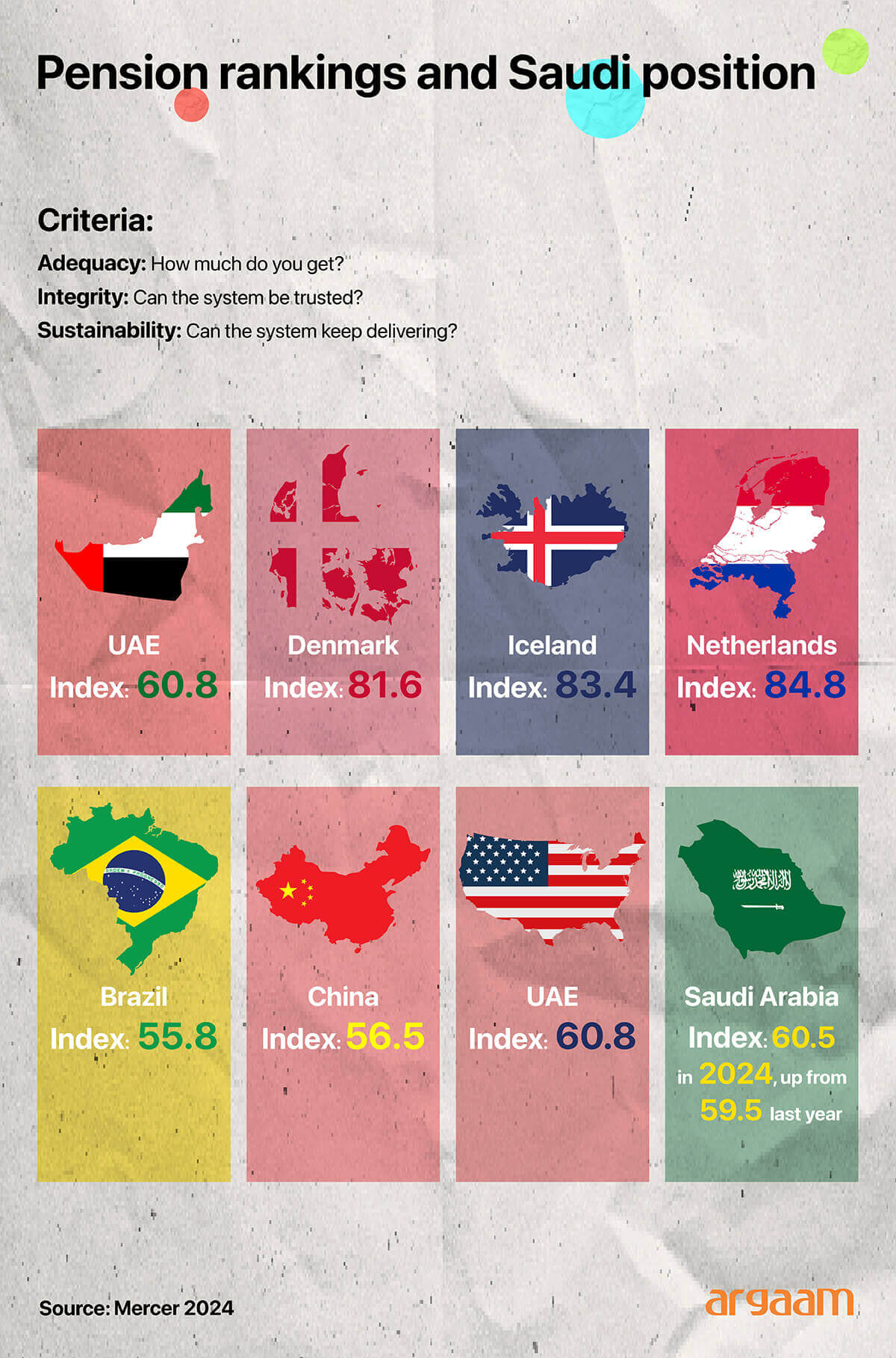

The kingdom’s pension scheme has been reformed in recent years with retirement age of public and private sector currently standing at 65 for men and women, while contribution period for early retirement increased from 25 to 30 years.

