|

In 2024, a promising young Saudi student from the Technical College in Riyadh achieved global recognition by securing first place in aerospace engineering at the prestigious International Invention, Innovation & Technology Exhibition (ITEX). Additionally, he was honored with the Best Young Innovator in the World award, presented by Singapore. His groundbreaking invention—a novel chemical compound serving as a radar-absorbing coating—enhances the stealth capabilities of military aircraft, underscoring the strategic value of innovation tied directly to national defense. Looking back to 2017, another Saudi inventor brought forward an inclusive innovation with the Educational Letters Game designed specifically for the blind. This multi-disciplinary invention spans education, disability support, entertainment, and gaming sectors. Featuring Braille functionality and complemented by a downloadable digital app, this product has transcended traditional educational tools, significantly enhancing market inclusivity. The inventor’s achievement was internationally recognized with a gold medal from the Portuguese Inventors Association, further signaling Saudi Arabia’s rising IP influence worldwide. These examples underscore how strategic development and protection of intellectual property assets serve as critical intangible investments for Saudi Arabia and the firms sponsoring the young Saudi brilliant minds. At the core of our analysis is how Saudi Arabia’s development of robust intellectual property portfolios actively fosters innovation ecosystems that attract investment capital, drive sustainable economic growth, and enhance value creation for shareholders of the institutional investment entities or firms investing in the Saudi talents with new brands in the market. Ultimately, such endeavors position the Kingdom as a key player in the knowledge economy, where innovation-driven intangible assets are paramount to long-term economic resilience.

