|

Saudi Arabia’s estimated real GDP of approximately $1.085 trillion in 2024, representing a growth of 1.3% over the previous year, could experience further enhancement through strategic profit-shifting policies for major multinational companies. The recent introduction of a 30-year 0% corporate tax incentive – that could be renewable -- is designed to attract multinational corporations (MNCs) to establish their Regional Headquarters (RHQ) within the Kingdom. Saudi Arabia can then capitalize on increased foreign direct investment (FDI), which directly contributes to gross capital formation (the total value of net additions to fixed assets (such as buildings, machinery, equipment), a key driver of GDP growth. Saudi Arabia can commit to full transparency by actively participating in international tax information exchange agreements and abiding by the Organisation for Economic Co-operation and Development’s Base Erosion and Profit Shifting code of ethics. This code is aimed at addressing tax planning strategies used by multinational companies that might exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. The code is endorsed by over 140 countries including the G20 -- in which Saudi Arabia is a member -- to bring consistency to international tax rules and improve transparency.

Accordingly, Saudi Arabia stipulated in its new tax law regarding the headquarters of multi-national companies, such as Microsoft, Apple and Amazon, that such companies must demonstrate genuine economic activities in the kingdom, chiefly opening a regional headquarters in the kingdom, maintaining significant staff and actual business functions within the kingdom. The 0% exemption RHQ law also applies to payments the RHQ makes to nonresidents in the shape of dividends. Nonresident shareholders refer to individuals or entities that hold shares in the RHQ but are tax residents of a jurisdiction other than where the RHQ is located. This provision facilitates the repatriation of profits back to the shareholders, making the RHQ's jurisdiction more attractive for foreign investment and multinational companies' financing structures. The recently introduced law also applies to payments made to unrelated persons for necessary services. This means that payments made by RHQ to unrelated third-party service providers for services essential to the RHQ's operations are also exempt from tax. This is to ensure that operational expenses crucial for the functioning of the RHQ do not attract taxation, facilitating business activities.

How it works

When the MNC decides to relocate its Middle East regional HQ to Saudi Arabia, profits that were previously reported and taxed elsewhere—or parked in distant tax havens—can now be booked legally in Saudi. The HQ requires employees, office space, professional services, and regional operations support. Profit shifting allows MNCs to allocate earnings to Saudi Arabia, thereby increasing reported revenues and reinvested earnings within the kingdom. This inflow of capital can enhance productive capacity across high-impact sectors such as energy, finance, technology, real estate and hospitality. The increased presence of MNC HQs can stimulate employment growth, raising labor income—a major component of real GDP. For example, if the HQ operation spends $2 billion annually on salaries, office leases, and other expenses, this spending circulates through Saudi Arabia’s economy. Saudi Arabia also implements a Value Added Tax (VAT) currently at 15%. Economic activity generated by the HQ means increased consumption and business transactions, yielding substantial VAT revenue. On $2 billion of local spending, for an example just for explanatory purposes, VAT collections alone could reach $300 million. How Microsoft Could Outsmart Taxes via Saudi IP Move

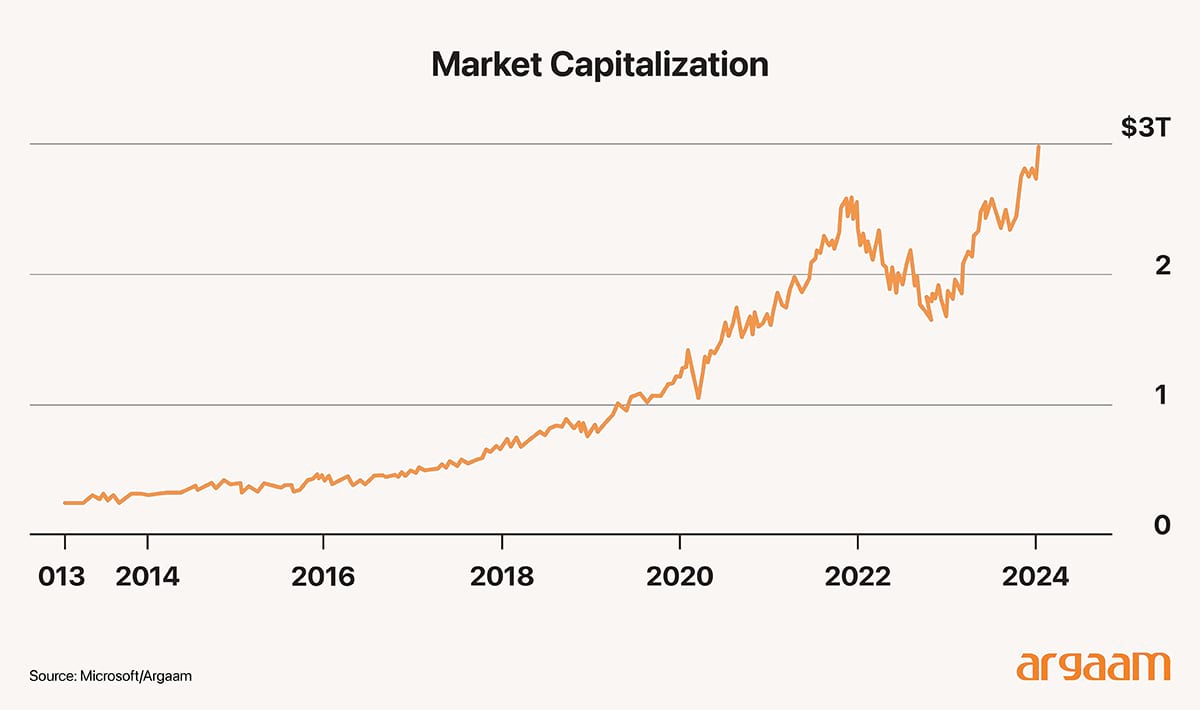

A giant IT company like Microsoft holds some of the most valuable intellectual property (IP) assets worldwide—like patents, software, and trademarks. These companies generate massive revenue streams from licensing these IP rights through royalties charged to their subsidiaries or partners in various countries. Let’s assume that the tech giant transfers ownership of key intellectual property rights to a newly established Saudi subsidiary. Because Saudi Arabia offers a 0% corporate tax rate on profits for up to 30 years for such entities if they move their regional HQ to the kingdom, the subsidiary incurs no local corporate tax on income derived from these IP assets. This Saudi subsidiary licenses out the IP to other subsidiaries in countries with higher tax rates—say, European countries or the U.S. These subsidiaries in other countries pay royalties to the Saudi entity for using the intellectual property. The royalty payments are deductible expenses in these higher-tax jurisdictions, thus reducing their taxable income there, lowering their overall tax liability. By allowing IP ownership and royalty inflows at 0% tax, Saudi Arabia positions itself as a new regional hub, attracting large multinationals to centralize their IP assets there.

To make things clearer with a hypothetical numeric example, If Microsoft’s subsidiary in Germany, for example, earns $1 billion in pre-tax profits by using licensed intellectual property (IP). The German subsidiary pays $400 million in royalties to Microsoft’s Saudi subsidiary that owns the IP. This royalty payment reduces the German subsidiary’s taxable income from $1 billion to $600 million. Since the corporate tax rate in Germany is 15%, the German subsidiary pays 15% of $600 million, which’s $90 million in taxes. Without paying royalties, the German subsidiary would have paid 15% of $1 billion, which’s $150 million in taxes. Since Microsoft’s German subsidiary uses IP (like software, patents, or technology) owned by another part of the company located in Saudi Arabia, to legally use this IP, it pays a royalty — a fee for the right to use that IP – to the Saudi subsidiary. The Saudi subsidiary receives the $400 million royalty payment, and because of Saudi Arabia’s 0% corporate tax rate, it pays no tax on this income.

A Win-Win Tax Move

In concluding our analysis, it is important to highlight the potential impact of Saudi Arabia’s corporate tax reduction. If the kingdom lowers its corporate tax rate for foreign firms—from the current 20% to only 8%—it would position itself as the most attractive in the GCC region and the Middle East, and one of the most competitive jurisdictions globally. Even at this low rate, significant tax revenues could be generated due to increased investment volume. These additional funds could be strategically allocated to boost critical local sectors such as healthcare, education, and infrastructure. Enhancing healthcare facilities and school systems would improve human capital and quality of life, supporting long-term economic growth and diversification beyond oil dependence. This approach balances competitiveness in attracting smaller foreign firms other than the major well-established MNCs, since smaller foreign firms typically lack the complex organizational structures and resources required to engage in sophisticated tax planning strategies such as profit shifting. Is the Incentives and Exemptions System Sustainable and Fair? Despite the apparent direct benefits of tax reductions or long-term exemptions, it’s essential to pause and ask: Can the Saudi economy rely on this model in the long run? And is it fair to all market participants? 1● From a Fiscal Sustainability Perspective: Long-term exemptions or sharp tax reductions reduce direct government revenue, which may strain the budget if oil prices decline or non-oil alternatives underperform. Incentives must be balanced against revenue diversification plans. 2● From a Competitive Fairness Perspective: Local companies, especially small and medium enterprises (SMEs), may find themselves at a disadvantage if large foreign firms enjoy broad incentives without reciprocal conditions. Matching incentives or parallel support programs for domestic investors are essential to avoid perceptions of "reverse discrimination." 3● From an International Compliance Perspective: Extended exemptions or low rates must be framed and applied within globally accepted norms, especially concerning transparency. In summary: Offering incentives isn’t inherently problematic—but it must be tied to a clear, time-bound, and methodical framework, and managed as part of a sound fiscal policy rather than as a permanent exception. Saudi Tax Policy Faces Three Possible Scenarios Over the Next Five Years: Scenario 1 – “Structural Success” Multinational corporations genuinely relocate to the Kingdom, not just to shift profits, but to establish operational and management hubs. - This drives the creation of high-value jobs, facilitates technical knowledge transfer, and contributes meaningfully to GDP. - Saudi Arabia positions itself as a flexible and integrated regional hub, similar to Singapore’s experience. - Success here requires strong governance, transparency, and a long-term strategic vision. Scenario 2 – “Temporary Appeal & Selective Exploitation” Some companies exploit the incentives without conducting real economic activity. - They legally shift profits but contribute little to the domestic economy. - Saudi Arabia may face international scrutiny and risk being reclassified as a “soft tax haven.” - This scenario could erode global credibility and undercut Vision 2030 objectives. Scenario 3 – “Disciplined Balance” The Kingdom attracts large firms within a strict regulatory framework. - Incentives are time-bound with mechanisms for periodic review. - Incentives expand to include domestic investors under equitable terms, enhancing fairness and balance. - This is the most realistic and sustainable path, fostering a competitive yet attractive investment environment. |

|

|

|

|

|