Both the employer and the employee contribute a total of 21.5%, with the employee bearing 9.75% and the employer 11.75%. This encourages a culture of saving to prepare for future expenses.

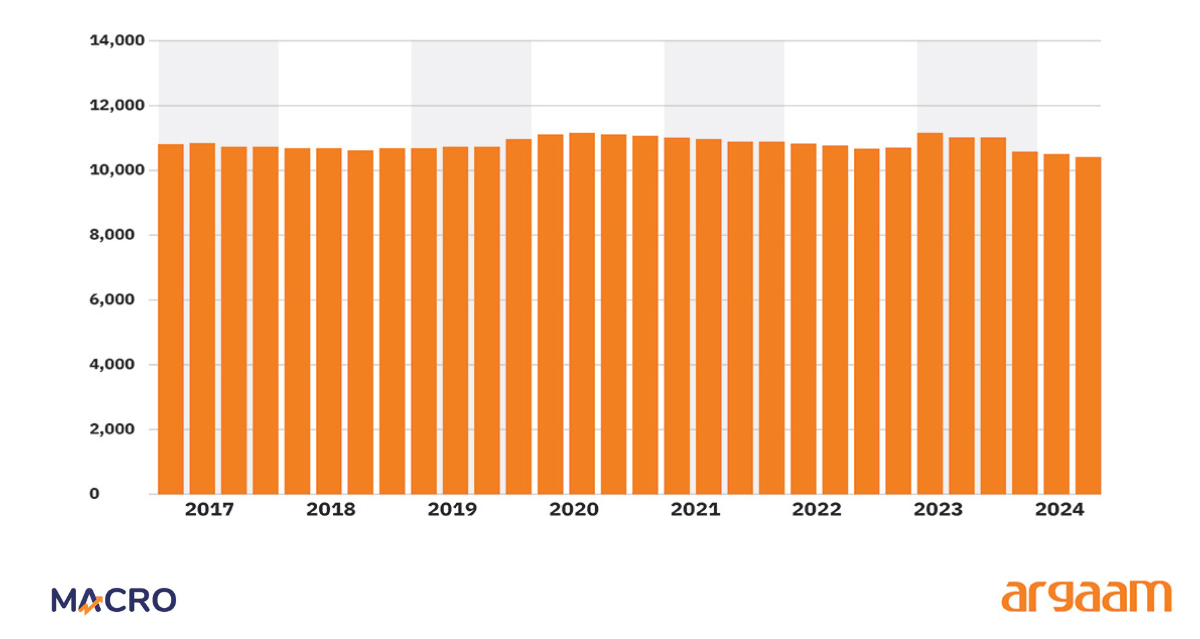

Total employees subject to civil service rules and regulations

What are the two main widely used pension schemes?

Which one is riskier than the other if the subscriber doesn't seek the help of a financial or investment advisor? and why?

What’s the proper safe asset in long-term pension investment then?

(PS: Argaam doesn't provide an investment advice, but it rather offers a mind-expanding financial and investment discussion. If in doubt, you have to seek the advice of an independent financial advisor)

🔎

What are the two common pension schemes worldwide?

1- In a defined-contribution scheme, each member pays into an account a fixed fraction of his or her earnings. These contributions are used to purchase assets, which are accumulated in the account as are the returns earned by those assets. When the pension starts, the assets in the account finance post-retirement consumption through an annuity.

2- In a defined-benefit (DB) scheme, a worker’s pension is based not on his accumulation, but on his wage history, possibly including length of services.

In a final-salary scheme, pensions are based on a person’s wage in his or her final year, or few years. The worker’s contribution is generally a fraction of his or her wage; thus the sponsor’s contribution is conceptually the endogenous variable in ensuring the scheme’s financial balance. |