|

|

The Portuguese football league’s success partly stems from its ability to attract and develop top young talent.

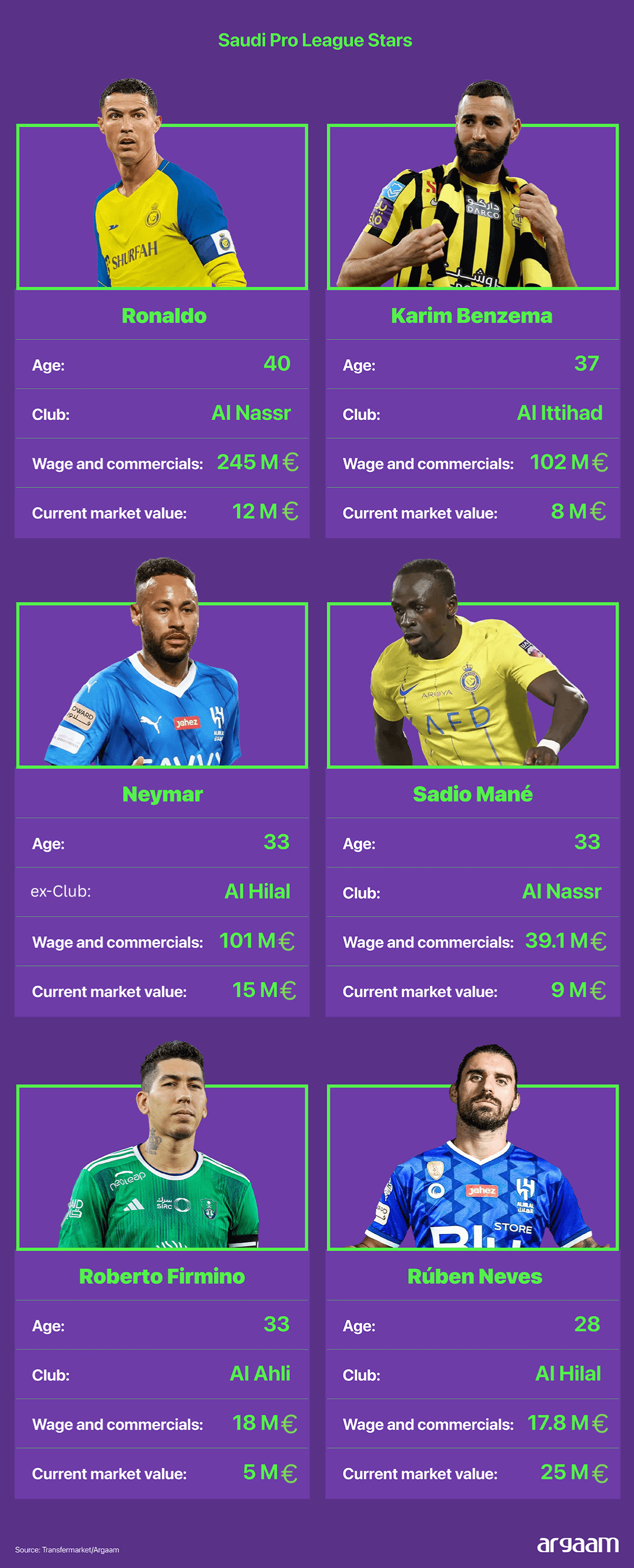

But Investing in scouting these exceptional talents, sometimes as young as 12 years old from around the world, is a proven successful business strategy that can bring significant returns to Saudi football clubs and the broader Saudi economy. This strategy allows Saudi clubs to identify promising talents before their market value rises significantly. Besides improving team performance and competitiveness in the Saudi Pro League (Roshn), these young talents could later in the future generate revenue via lucrative transfer fees, increase commercial opportunities -- including sponsorships and merchandise sales. But more importantly recruiting these very young football talents for relatively small initial sums allows Saudi clubs to develop high-potential players internally rather than spending exorbitantly on established aging stars. This sustainable talent pipeline minimizes reliance on costly, older players whose value and performance may decline, thus optimizing club finances and preserving capital for strategic investments like infrastructure development.  Top football stars like Neymar, for example, can command extremely high salaries, such as his reported annual pay of 101 million euros in the Saudi Pro League in 2024, despite limited playing time (reportedly only 42 minutes a torn anterior cruciate ligament) during that year. His contract was terminated by Al Hilal club in 2025 in mutual consent. Such large financial outlays on established stars represent significant expenditures for clubs, contrasting with the strategic advantage of investing in younger talent as a more sustainable and cost-effective approach.

