The use of debt financing is a common practice in the real estate sector, where large upfront capital investments are typical before generating steady cash flow.

The recent debt crisis experienced by Evergrande, once China’s largest property developer as we explain in the last part of this analysis, has brought global attention to the critical importance of prudent debt management in the real estate sector in the Middle East and the Arabian Gulf.

Given the sector’s traditional reliance on substantial upfront capital investment and time lag before steady cash flows emerge, understanding developers’ debt positions is essential.

We chose four major property developers from Saudi Arabia, the UAE, Egypt and Qatar, where real estate markets play a vital role in economic growth and stability.

This financing approach is crucial in real estate where projects require significant upfront capital expenditures to acquire land, design the project, start construction, and marketing, before any revenue streams materialize.

Debt could be also less costly than equity because interest payments on debt are tax-deductible in corporate finance. (Journal of Property Research)

When a firm incurs debt, it is obligated to pay periodic interest to lenders. Unlike dividends paid on equity, which are made from after-tax profits, interest payments are considered a business expense and can be deducted from a firm’s taxable income. This means the company reduces its taxable earnings by the amount of interest paid.

By deducting interest expenses, the firm's taxable income decreases, which means it pays less income tax to the government.

That said, relying on debt to finance property development is a double-edged sword in an uncertain and cyclical industry like real estate.

The future returns and market conditions for real estate are highly uncertain, influenced by factors such as macroeconomic changes, interest rates, demand fluctuations, and regulatory environment. (Minimizing Risk in Real Estate Development)

