|

The exponential rise of venture capital (VC) in the MENA region, notably in Saudi Arabia and the UAE, has catalyzed a rapid influx of investment into AI-driven startups, promising technological innovation and economic diversification. However, this rapid rise in VC funding over the past five years often focuses more on increasing the financial value of AI algorithms and data that companies own, rather than making sure these technologies actually benefit society. By securing exclusive legal and organizational control over these intangible assets, startups transform AI technologies into financial vehicles optimized for capital accumulation rather than serving public interests, a phenomenon supported by empirical case studies as we will explain later in our analysis. The development of AI in such start-ups is primarily driven by investors' demands for very high financial gains and quick opportunities to sell their stakes. As a result, AI technologies are often designed to maximize immediate profits at the expense of long-term reliability. In other words, this analysis is aimed at drawing the attention to this phenomenon that some of these start-ups driven by Venture Capital in the region are prioritizing investor interests over broader benefits for the essential sectors they are targeting, chiefly public healthcare and education. But it’s important to note that while many startups exhibit this pattern, others may embed social missions, open-source approaches, or cooperative ownership models that explicitly prioritize public or user interests over financial gains.

MENA Leads in Early-Stage VC Deals

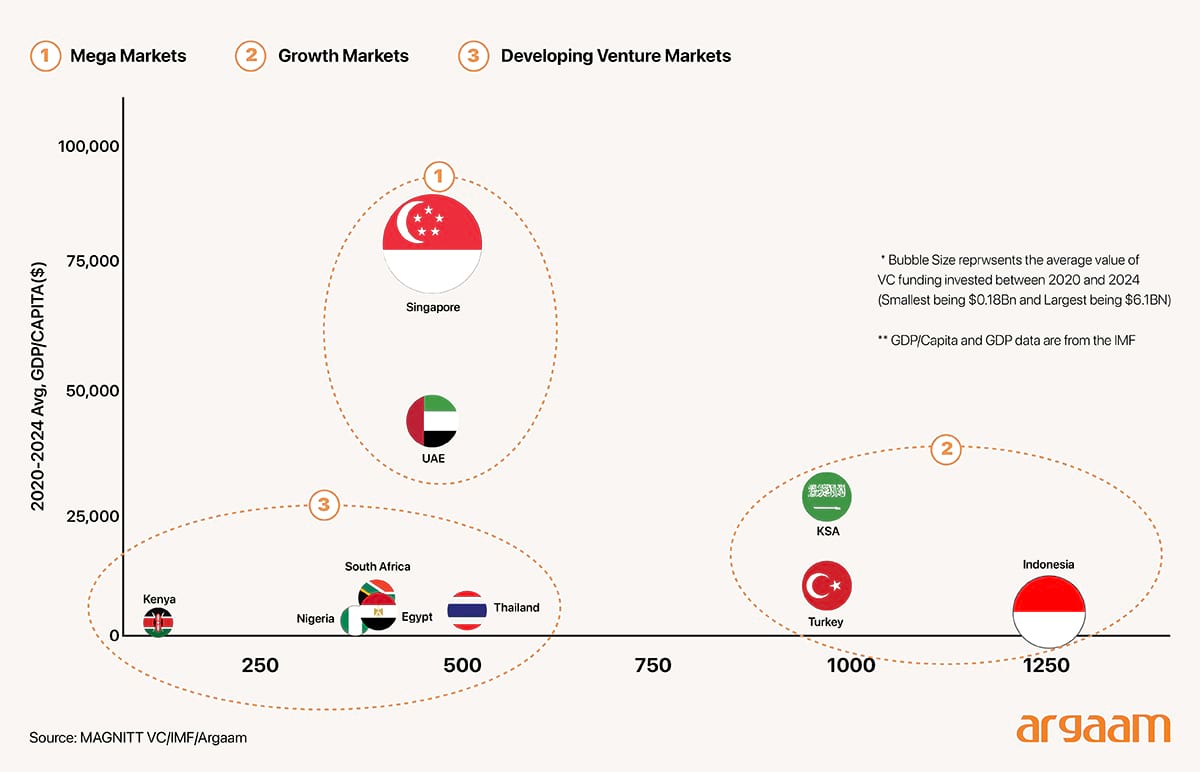

Across the broader Middle East and North Africa region, venture capital activity has continued to evolve unevenly. Overall, MENA’s five-year aggregate venture funding reached $12.52 billion, according the recently published report by data analytics firm MAGNITT VC. MENA also posted the highest deal count relative to its peers in Southeast Asia and Africa over the period, indicating a broader base of early-stage transactions even as late-stage funding remains more limited. However, the value of venture capital deals dropped 29% in the region in 2024, but it’s due to global economic challenges. VC funding in Southeast Asia, for example, was down 45% last year.  The UAE has retained its reputation as a strategic innovation hub and one of the few “MEGA Markets” in the emerging world, boasting a five-year average VC-to-GDP ratio of 0.20%. This proportion — identical to Indonesia’s ratio — signifies robust venture activity relative to the economy’s size. Saudi Arabia recorded a five-year average VC-to-GDP ratio of 0.07%. In Egypt, VC has gained further traction over the period under review. Egypt achieved a 25% rise in total funding compared to the previous five-year average, lifting its VC-GDP ratio by 0.02 percentage points to 0.11%. The Illusion of ‘AI Savings’

AI-driven start-ups frequently promote automation’s potential to reduce costs by replacing human labor in areas such as customer service, administrative support and technical infrstructure management exemplified by companies marketing AI chatbots as substitutes for human labor. However, these ventures often spiral into losses after an initial surge of financial valuation driven by investor hype and speculative anticipation of profits significantly above competitive levels due to control over unique assets or technologies. This speculative anticipation involves the belief that capturing large amounts of proprietary data, owning exclusive algorithmic technologies, and scaling rapidly (blitzscaling) will create barriers to competition. This dominance is expected to allow the startup to charge premium prices or reduce costs enough to generate outsized profits. But the startup's ability to enact this strategy is not guaranteed. This occurs because the promised cost savings from automation frequently fail to materialize in practice; the technology may not perform reliably at scale or improve sufficiently despite ingesting more data, necessitating continued high investment in skilled labor. Financial valorization (e.g., rising equity prices, "unicorn" valuations) can operate with a degree of autonomy for some time but remains ultimately anchored in real valorization; which’s the actual production of value through labor, technology, and the commercialization of innovations.