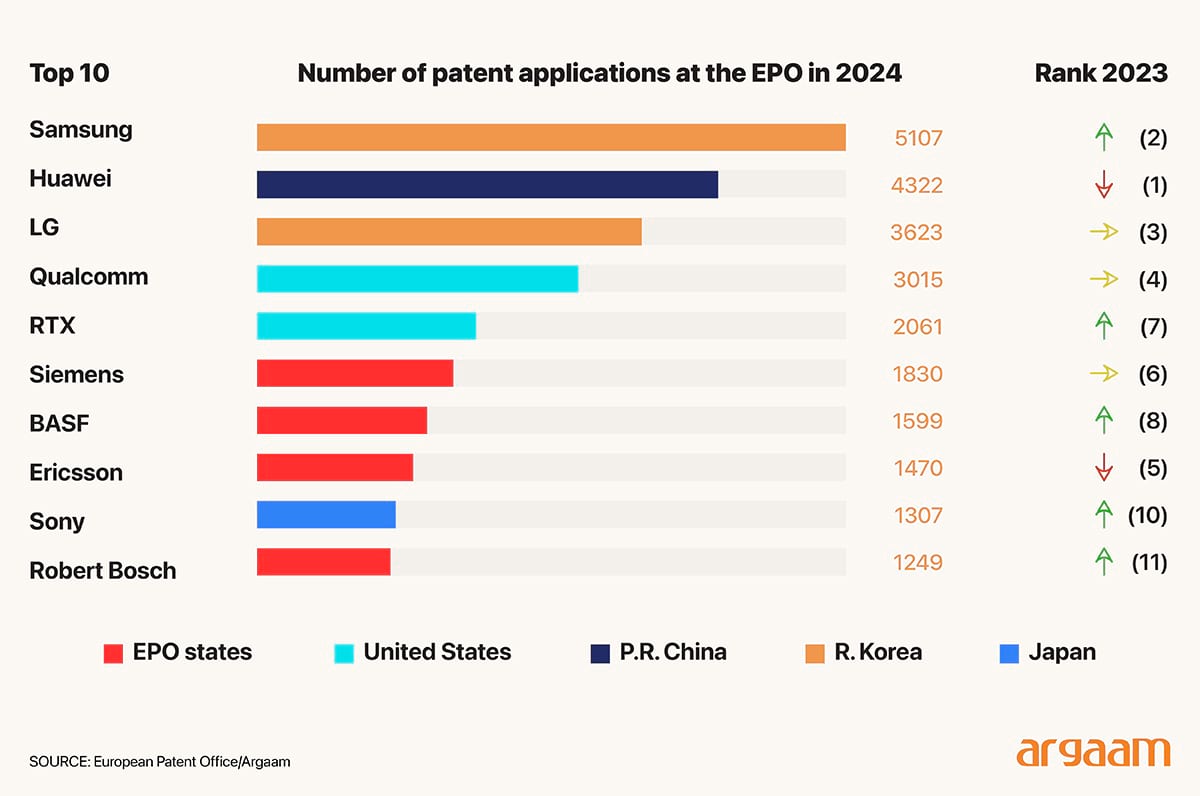

For decades, Saudi citizens and residents in the kingdom relied on international brands for the latest trends across sectors such as cosmetics, fashion, and food and beverages. Today, however, a growing number are turning to local firms whose innovative intellectual property—ranging from unique product formulations to distinctive branding—has driven the rise of high-end Saudi make-up brands. Moreover, these homegrown brands, protected by robust IP rights, are not only thriving domestically but are also capturing devoted followings abroad, exemplified by innovactions across several sectors led by major listed companies like Aramco and Almarai. This shift underscores the critical role of intellectual property in enhancing the competitiveness and global appeal of Saudi companies. Patent grants to KSA-based organizations have shown an upward trend since the announcement of Saudi Vision 2030 in 2016, increasing from 1 patent in 2016 to 1994 by September 2024, according to an academic study published in 2024 by the Multidisciplinary Digital Publishing Institute. The United States Patent and Trademark Office is the most favored destination for Saudi patent registrations, with 7756 granted patents, reflecting the importance of the U.S. market. It’s followed by the Saudi Authority for Intellectual Property with 1929 patents, illustrating a focus on bolstering local innovation within the Kingdom as part of Saudi Vision 2030’s goals. The European Patent Office comes third with 554 patent filings, signaling that KSA-based organizations are also targeting European markets. Organic Chemistry and computing sectors account for 646 and 505 patents, respectively, reflecting the growing importance of digital technologies in the KSA’s innovation ecosystem. Drug compositions account for 383 patents, showing considerable innovation in pharmaceutical development and healthcare technology.

IP Drives Premium Stock Returns

Financially, the robust IP rights—encompassing patents, trademarks, and distinctive branding—signal sustained competitive advantages and potential for higher future cash flows, which investors price into the stock. Consequently, companies owning such IP-protected products experience positive abnormal returns and increased market capitalization on the Saudi Stock Exchange. Empirical evidence showing that superior innovation and brand management translate into significant premiums in stock prices, reflecting investors’ confidence in the firms’ long-term profitability and market leadership. When patents and trademarks are considered separately, each has a positive impact on firm market valuation. However, the combined use of both intellectual property rights (IPRs) produces an additional positive effect that is greater than the sum of their separate impacts. This indicates that jointly holding patents and trademarks yields benefits that are not captured by looking at each asset alone. A 1% increase in patent stock above competitors corresponds to about a 12.8% increase in market valuation, according to a study published by the European Commission under the title "Firm market valuation and intellectual property assets.” A 1% increase in trademark stock above competitors corresponds to over a 16% increase in market valuation.  Suppose a company holds 20% more patents and trademarks than its competitors in the same industry. This corresponds to an approximate increase in market value of: ● For patents: 20% × 12.8% = 2.56% ● For trademarks: 20% × 16% = 3.2% ● Considering interaction effects, the combined premium might push total market value even higher Let’s assume for explanatory purposes in this analysis that market capitalization without considering IPR is $1 billion, then: ● The patent advantage alone can raise its value by approximately $25.6 million ● The trademark advantage alone can raise its value by approximately $32 million ● Together with synergy, the total valuation uplift could be conservatively estimated above $60 million While investors value the overall stock of high-quality IPR assets that reflect a firm's accumulated innovation and market positioning, but they may penalize firms with a high ratio of ongoing R&D expenses relative to physical investments because these expenses do not always translate quickly into valuable, protectable innovations or products. For instance, pharmaceutical companies invest heavily in R&D to develop new drugs and build strong patent portfolios that eventually protect market exclusivity. However, until those patents and products materialize and generate revenue, the high upfront R&D intensity may weigh on their valuation. In conclusion, Investors interpret Saudi Arabia’s patent and trademark portfolios, along with those of its leading firms, as signals of both technical innovation and commercial strength at the national level. The country’s ability to hold significantly more or stronger IPR assets than other nations, supported by the innovative and branded capabilities of its firms, sends positive signals about Saudi Arabia’s potential to generate future economic growth through innovation and brand power. |

|

|

|

|

|