A Closer Look at Four Major Middle Eastern Property Powerhouses

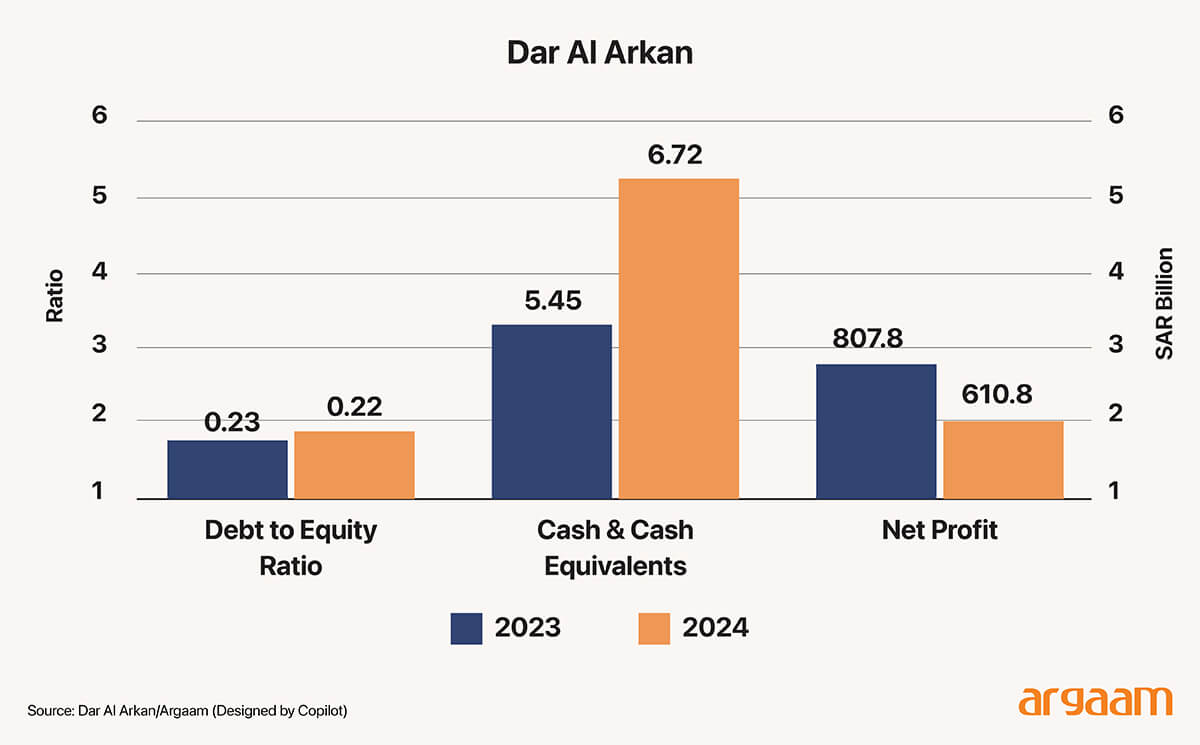

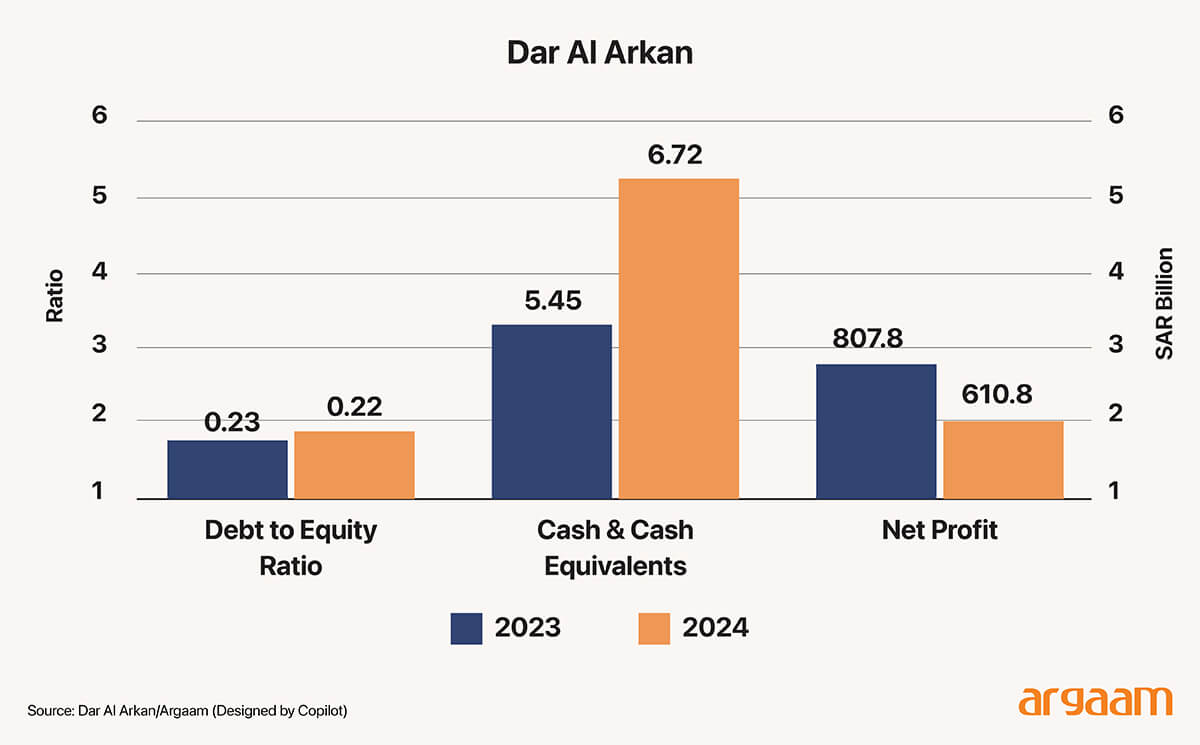

Saudi Arabia’s Dar Al Arkan’s Debt to Equity ratio was 0.23 in 2023 and 0.22 in 2024 (Annual report, page 131). A ratio of 0.22 indicates that for every SAR 1 of equity, Dar Al Arkan has SAR 0.22 of net debt.

This is relatively low leverage, suggesting a conservative capital structure with more reliance on equity than debt.

This confirms that the equity growth outpaced the growth in net debt, leading to improved leverage.

According to the company’s balance sheet in 2024, the increase in cash and cash equivalents from SAR 5.45 billion to SAR 6.72 billion strengthens liquidity, which also offsets leverage concerns.