The rise and fall of Babylon

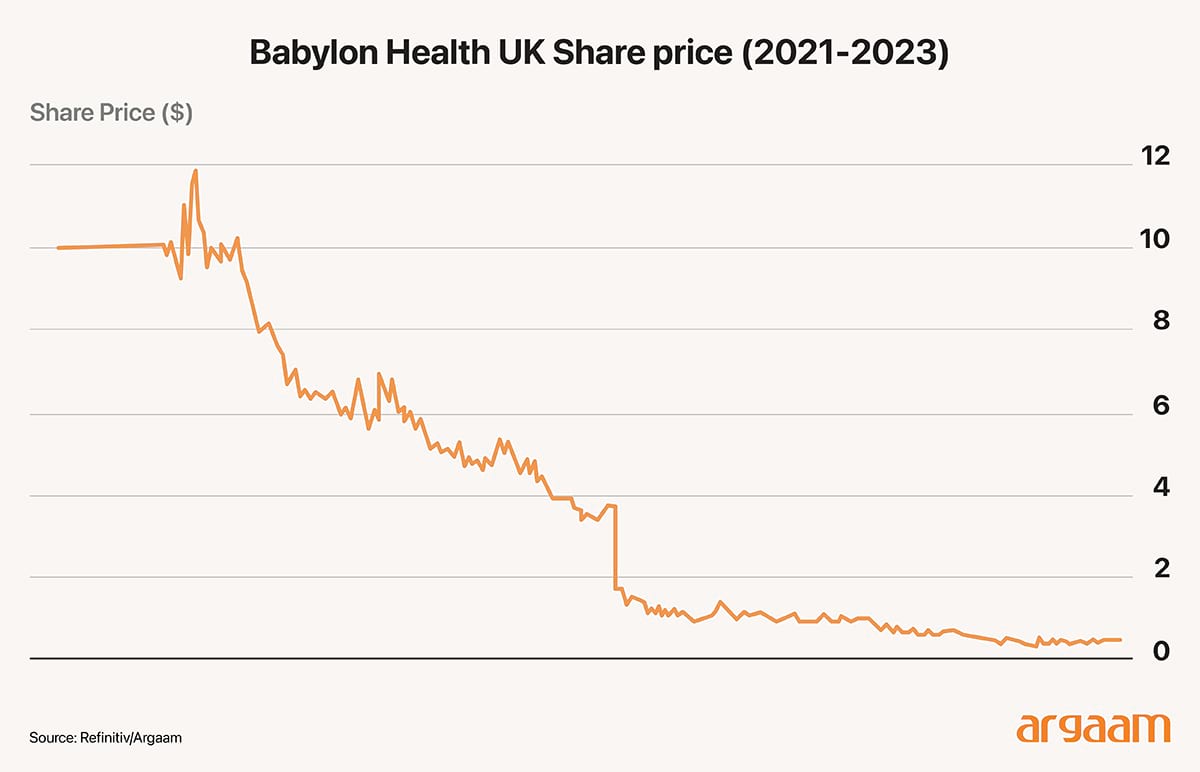

To illustrate the dynamics of venture capital and the challenge of investing in AI-driven start-ups, we cite the example of a former start-up called Babylon Health, which was founded in the UK as a digital health company aiming to transform healthcare delivery through an AI-powered symptom checker and telemedicine platform. The case is taught in economics master’s programes in UK universities and was published in 2024 in a journal titled "Venture capital, the fetish of artificial intelligence and the contradictions of making intangible assets" Babylon experienced rapid financial valorization followed by collapse. Initially, Babylon attracted substantial venture capital funding, with investors valuing the company’s equity at $4.2 billion in its IPO debut at the New York Stock Exchange on in October 2021. Their business model was based on something called ‘value-based contracts’, which involved fixed monthly payments from big health insurers like Medicare in the US, in return for being responsible for managing all primary and secondary care costs within that budget. If actual care costs exceeded the prepaid amount, Babylon had to cover the extra expenses, bearing the financial risk. They aimed to use predictive analytics via a smartphone app to nudge patients toward preventive health by following a healthy lifestyle to reduce expensive consultations and generating cost savings and profits for investors.

This model contrasts with traditional fee-for-service, where providers are paid for each service regardless of outcome or cost control. The company’s aggressively for-profit model led to a "blitzscaling" strategy, where Babylon aggressively expanded by hiring high-skilled labor, investing in digital infrastructure, and entering multiple international markets to rapidly grow its user base and intangible assets such as proprietary health databases and algorithmic system. Babylon's platform depended heavily on a growing pool of clinical and non-clinical healthcare workers despite efforts to reduce labor costs through the AI symptom checker. The AI chatbot technology did not live up to expectations and was only used by about half of the patients seeking consultations. Many patients still required direct consultations with doctors because the AI could not reliably replace human clinical judgment. Despite the promise that AI and automation could dramatically reduce labor costs and consultation expenses, the high-skilled labor and platform infrastructure costs actually increased, and the anticipated cost savings in medical consultations never fully materialized, keeping Babylon dependent on human labor. When investors recognized the lack of real profit generation, the company’s share price plummeted, leading to bankruptcy and the sale of its UK subsidiary at a tiny fraction of its peak valuation, at only $620,000 in August 2023. To conclude, this AI-driven business models in different sectors often results in a very small number of extremely successful investments that generate the vast majority of returns, while many other investments result in losses or mediocre returns. The failure of such start-ups is centred around the “fetishization” of AI based; namely, this exaggerated and often false belief in AI as a near-magical solution, especially as a cost-cutting tool that can vastly reduce labor expenses by automating complex tasks. This phenomenon obscures the actual limitations and challenges involved in replicating sophisticated professional work with AI. Another key reason for failure and the eventual financial collapse is the ‘Blitzscaling’ strategy to quickly capture or create large markets before competitors can catch up. Rapid scaling allows them to leverage network effects, accumulate critical data (especially in AI-driven sectors), and build monopolistic positions. This strategy fuels increased operational expenses, including high skilled labor and digital infrastructure costs, a cycle that can lead to inflated financial valuations based on optimistic future expectations rather than focusing on sustainable and gradual economic growth of the business. |

|

|

|

|

|