|

|

As Europe strengthens its commitment to sustainability with new stringent regulator rules, global investors face a complex challenge. They need to rapidly adapt to these very strict standards while simultaneously protecting the profitability and continuity of their existing investments. The Saudi Public Investment Fund (PIF) is a major investor in Europe, having strategically invested over $85 billion since 2017, establishing itself as a key player in the continent’s economic landscape. The EU’s Corporate Sustainability Reporting Directive (CSRD), effective by 2028, mandates compliance with up to 1,000 sustainability metrics, enforced through retrospective strict penalties, including fines of up to 5% of a company’s annual turnover. For the PIF, which already integrates sustainability across its new international investments, this retrospective enforcement of new rules introduce unprecedented financial and operational challenges in the EU. → Through this perspective, our analysis provides a realistic and pragmatic assessment of this challenge in Europe, based on the insights given by Yasir Al-Rumayyan, Governor of the Public Investment Fund (PIF) and Chairman of Aramco, in his recent conversation with former HSBC CEO Sir Noel Quinn at the FII Priority Summit in Tirana last month.

❝

The regulation is saying if you’re not compliant, you will be penalized not only for your operation in Europe, but you will be penalized on the parent company — 5% of your top line,” he said. This is really outrageous for a lot of investors.

Yasir Al-Rumayyan

Governor, Public Investment Fund |

In December, Qatar’s Energy Minister Saad al-Kaabi echoed the pragmatic concerns expressed by Al-Rumayyan. He even threatened to halt vital gas shipments to the EU if strict penalties under the new sustainability rules were enforced. Both Qatar and Saudi Arabia, as major institutional investors, demonstrate a measured and strategic stance rather than emotional reactions. Their aligned positions signal that such heavy stakeholders demand realistic requirements for existing investments.  Sustainability at the core of Saudi Vision 2030

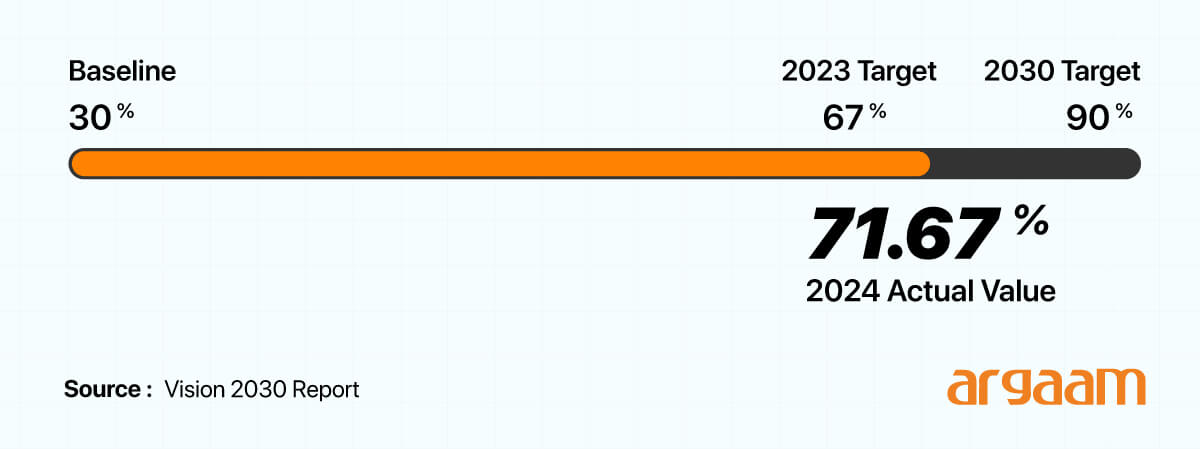

With the launch of Vision 2030, environmental sustainability was elevated to a national priority. Between 2018 and 2024, corporate participation in social responsibility programs more than doubled, surpassing its annual target for 2023, with a compound annual growth rate (CAGR) of 15.62%, according to the latest report of Vision 2030.  In connection with environmental sustainability, Vision 2030 has launched the Saudi Green Initiative (SGI). The initiative sets ambitious long-term targets:

10B

Trees to be planted

40M ha

Degraded land to be rehabilitated

30%

Of land & marine areas to be protected  A Phased Path to Sustainability

~ We argue in our analysis that integrating the new EU sustainability rules into existing corporate ecosystems requires significant time and gradual adaptation. In financial terms, retroactive regulations create unplanned expenses, which reduce net profit margins. Companies may face large lump-sum payments that were not budgeted for, negatively affecting cash flows and liquidity. The EU’s retrospective sustainability regulations could be viewed then as unrealistic because Saudi Arabia’s experience under Vision 2030 shows that corporate participation in social responsibility programs has been steadily increasing, reflecting a phased and constructive approach to sustainability. Retrospective rules might also worsen a company’s credit ratings, making it more expensive or difficult to secure financing for new projects or to refinance existing debt. Companies might need to halt or modify project operations to come into compliance, incurring downtime and additional costs. In extreme cases, projects that are no longer economically viable due to these EU penalties and compliance costs might be shut down.