Net profit for 2023 amounted to around SAR 610.8 million, and it increased to SAR 807.8 million in 2024. This represents a significant increase in net profit of approximately 32.10% from 2023 to 2024.

In Egypt, the Talat Moustafa Group’s debt to equity ratio in 2024 was 1 to 7.9. (FY 2024 earnings release, page 4)

This means that for every 1 unit of debt, TMG Holding has 7.9 units of equity. In other words, the debt-to-equity ratio is approximately 0.127 (1 divided by 7.9), which is exceptionally low.

The cash and cash equivalents increased substantially from LE 8.1 billion in 2023 to LE 44.9 billion in 2024. This indicates a significant improvement in the company’s liquidity position.

The net profit for FY 2024 was EGP 10.7 billion, more than doubling from EGP 3.3 billion reported in FY 2023, indicating a remarkable year-over-year growth of 224%.

In the United Arab Emirates, the debt to equity ratio of Emaar Properties decreased from approximately 0.14 in 2023 to about 0.10 in 2024, indicating a reduced leverage level and stronger equity position. (Annual Report 2024)

The company significantly increased its cash and cash equivalents by approximately AED 13 billion (around 51% increase) from 2023 to 2024, reflecting improved liquidity and stronger cash position.

Net profit increased by approximately 18% year-over-year from 2023 to 2024.

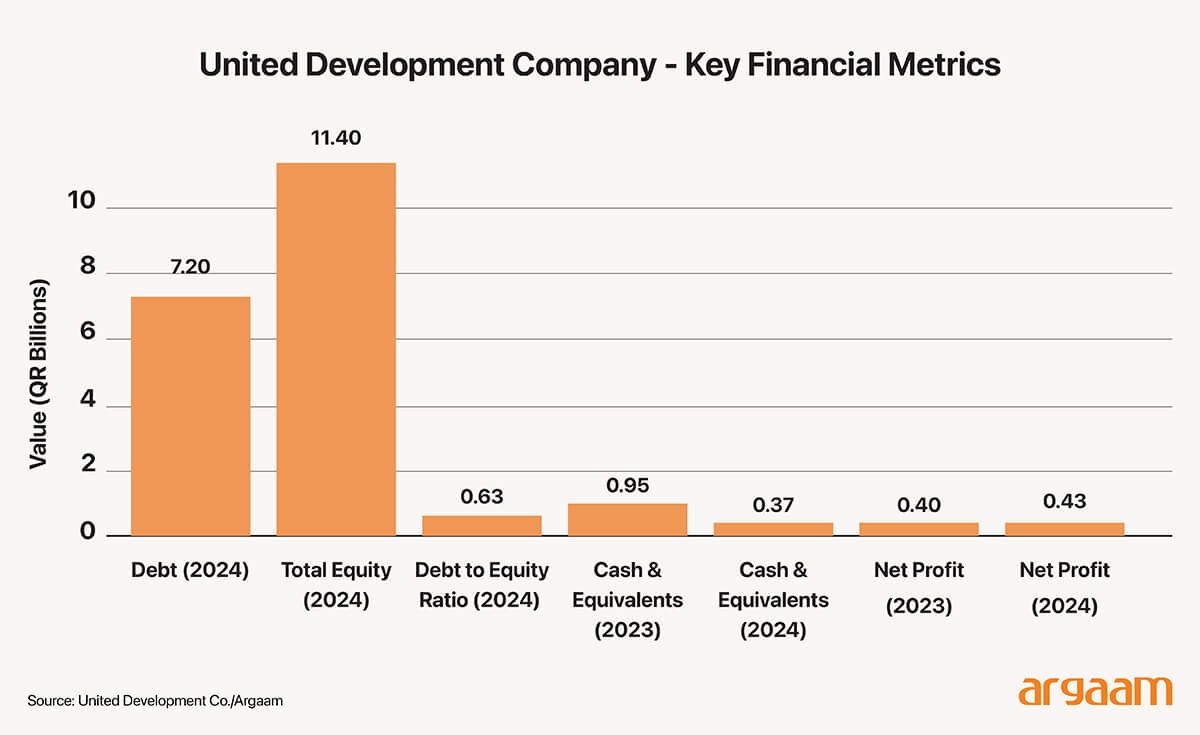

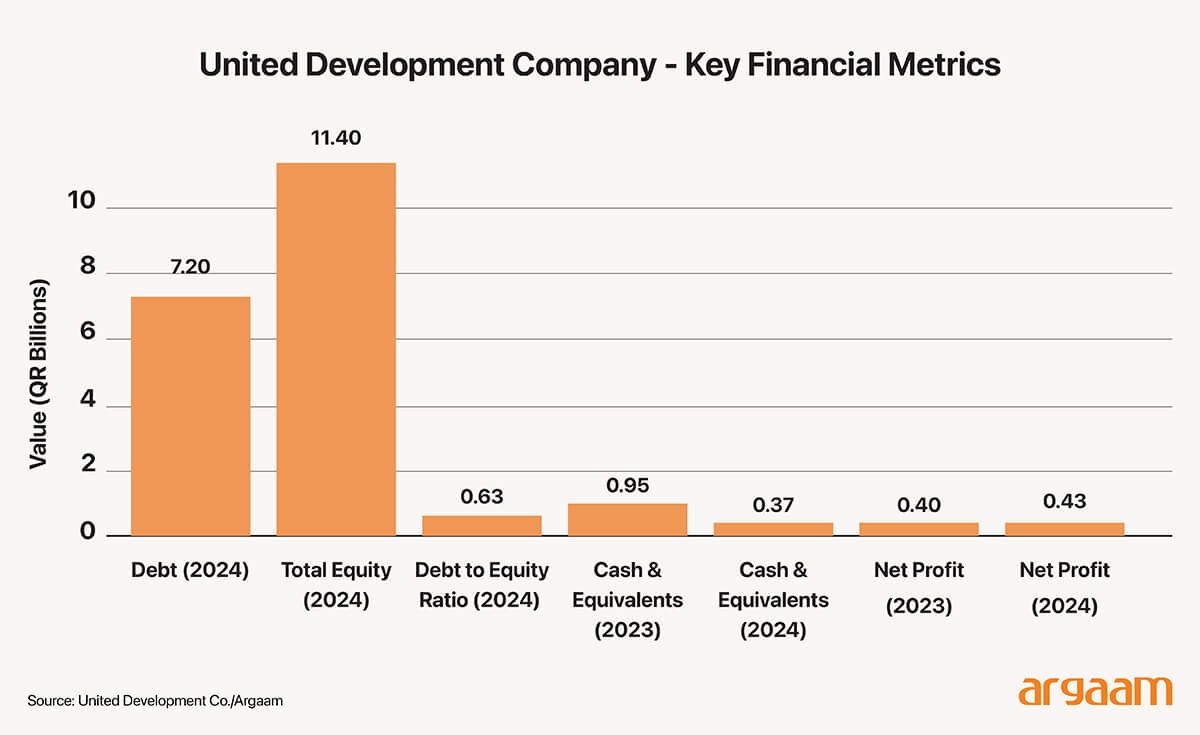

Qatar’s United Development Company’s debt-to-equity ratio in 2024 was 0.63. A ratio below 1 generally implies a conservative leverage position, suggesting that UDC is not highly dependent on debt, which can mean lower financial risk.

It’s also noticeable from the company’s annual report that it repaid more loans and borrowings (QR 615.6 million) than it borrowed (QR 738.1 million).

There is a noticeable reduction of approximately QR 577 million in cash and cash equivalents during 2024.

The decrease in cash and cash equivalents reflects the company's active use of cash for operational needs, capital expenditures, and debt servicing.

The net profit in 2024 was QR 427.108 million, compared to QR 401.720 million in 2023, reflecting an increase of approximately 6%.

A Lesson from China’s Evergrande

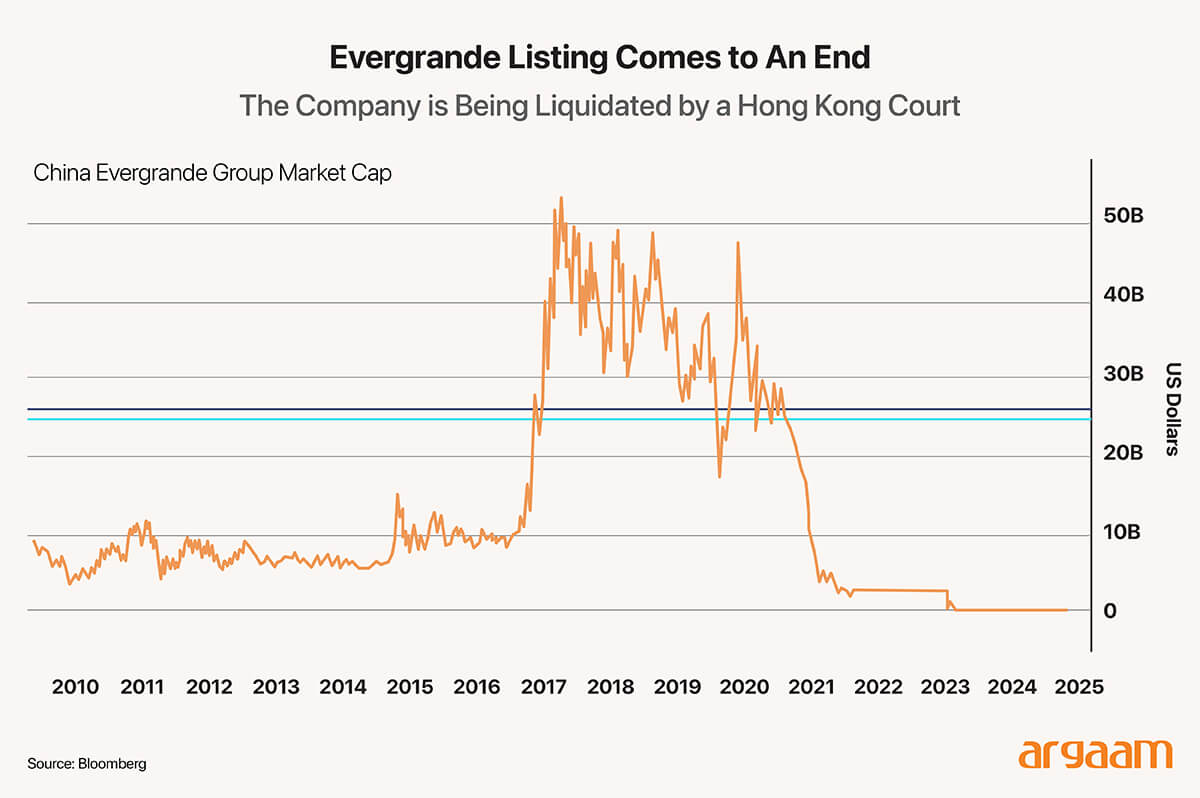

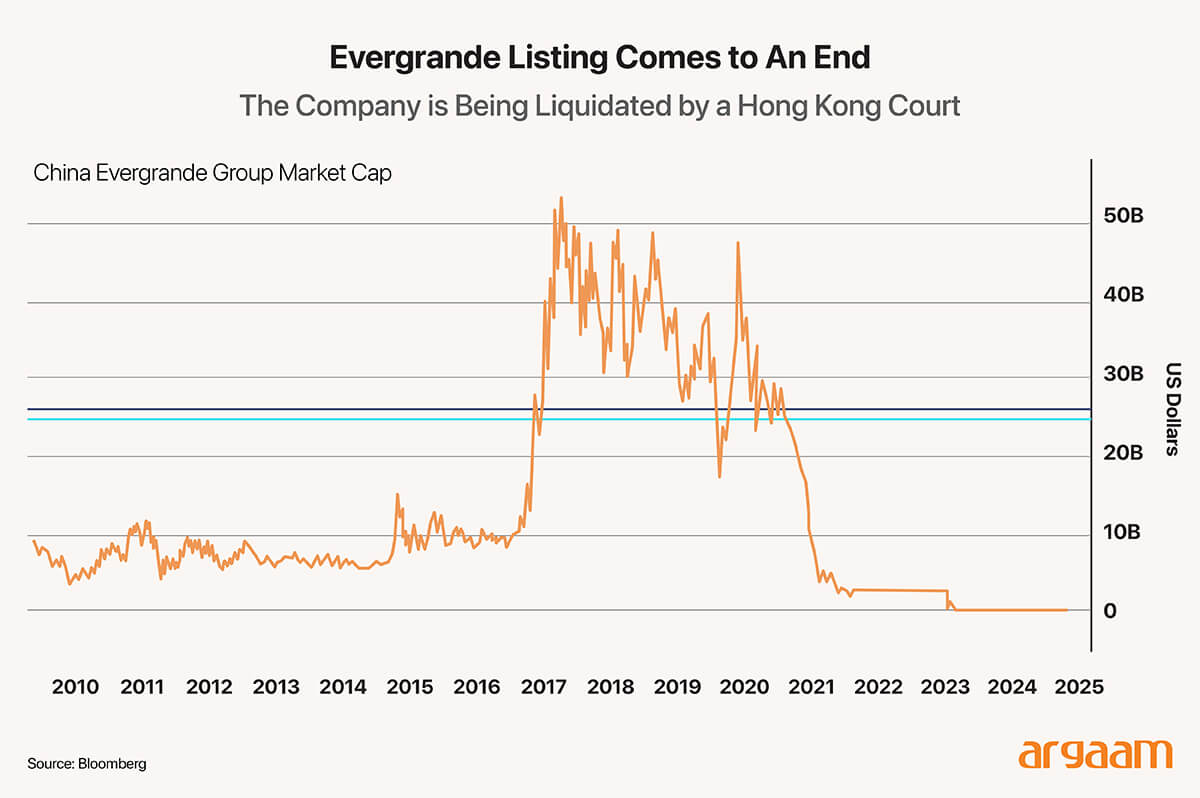

We are highlighting in this last part of our analysis a case study of a Chinese company, which is still making headlines to date over the past five seven years due to its debt crisis and the ensuing impact on the real estate industry.

Evergrande faced a debt crisis primarily due to its aggressive expansion funded by high-leverage financing, leading to an unsustainable imbalance between its assets and liabilities.

Just in August, in August, property giant China Evergrande Group delisted from the Hong Kong stock exchange — making the shares effectively worthless — marking a grim milestone for the nation’s property sector. (Reuters, August 2025).

The company heavily relied on short-term, high-interest debt to finance long-term real estate projects, while its vast inventory and diversified investments consumed significant capital without generating sufficient cash flow. (Zhejiang University of Finance and Economics).

Founded in 1996, Evergrande’s rapid expansion was from the outset fueled by heavy borrowing.

Evergrande’s downfall is by far the biggest in a crisis that dragged down China’s economic growth and led to a record number of distressed builders. (Bloomberg, 2021)

It became the most indebted borrower among its peers, with total liabilities reaching about $360 billion at the end of 2021. For a time it was the country’s biggest developer by contracted sales and was worth more than $50 billion in 2017 at its peak.

Founder and chairman Hui became Asia’s second-richest person. Over the years the company also invested in the electric vehicle industry and bought a local football club.

In 2020, Beijing started to crack down on the property sector. The new measures put a cap on the developer’s borrowing capacity, effectively cutting off its lifeline from credit markets.

Following failed restructuring attempts, Evergrande was instructed by a court in 2024 to dissolve to dissolve as a company because it is unable to pay its debts.

The property craze in China was mainly powered by debt as other developers rushed over the past decade to satisfy expected future demand.

The boom encouraged speculative buying, with new homes pre-sold by developers who turned increasingly to foreign investors for funds.

The speculation led to astronomical prices, with homes in boom cities becoming less affordable relative to local incomes than those in London or New York.

Chinese banks’ bad debt — loans they no longer expect to recover — hit a record 3.5 trillion yuan ($492 billion) at the end of September. Fitch Ratings has warned the situation could deteriorate further in 2026 as households struggle to repay mortgages and other loans. (China observer).