🇵🇹 The Talent Factories

In Portuguese football, the "Big Three" clubs - FC Porto, SL Benfica, and Sporting CP - have long established themselves not only as dominant forces on the pitch but also as pioneers in youth development. Since the early 2000s, these clubs have made substantial investments in their youth academies, recognizing the dual benefit of nurturing homegrown talent and generating significant financial returns through player transfers.

In this analysis, let’s focus on one impressive case study, which’s SL Benfica: The club’s decision to invest approximately €15 million in 2005 to construct the Benfica Campus represented a landmark commitment to youth development in Portuguese football. This state-of-the-art training facility was designed not only to provide top-tier infrastructure but also to cultivate an environment where young talents could develop their technical skills, tactical understanding, and physical conditioning in a comprehensive manner. The Benfica Campus integrates world-class training pitches, fitness centers, medical and rehabilitation facilities, and educational support for players, creating an optimal setting to nurture footballers from a young age.  This strategic approach has borne impressive fruit in recent years. Several young players groomed at the Benfica Campus have ascended to global stardom, commanding transfer fees worth tens or even hundreds of millions of euros. One prominent exemplar is João Félix, who developed in Benfica’s academy before being transferred in 2019 to Atlético Madrid for €126 million. This transfer fee alone eclipsed the entire investment Benfica made in the campus infrastructure. Other notable alumni include Bernardo Silva, who transferred from Benfica B to Benfica in 2014 for €15 million, then to Monaco in 2015 for €16 million and then to Manchester City in 2017 for €50 million. Rúben Dias, who transferred to Manchester City for approximately €68 million. The three players highlight Benfica’s success in identifying and nurturing talent who thrive in top European leagues and generate substantial financial returns for the club.  Exporting Football’s Future Stars

The Portuguese Primeira Liga has established itself as a crucial hub and exporter of young football talent to top European leagues, notably the English Premier League. As noted above, the clubs’ academies achieve tens of millions in transfer revenue with comparatively modest spending, making youth recruitment a highly profitable financial strategy. Over the last decade, Benfica has generated approximately €1.2 billion in revenue from player sales, demonstrating the club's exceptional ability to develop and market young talent. According to a recent academic study under the title “The Geostrategy of Youth Player Recruitment in Portuguese Clubs”, Portugal produces approximately 130 professional players per 1 million inhabitants.

So, If Portugal's population today is approximately 10 million and there are about 130 professional soccer players per 1 million inhabitants, then the total number of professional soccer talents would be: ● 130 players/million × 10 = 1300 professional players.

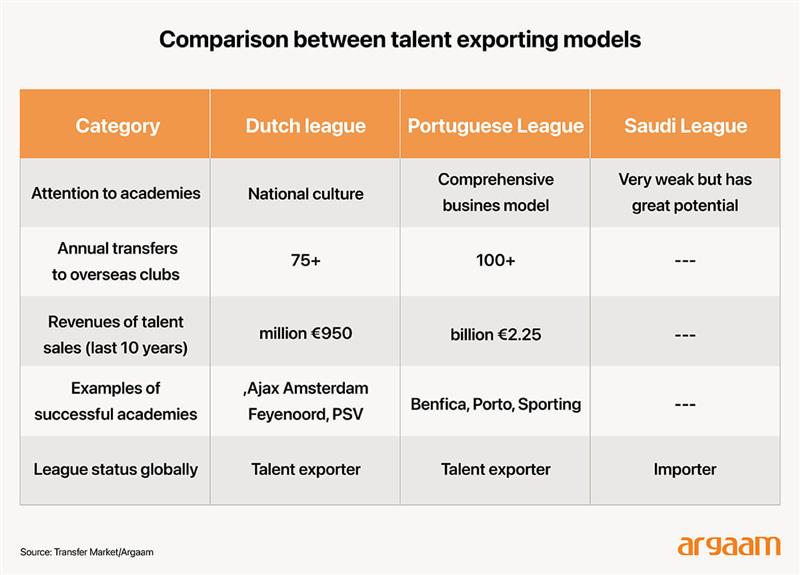

This illustrates the efficiency and effectiveness of Portugal’s football system in nurturing and investing in producing professional players, contributing to its success as a key exporter of young talent to top leagues worldwide. The number further reflects the strong cultural significance football holds in Portugal, fueling widespread participation and talent development across the country. In conclusion, the Saudi Pro League has emerged as a competitively successful league in the region. By prioritizing youth academies and training programs, Saudi clubs can build a sustainable pipeline of skilled athletes who not only elevate the quality of football domestically but also become valuable assets in the global sports market. As demonstrated in the Portuguese context, significant returns on investment are achieved through well-structured youth academies that focus on local talent identification, development pathways, and cost-effective recruitment strategies.  |

|

|

|

|

|

Argaam.com Copyright © 2025, Argaam Investment, All Rights Reserved |