Committed to Growth Opportunities

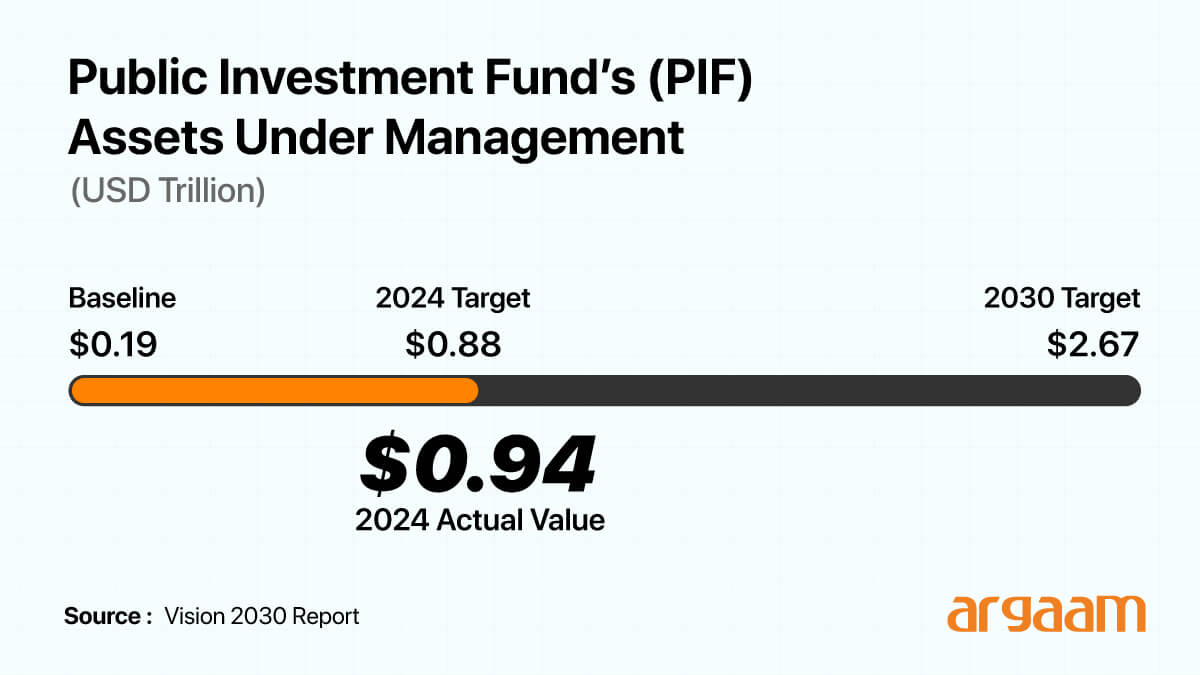

~ This analysis is largely about the retrospective application of the new EU requirements, which could complicate existing investments, rather than a fundamental rejection of sustainability. PIF likely anticipates that aligning gradually with these regulations, and investing in sectors that fit sustainability trends, will still permit growth of its portfolio in Europe. We understand that PIF’s approach involves managing regulatory risks rather than retreating from these European markets.  Despite PIF’s concerns toward the EU’s retrospective and stringent sustainability regulations, PIF still expects investments in Europe to increase to $170 billion by 2030. PIF is poised to reach $2 trillion in assets under management by the end of 2030, propelling it from fifth to second place globally among sovereign wealth bodies. Last year, the PIF’s assets under management surpassed $925 billion, up from $700 billion at the end of 2022, securing its position as the fifth largest global sovereign wealth fund. In conclusion, the forward-looking ambition of PIF to boost investments and increase its assets under management reflects a strategy to seize growth opportunities in markets around the world, including Europe. To mitigate the new regulatory rules in the EU countries, PIF may decide on specific entry or operational modes, such as joint ventures with local firms. Partnering with established European entities familiar with regulatory landscapes and local business practices can provide inside knowledge and smooth navigation of compliance requirements. Also, operating through a dedicated subsidiary, like the one that PIF opened in May 2025 in Paris, allows PIF to implement targeted compliance frameworks aligned with the EU’s stringent sustainability regulations and this helps mitigate regulatory risks. More importantly, a physical presence in Paris positions the PIF closer to key European markets, regulators, and partners. This proximity improves its ability to monitor evolving regulatory landscapes and build relationships with local stakeholders.

ℹ️

Note: We have contacted Public Investment Fund to request detailed information regarding the fund’s EU portfolio, but the requested data has not yet been provided till the publishing of this analysis. |

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |