce the real hourly wage, pushing many women out of the labor market or causing them to reduce their hours.

Lower and middle-income families often find childcare costs consuming a larger percentage of their household budget, making it economically unfeasible for one parent (often the mother) to work. This can trap families in lower-income brackets.

Childcare to average wage

To determine the affordability of childcare for average earners in Riyadh, Dubai and New Cairo, this analysis will first convert all annual childcare costs into monthly figures based on the year is made of three terms (9 months).

These monthly childcare costs will then be expressed as a percentage of the average monthly household income for each respective city.

This approach allows for a direct comparison of the financial burden across different regions and childcare options.

|

Childcare Type |

Monthly Cost |

% of Average Household Income |

|

Local Nursery |

3,000 |

11.54% (3,000/26,000) |

|

International Nursery |

5,555 |

21.37% (5,555/26,000) |

These percentages demonstrate the considerable financial burden childcare places on families, which directly influences a woman's decision to participate in the labor force, as a significant portion of the household's income can be dedicated to these expenses.

Dubai

|

Nursery Type |

Average Monthly Household Income (AED) |

Monthly Childcare Cost (AED) |

% of Monthly Income |

|

Local Nursery |

30,000 |

4,000 |

13.33% |

|

International Nursery |

30,000 |

7,222 |

24.07% |

Even at the lower end, local nursery costs consume a notable portion of the household's income. This percentage is clearly straining the family budget and reducing funds available for other necessities like housing, food, and savings.

The cost of international nurseries presents a substantial financial burden, absorbing nearly a quarter of the household's gross monthly income.

New Cairo

|

Category |

Value |

% of Monthly Income |

|

Average Monthly Household Income |

40,000 |

- |

|

Childcare (Local Nurseries) Monthly Cost |

2,916.67 |

7.29% |

|

Childcare (International Nurseries) Monthly Cost |

11,250 |

28.13% |

The cost for local nurseries consumes a moderate portion of the household's income.

While seemingly manageable, even this percentage can contribute to the significant deterrent effect of high childcare costs on women’s labor force participation.

The cost for international nurseries presents a substantial financial burden, consuming over a quarter of the household's monthly income.

A Closer Look at Nursery Costs vs. Monthly Wages

We now pivot our focus to a critical aspect of household economics: housing costs. This section will delve into the average rental expenses for a 3-bedroom apartment in central locations across three distinct cities: Riyadh, Dubai, and New Cairo.

Beyond merely stating these figures, we will explore what these housing costs represent as a proportion of the average monthly income in each respective city.

|

City |

Average Household Monthly Wage (USD) |

Average Monthly Housing Cost (3-Bedroom, central) (USD) |

% of Housing Cost out of Monthly Wage |

|

Riyadh |

$6,930 |

$2,350 |

33.9% |

|

Dubai |

$8,170 |

$4,350 |

53.24% |

|

New Cairo |

$850 |

$425 |

50.00% |

Riyadh is the most favourable in terms of housing affordability relative to wages, with housing costs consuming approximately one-third (33.91%) of the average monthly wage.

As for Dubai and New Cairo, still presents a higher burden, where housing costs take up 53.24% and 50% respectively of the average monthly wage.

|

City |

Housing Costs (%of Avg. Monthly Wage) |

Local Nursery Costs (% of Avg. Monthly Wage) |

|

Riyadh |

33.91% |

11.54% |

|

Dubai |

53.54% |

13.33% |

|

New Cairo |

50.00% |

7.29% |

While housing costs significantly outpace local nursery costs in Riyadh, Dubai, and New Cairo, it is important to note that both commitments combined represent a substantial portion of an average monthly wage in all three cities.

In Riyadh, housing and nursery costs collectively consume approximately 45.45% of the average monthly wage. This figure rises dramatically in New Cairo, where these expenses account for around 57.29% of the average wage, and even more so in Dubai, reaching roughly 66.57%.

Saudi Arabia aims to achieve 40% female workforce participation in the Kingdom by the end of this decade, having already surpassed its Vision 2030 target of 30% in 2024.

The gross domestic product (GDP) per capita in Saudi Arabia amounted to 35,120 U.S. dollars in 2024.

Between 1980 and 2024, the GDP per capita rose by 15,580 U.S. dollars. The GDP per capita will steadily rise by 5,040 U.S. dollars over the period from 2024 to 2030, reflecting a clear upward trend.

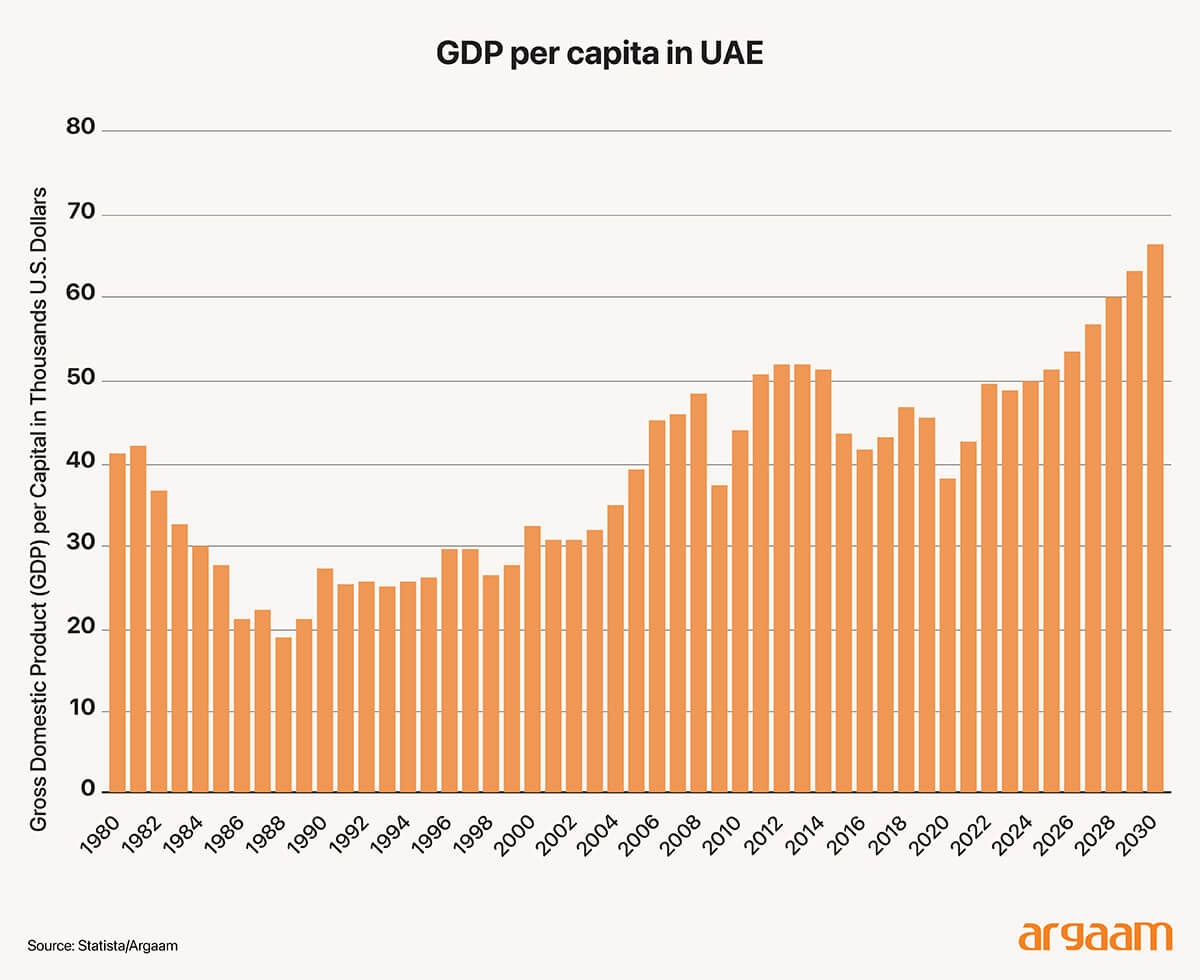

The gross domestic product (GDP) per capita in the United Arab Emirates was estimated at 50,220 U.S. dollars in 2024. Between 1980 and 2024, the GDP per capita rose by 8,910 U.S. dollars. The GDP per capita will steadily rise by 16,450 U.S. dollars over the period from 2024 to 2030, reflecting a clear upward trend.

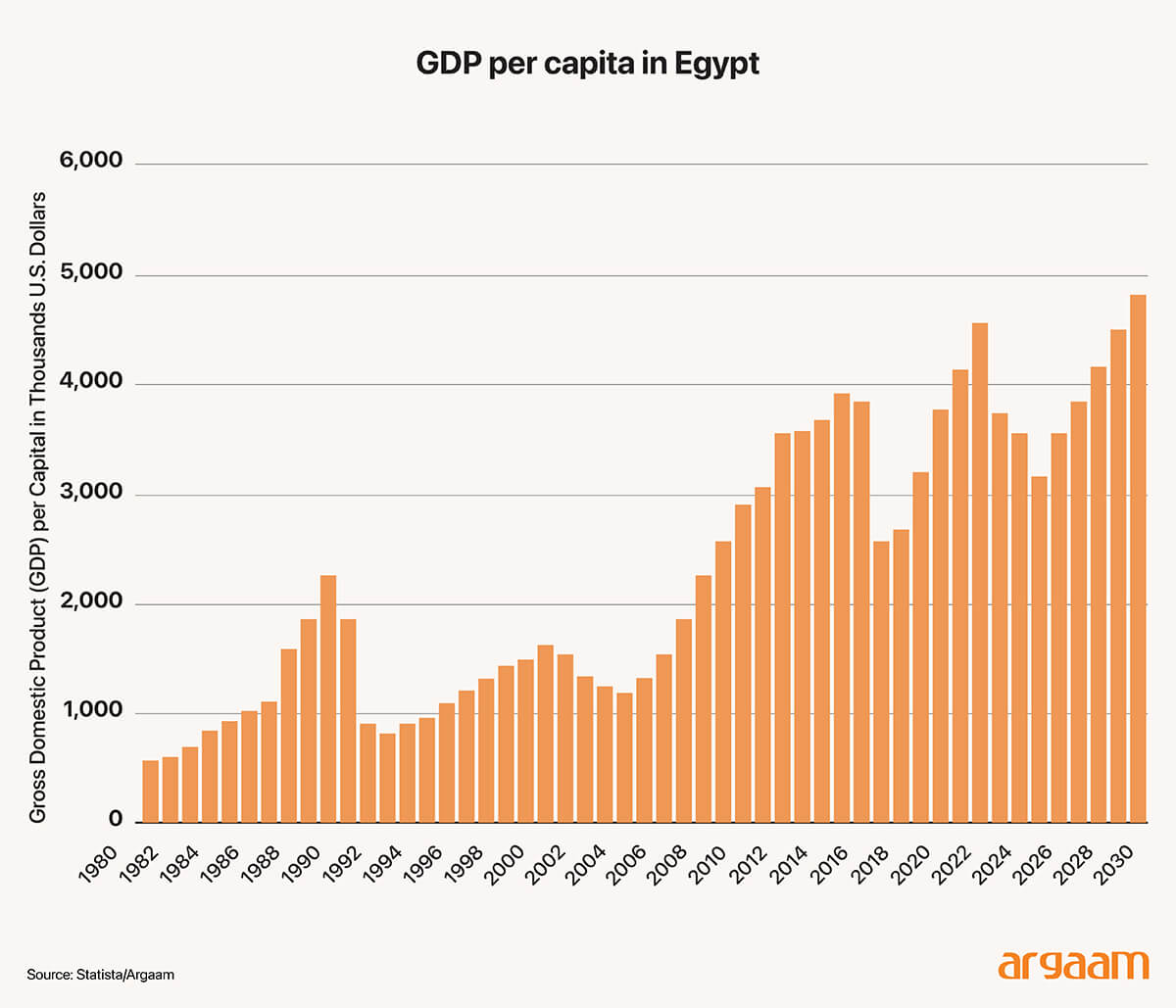

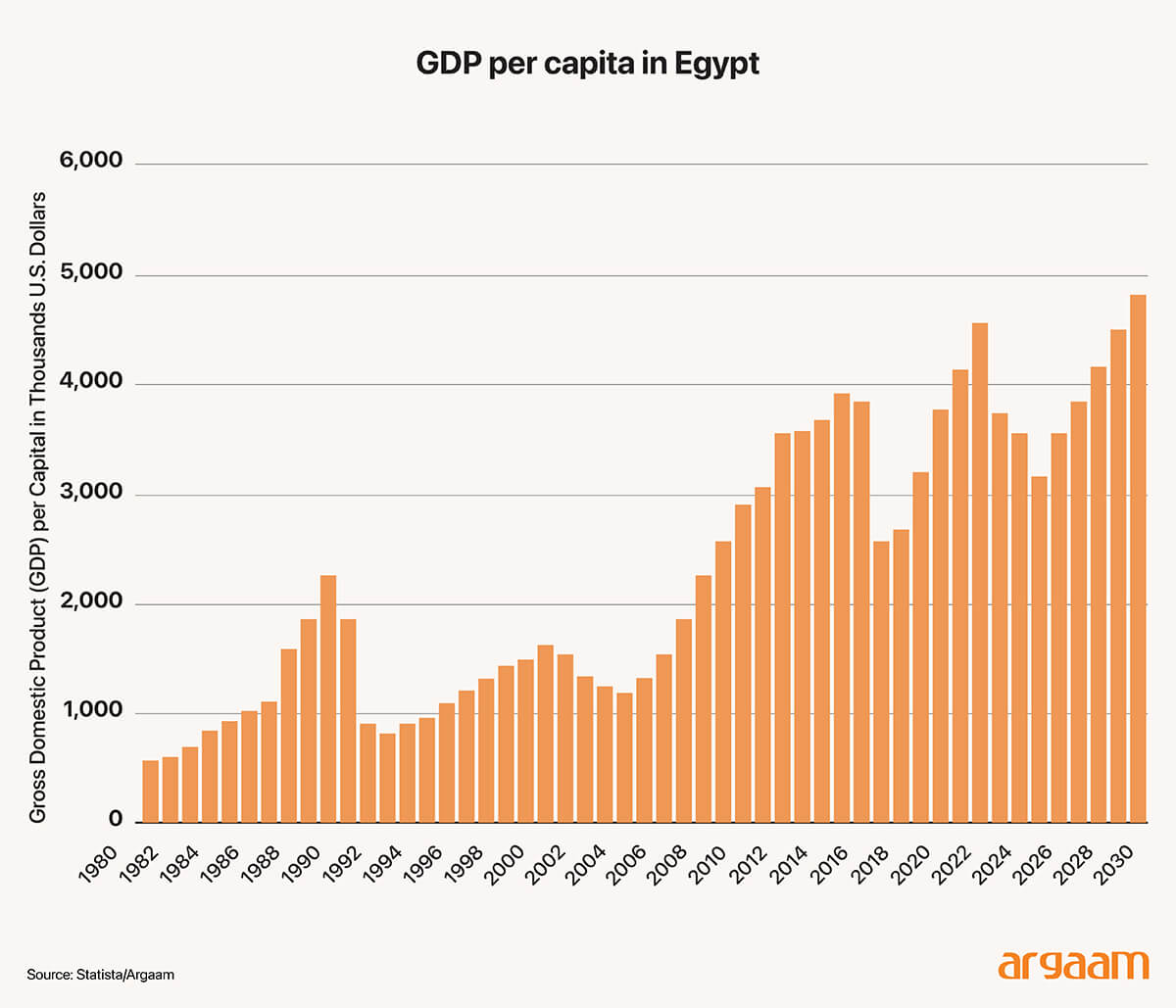

The gross domestic product (GDP) per capita in Egypt was 3,570.28 U.S. dollars in 2024. From 1980 to 2024, the GDP per capita rose by 2,990.24 U.S. dollars. Between 2024 and 2030, the GDP per capita will rise by 1,263.53 U.S. dollars, showing an overall upward trend with periodic ups and downs.

Increasing childcare subsidies in some countries like Saudi Arabia is crucial not only for supporting individual families but also for broader economic health.

In the kingdom, there’s an existing programme called “Qurrah”, which is designed to support Saudi women working in the private sector by making childcare more affordable, thereby helping them stay employed.

But the eligibility requirements are that applicants must be Saudi nationals, their monthly wage must not exceed SAR 8,000, and they must be registered in the social assurance system.

The program covers up to 50% of the cost of booking a childcare center, but with a maximum payment of SAR 1,600 per child. This support is available for children under 6 years old.

By reducing the financial strain of childcare, more mothers can remain in or re-enter the workforce, contributing to the overall labor supply, consumer spending, and tax revenues, thereby positively impacting the Gross Domestic Product (GDP).

In the US, an estimated $237 billion a year vanishes due to women paring back their workloads to care for kids.

That $237 billion figure means the U.S. economy loses out on that much in potential economic output (wages, productivity, taxes) because high childcare costs force women to reduce work hours, take lower-paying jobs, or leave the workforce entirely to manage childcare, creating what’s known in economics and gender studies as "motherhood penalty" and hindering overall economic growth, with the costs rising and impacting millions of families.